UK up, Europe down as demand for CVs cools

Page 8

If you've noticed an error in this article please click here to report it so we can fix it.

DESPITE ACHIEVING only modest growth, the UK's truck market was one of the strongest performers in Europe last year.

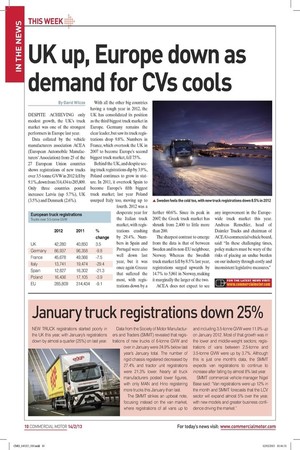

Data collated by the vehicle manufacturers association ACEA (European Automobile Manufacturers' Association) from 25 of the 27 European Union countries shows registrations of new trucks over 3.5-tonne GVW in 2012 fell by 9.1 %, down from 314,434 to 285,809. Only three countries posted increases: Latvia (up 5.7%), UK (3.5%) and Denmark (2.6%).

With all the other big countries having a tough year in 2012, the UK has consolidated its position as the third biggest truck market in Europe. Germany remains the clear leader, but saw its truck registrations drop 9.8%. Numbers in France, which overtook the UK in 2007 to become Europe's second biggest truck market, fell 7.5%.

Behind the UK, and despite seeing truck registrations dip by 3.9%, Poland continues to grow in stature. In 2011, it overtook Spain to become Europe's fifth biggest truck market; last year Poland usurped Italy too, moving up to fourth. 2012 was a desperate year for the Italian truck market, with registrations crashing by 29.4%. Numbers in Spain and Portugal were also well down last year, but it was once again Greece that suffered the most, with registrations down by a further 60.6%. Since its peak in 2007, the Greek truck market has shrunk from 2,400 to little more than 200.

The sharpest contrast to emerge from the data is that of between Sweden and its non-EU neighbour, Norway. Whereas the Swedish truck market fell by 8.5% last year, registrations surged upwards by 14.7% to 5,861 in Norway, making it marginally the larger of the two.

ACEA does not expect to see any improvement in the Europewide truck market this year. Andreas Renschler, head of Daimler Trucks and chairman of ACEA's commercial vehicle board, said: "In these challenging times, policy makers must be wary of the risks of placing an undue burden on our industry through costly and inconsistent legislative measures."

European truck registrations Trucks over 3.5-tonne GVW 2012 2011 change UK 42,280 40,850 3.5 Germany 86,937 96,358 -9.8 France 45,678 49,366 -7.5 Italy 13,741 19,474 -29.4 Spain 12,827 16,302 -21.3 Poland 16,436 17,105 -3.9 EU 285,809 314,434 -9.1