Logical Costing for TYRES

Page 54

Page 59

If you've noticed an error in this article please click here to report it so we can fix it.

IHAVE from time to time laid down what I believe to he the proper procedure in recording tyre costs.

I am not alone in believing that tyres are a separate item of operating cost and that when a new vehicle is purchased, the cost of a set of, tyres should be deducted from the initial cost of the vehicle, that cost being inserted at once under the heading " Tyres " and the value of the vehicle, less tyres, being then taken as a basis for assessment of depreciation. usually after the residual value has also been deducted.

This method is ustrat, and is the one employed in the United States as well as in this country. Nevertheless, questions have been asked concerning the point and the matters arising on those questions are of sufficient importance to justify me in treating them at length in an article.

A friend of mine said that this method of accounting was being used by the Milk Marketing Board and certain other organizations. In his view that method of calculating depreciation operated ,to the disadvantage of a haulier, in assessing the rates which be should be allowed to charge for the work he does.

Question of Tyre Value

His objection, however, was a particular one. He pointed out that the value which the vehicle manufacturer would put upon the tyres was less than the retail price. Before the war he thought the vehicle manufacturer paid considerably less than half the retail price and even to-day there must be a substantial discount allowed, so that if the retail price of the tyres be deducted from the vehicle cost, the figure left is very much less than its value.

He went on to say that it would be better all round if, in the first instance, the vehicle were depreciated as a whole, complete with tyres, and tyre replacements only entered under the heading of tyre costs.

There is no disputing the point raised about the actual cost of the tyres. If confirmation of this be necessary, the operator should try to buy a vehicle less tyres from the manufacturer and see what allowance he would get for the tyres As regards his view that the method employed is disadvantageous to the operator in dealing with big buyers of transport, he is wrong. On the contrary, it can easily be shown that his credit is increased by this method of costing.

Peter Pays Paul

Writing to him, I said: "Let us assume, for the sake of simplicity, that the retail price of a set of tyres is £100 and that your figure of 50 per cent, is correct. That is to say; you are loading your tyre-cost item with £50 more than you think it should be but deducting it from your vehicle depreciation allowance.

" As tyre cost, that £50 is depreciated over, say, 20,000 miles, so that you are credited with 0.6d. per mile. Taking it as depreciation, you wilt be credited with the amount' at the rate of probably 120,000 miles, which is equivalent to only 0.1d. per mile. You are therefore Id. per mile better-off, in your negotiation, with such organizations by the orthodox method, than you would be if you were to insist upon your system being adopted.

Nor does the method operate to your disadvantage in other directions. The income-tax authorities, for example, do not take into account the cost of tyres. So far as my experience goes, the operator enters the full price paid for the vehicle, including tyres, and is credited with depreciation on that amount.

"Again, if you are selling a vehicle, you sell it for what el 6

you can get. The buyer does not ask if you have deducted the tyres from your idea of what it is worth, before he agrees to any price.

" I think you will agree, therefore, that the matter is best left as it is, so far as your interest and the interest of other operators are concerned."

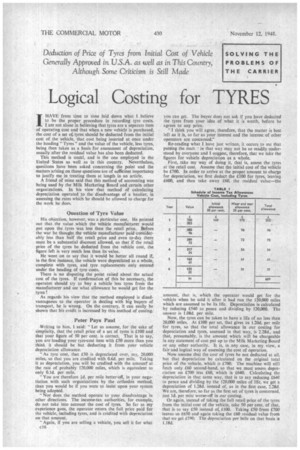

Re-reading what I have just written, it occurs to me that putting the matt; in that way may not be so readily understood by everyone and I suggest, therefore, that we take the figures for vehicle depreciation as a whole, First, take my way of doing it, that is, assess the tyres at the retail cost. Assume that the initial cost of the vehicle be £700. In order to arrive at the proper amount to charge for depreciation, we first deduct the £100 for tyres, leaving £600, and then take away £60 the residual value—the amount, that is, which the operator would get for the vehicle when he sold it after it had run the 120,000 miles which are assumed to be its life. Depreciation is calculated by reducing £540 to pence and dividing by 120,000. The answer is 1.08d. per mile.

Now, the tyres can be taken to have a life of no less than 20,000 miles. At £100 per set, that gives us 1.20d. per mile for tyres, so that the total allowance in our costing for depreciation and tyres. assessed in that way, is 2.28d., and that, presumably, is the amount which will be chargeable in any statement of cost put up to the Milk Marketing Board or any other authority. It is, in any case, in my view, a fair and logical way of assessing the cost of operation.

Now assume that the cost of tyres be not deducted at all, but that depreciation be calculated on the original total price of the vehicle, which is £700. The machine wilt still fetch only £60 second-hand, so that we must assess depreciation on £700 less £60, which is £640. Calculating the depreciation in that same way, that is to say reducing £640 to pence and dividing by the 120,000 miles of life, we get a depreciation of 1.28d. instead of, as in the first case, 2.28d. We are, therefore, so far as the first set of tyres is concerned, just id. per mile worse-off in our costing.

Or again, instead of taking the full retail price of the tyres from the initial cost of the vehicle, take 50 per cent. of that, that is to say £50 instead of. £100. Taking £50 from £700 leaves us £650 and again taking the £60 residual value from that we get £590. The depreciation per mile on that basis is 1.18d.

If the £50 for tyres be transferred to the tyre-cost column and the tyres last 20,000 miles, then the depreciation of tyres per mile is only 0.60d. and the total allowance is 1.78d., which is half-way, as might be expected, between the other two figures which we have calculated. There seems to be no doubt that from tha operator's point of view, the most satisfactory way of calculating the depreciation of a vehicle and cost of tyres is the one which I have always recommended, and which is generally used.

The same problem cropped up during the many interviews which I had with operators at the Commercial Motor Transport Exhibition at Earls Court. This time, however, the operator was concerned with his return of income for income-tax assessment. In the course of the discussion of the problem with' this operator, I discovered that he did not know how he should put forward his claim for initial and wear-and-tear allowance in connection with a commercial vehicle. There were several other queries of the same kind, and before I deal with his question of the separation of tyre cost from vehicle cost, I will once more explain how these claims should be made out.

First, let us assume, aS,is usual, that in making such a , claim, the total price paid for the vehicle be taken as the basis for the claim. The manner of setting out the figures is shown in Table I.

Allowance on Income Tax

During the first year of. operation of a new vehicle the operator can put in a claim for an initial allowance of 20 per cent, of the price paid, as well as a wear-and-tear allowance of 25 per cent, of that amount, so that if the initial cost were £700, then the initial 'allowance would be 20 per cent. of £700, which is £140; the wear-and-tear allowance would be 25 per cent. of £700, which is £175. The total claim is thus £315.

For the second year, the value of the vehicle is reduced in the eyes of the income-tax assessor by £315, which has been allowed. Its value then becomes only £385, as set out in Table 1. There is, of course, no initial allowance, but there is a wear-and-tear allowance of 25 per cent. of £385, which is £96, and so on down the years, as shown in the table, until at the end of the sixth year the total amount which has been allowed is £609, and the vehicle has a value of £91.

This operator wished to follow the practice which I recommended and to deduct the cost of a set of tyres from the price of the vehicle, before making out his claim. It might be thought that he was making a mistake, because if a set of tyres be valued at £100, he reduces the value of his vehicle to £600 instead of £700 and the amount of the allowances, caldulated on that figure as a basis, is correspondingly diminished, as is shown in Table IL At the end of the sixth year his allowance is £522, as against £609 by the other method.

He has, however, transferred that figure of £100 to the heading "Tyres," so that the whole amount is charged as an item of operating cost of the vehicle. In that event the operator is the gainer, for the total amount he has set off is £522 plus £100, or £662 as against £609.

As a matter of interest I have shown, in Table Ill, the corresponding figures, on the assumption that the vehicle cost be diminished by the assumed vehicle manufacturer's cost of tyres, that is to say, £50 instead of £100. I assume that I need not go into those figures in any detail, only pointing out that the amount to be set off against income in respect of the vehicle is £565 and that, plus the £50 for tyres, is a total of £615.

This operator told me that he had tried to persuade his accountant to deal with the matter in that way, that is, to separate the tyres from the vehicle in the manner described, but that the accountant had told him that it was no use to attempt it, as the income-tax authorities would not approve it.

Ruling on a Special Case

The income-tax authorities will answer a specific inquiry relating to an individual's own return of tax or assessment, so that this operator should put the question himself direct to the income-tax authorities in his own area. If he does that he will get a ruling on his own case.

All that I can do, in this case, is to indicate a way of approach, and I therefore suggest that the operator writes to the local Inspector of Taxes, on the following lines:— " In order that my accounts shall correctly indicate the operating cost of my vehicles, I find it preferable, when putting a new vehicle into commission, to deduct from the purchase price the cost to me of a set of tyres. The net price of the vehicle thus obtained is taken as the basis for the calculation of depreciation and entered accordingly. The cost of the tyres is immediately debited in my accounts under the heading 'Tyres.'

"You will appreciate, I am sure, that as the tyres wear out much more quickly than the vehicle, say 20,000 miles per set of tyres as against 120,000 or perhaps 150,000 miles, this differentiation is advisable.

"I have just purchased a vehicle for £700 complete. The value of the tyres is £100. What I want to know is, whether I am in order, in preparing my return of income for the coming year, in setting down the price of the vehicle as £600, debiting the tyres separately as being consumed in the course of operation of the vehicle. "1 shall be grateful to have your ruling on this matter." S.T.R.