THE CUTTING EDGE

Page 45

Page 46

If you've noticed an error in this article please click here to report it so we can fix it.

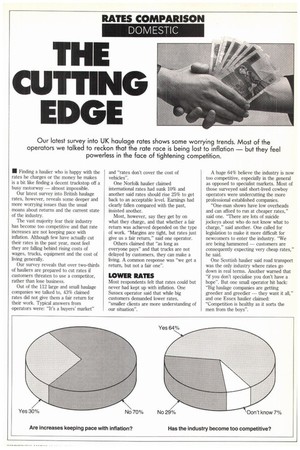

Our latest survey into UK haulage rates shows some worrying trends. Most of the operators we talked to reckon that the rate race is being lost to inflation — but they feel powerless in the face of tightening competition.

• Finding a haulier who is happy with the rates he charges or the money he makes is a bit like finding a decent truckstop off a busy motorway — almost impossible.

Our latest survey into British haulage rates, however, reveals some deeper and more worrying issues than the usual moans about returns and the current state of the industry.

The vast majority fear their industry has become too competitive and that rate increases are not keeping pace with inflation. Although few have actually cut their rates in the past year, most feel they are falling behind rising costs of wages, trucks, equipment and the cost of living generally.

Our survey reveals that over two-thirds of hauliers are prepared to cut rates if customers threaten to use a competitor, rather than lose business.

Out of the 112 large and small haulage companies we talked to, 43% claimed rates did not give them a fair return for their work. Typical answers from operators were: "It's a buyers' market" and "rates don't cover the cost of vehicles".

One Norfolk haulier claimed international rates had sunk 10% and another said rates should rise 25% to get back to an acceptable level. Earnings had clearly fallen compared with the past, insisted another.

Most, however, say they get by on what they charge, and that whether a fair return was achieved depended on the type of work. "Margins are tight, but rates just give us a fair return," said one operator.

Others claimed that "as long as everyone pays" and that trucks are not delayed by customers, they can make a living. A common response was "we get a return, but not a fair one".

LOWER RATES

Most respondents felt that rates could but never had kept up with inflation. One Sussex operator said that while big customers demanded lower rates, "smaller clients are more understanding of our situation". A huge 64% believe the industry is now too competitive, especially in the general as opposed to specialist markets. Most of those surveyed said short-lived cowboy operators were undercutting the more professional established companies.

"One-man shows have low overheads and can afford to run at cheaper rates," said one. "There are lots of suicide jockeys about who do not know what to charge," said another. One called for legislation to make it more difficult for newcomers to enter the industry. "We are being hammered — customers are consequently expecting very cheap rates," he said.

One Scottish haulier said road transport was the only industry where rates go down in real terms. Another warned that "if you don't specialise you don't have a hope". But one small operator hit back: "Big haulage companies are getting greedier and greedier — they want it all," and one Essex haulier claimed: "Competition is healthy as it sorts the men from the boys". Although only 6% of those who replied had actually cut rates, some responses were worryingly frank. "We can't increase our prices because others won't," said one. "Costs have gone up by 6.9% from last year, but we've had to cut our rates by 3%," admitted another operator. "Rates have not increased in three years, but the cost of lorries has by 25 to 40%", said another.

Our survey finds that 69% are prepared to negotiate rates. Although it seems natural for any business to haggle over what it charges, the responses show a growing lack of confidence in being able to keep regular customers and charge for higher quality work.

Although one West Sussex operator said he preferred to concentrate on track record and integrity rather than cut costs and not do a job properly, others were less resolute.

NEGC1TULTE

One customer demanded rates to be frozen until June 1990, so of course I have to negotiate," said one. We do cut rates but try not to sell ourselves cheap," claimed one East Anglian operator.

Many of our respondents admitted that if the customer was especially valuable they would negotiate. "Anyone who doesn't is an idiot," said one. The 23% who were not normally prepared to negotiate fell into two groups: those that felt their standard of service justified their price, and those who felt prices were so low they could not go lower.

Despite 74% of those surveyed saying they set their own rates, most admitted they were governed by market conditions or what customers could afford. Large customers could dictate rates, said one. "We set them, but 99% of the time we have to go below," admitted another.

Of those questioned, 26% were Road Haulage Association members and 15% were in the Freight Transport Association. Of these, 22% felt that belonging to a trade association helped them set a higher rate.

However, 55% belonged to neither and did not feel membership would help with rates. "If we could get the rates recommended by the RBA we would be happy," said one RHA member.

Several said there were advantages in having the backing of a professional body and that the RHA set guidelines for rates. But one haulier felt organisations did not have the control to determine rates, and another added wryly: —The only trade association which might help is the Mafia".

Those surveyed were split between those who felt cabotage and increased competition from the Continent would cut rates after 1992, and those who thought it would not. Worryingly, 33% had no knowledge of cabotage.

"More freedom of movement and therefore more competition will cut rates," said one haulier. "We must be aware of the effect of cabotage, but the relationship with the specific customer is most important," said another.

GENERAL HAULAGE

The companies we surveyed ranged from single truck operators to firms with hundreds of trucks. The most common size of company had 20 vehicles.

Most classed themselves as general haulage, although tipping, agricultural, building materials, aggregates, waste disposal, petroleum and removals firms were represented.

0 by Murdo Morrison