CEEing off the competition

Page 18

Page 19

If you've noticed an error in this article please click here to report it so we can fix it.

The European Union is set to expand next year, but what will this mean for UK hauliers? And how can they best prepare to cope with increased competition? Julian Milnes looks at the situation and the way ahead for UK companies.

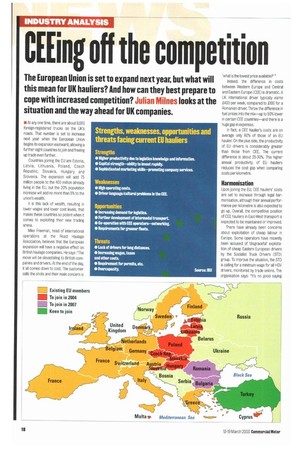

• At any one time, there are about 9,000 foreign-registered trucks on the UK's roads. That number is set to increase next year when the European Union begins its expansion eastward, allowing a further eight countries to join and freeing up trade even further.

Countries joining the EU are Estonia, Latvia, Lithuania, Poland, Czech Republic, Slovakia, Hungary and Slovenia. The expansion will add 75 million people to the 400 million already living in the EU, but the 20% population increase will add no more than 5% to the union's wealth.

It is this lack of wealth, resulting in lower wages and lower cost levels, that makes these countries so potent when it comes to exploiting their new trading arena.

Mike Freeman, head of international operations at the Road Haulage Association, believes that the European expansion will have a negative effect on British haulage companies. He says: "The move will be devastating to British companies and drivers. At the end of the day, it all comes down to cost. The customer calls the shots and their main concern is 'what is the lowest price available'" Indeed, the difference in costs between Western Europe and Central and Eastern Europe (CEE) is dramatic. A UK international driver typically earns 1400 per week, compared to £100 for a Romanian driver. Throw the difference in fuel prices into the mix—up to 50% lower in certain CEE countries—and there is a huge gap in expenses.

In fact, a CEE haulier's costs are on average only 60% of those of an EU haulier. On the plus side, the productivity of EU drivers is considerably greater than those from CEE. The current difference is about 25-30%. This higher annual productivity of EU hauliers reduces the cost gap when comparing costs per kilometre.

Harmonisation

Upon joining the EU, CEE hauliers' costs are set to increase through legal harmonisation, although their annual performance per kilometre is also expected to go up. Overall, the competitive position of CEE hauliers in East-West transport is expected to be maintained or improved.

There have already been concerns about exploitation of cheap labour in Europe. Some operators have recently been accused of 'disgraceful' exploitation of cheap Eastern European drivers by the Socialist Truck Drivers (STD) group. To improve the situation, the STD is calling for a minimum wage for all HGV drivers, monitored by trade unions. The organisation says: "It's no good saying this is a good wage in Bulgaria; they don't work in Bulgaria, they work in the West earning Western profits."

Safety levels are also a concern as they vary considerably between countries. Safety regulations that are taken for granted in the UK are quite another matter in the CEE. James Hookham of the Freight Transport Association believes that the expansion could open the floodgates for unregulated, and therefore, potentially dangerous haulage in Britain.

He says: "Eastern Europe has far less safety regulation, leading to fears when drivers are visiting the UK. The quality of some of the trucks coming over is debatable, There have already been concerns voiced regarding inexperienced drivers having problems driving on the left on our motorways."

But while the debate continues, UK hauliers must still make a living in a ferociously competitive sector—so what can operators do to ensure survival? Industry pundits believe UK hauliers need to be proactive in their approach: working to th& strengths and focusing on where the industry is heading.

The International Road Transport Union (IRU) report. Competition in the East-West Road Transport Markets, stresses that change has to be embraced as those who hold back will be left behind. Current industry movements show the shift away from traditional haulage to logistics, and supply chain management is a universal trend—although this is more advanced in developed economies such as those in the EU.

Logistics providers

Logistics providers in the EU are concentrating increasingly on warehousing, distribution and value-added logistics, while traditional 'traction' is contracted out to lower-cost carriers—mainly but not exclusively from the CEE. According to the IRU, the share of warehousing and distribution in the turnover of large EU companies is rapidly increasing, and their value-added and profitper-employee are much higher than In 'pure' transport.

Another solution would be to go with the old analogy, "if you can't beat them, join them", freeman believes that companies may have to bite the bullet and unite with the opposition: "The best way for companies in this country to survive is to face the problem head on. That is, to get into bed with the opposition.

"Companies here have the logistics expertise, the experience and the solid foundations that are either not available, or are poorly developed in Eastern Europe. By collaborating with Eastern European companies, you can combine your strengths and survive."

This tactic is echoed in the IRU report; it says market developments should be encouraged, particularly those enhancing co-operation such as partnerships, alliances and joint ventures between CEE hauliers and EU logistic providers.

The report adds: "Support of smaller companies, which cannot rely on their own networks, can act as an information and partnership gateway."

But haulage is a diverse market: dis tinct niches do exist, and that can h hauliers, and others within the e EU states, to stave off competitiot countries due to join the Union. In analysts believe that identifyinl exploiting these niches will help transport companies survive.