Problems of the

Page 62

Page 63

If you've noticed an error in this article please click here to report it so we can fix it.

HAULIER and CARRIER WHEN an owner-driver takes delivery of a second vehicle, his methods of working must begin to differ from those which prevailed when there was only the one machine which he himself drove. How great the difference may be depends, to some extent, upon the type of man engaged to drive the second ;vehicle. If he be just a driver, which is all that can be expected as he will, be paid only a driver's wage, then the proprietor will have the added responsibility of planning for a second vehicle, obtaining loads, securing payment and attending to all the other business routine which he has hitherto been accustomed, more or less, to taking in his stride.

When a third machine is put into commission it will nearly always be found advisable to engage two more drivers and for the owner to devote himself entirely to the management of his business, In the majority of eases, according to my experience, a man who commences as an owner-driver has usually a fair amount of mechanical knowledge and, when he reaches the stage of owning three vehicles, he may combine the two functions of business manager and maintenance engineer.

One thing is quite certain : the aspect of his account Kooks in respect of net profit will change considerably. There will be additions to the establishment costs, which I discussed in the former article, dealing simply with the operations of the owner-driver. There will be a new • item, supervision, a term which will be applied to the wages which the owner will allocate to himself as manager.

If he is going to tackle the business in a proper manner he will require a little office. Under those conditions there will be further Heins of expense, rent and rates of office, insurance of office and effects, office furniture (maintenance, depreciation and interest on cost), cleaning, lighting and heating of the office, and wages of an office boy, junior typist or clerk.

Some of the other items, those referred to in the previous article, will increase as the fleet grows, but not, of course, in exactly the same proportion. The rather heavy item of insurance of the load, for example, will be a little less, chiefly because the amount of business which the insuree can place is greater. There is usually a diminution of about per cent, in the rate of the premium when the total amount for which the policy is taken out exceeds £1,000. Whilst, therefore, the premium for a "goods in transit" policy to cover the operation of one vehicle may be £20 per annum, £40 may cover the risks for three.

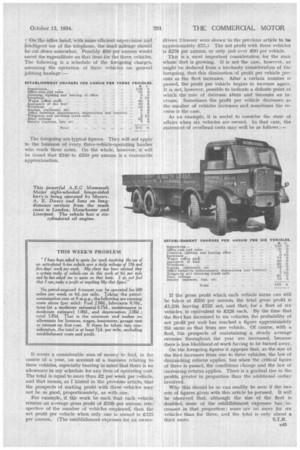

The telephone bill will increase to, say, £20 per annum, and expenditure on stamps and stationery to £6. it will still be safe, I imagine, to set down £1 as being sufficient for the item of office furniture, whilst trunk calls and telegrams may total £2 10s. in the year. 'Onithe. ether hand, 'With More efficient Supervision and " intelligent Use of the telephone, the dead mileage Shoald be cut clown somewhat. Possibly £00 per annum would cover the expenditure on that item for the three vehicles. The following is a schedule of the foregoing charges, asSurning the operation of three vehicles on . general jobbing haulage :— The foregoing are typical figures. They will not apply to the business of every three-vehicle-operating haulier who reads these notes. On the whole, however, it will be found that 2340 to £350 per annum is a reasonable approximation.

It seems a considerable sum of money to find, in the course of a year, on account of a business relating to three vehicles, especially bearing in mind that there is no allowance in my schedule for any item of operating cost.

The total is equal to more than per week per vehicle, and that means, as I hinted in the previous article, that the prospects of making profit with three vehicles may not be so good, proportionately, as with one.

For example, if the work be such that each vehicle returns an average gross profit of 200 per annum, irrespective of the number of vehicles employed, then the net profit per vehicle when only one is owned is £125 per annum. (The establishment expenses for an owner driven 2-tonner were shown -in the previous article to 136 approximately .i£75.) The net profit with three vehicles is £258 per annum, or only just over £80 per vehicle.

This is a most important consideration for the man whose fleet is growing. It is not the case, however, as might be deduced from a too-hasty consideration of the foregoing, that this diminution of profit per vehicle persists as the fleet increases. After a certain number is passed, the profit per vehicle begins to increase again. It is not, however, possible to indicate a definite point at which the. rate of decrease alters and becomes an increase. Sometimes the profit per vehicle decreases as the number of vehicles increases and sometimes the reverse is the case.

As an example, it is useful to consider the state of affairs when six vehicles are owned. in that case, the statement of overhead costs may well be as follows

If the gross profit which each vehicle earns can still be taken at 200 per annum, the total gross profit is £1,200, leaving £755 net, and that, for a fleet of six vehicles, is equivalent to £126 each. By the time that the fleet has increased to six vehicles, the probability of net profit per unit. has reached a figure approximately the same as that from one vehicle. Of course, with a fleet, the prospects of maintaining a steady average revenue throughout the year are increased, because there is less likelihood of work having to be turned away.

On the foregoing figures it appears that, as the size of the fleet increases from one to three vehicles, the law of diminishing returns applies, but when the critical figure of three is passed, the conditions change and the law of increasing returns applies. There is a gradual rise in the profits, greater in proportion than the additional outlay involved.

Why this should be so can readily be seen if the two sets of figures given with this article be pernsed. It will be observed that, although the size of the fleet is doubled, none of the establishment expenses has increased in that proportion ; some are no more for six vehicles than for three, and the -total is only about a third more.