Light: Dawns on the .M.M

Page 55

Page 56

Page 59

If you've noticed an error in this article please click here to report it so we can fix it.

Our Costs Expert Considers that the Milk Marketing Board Has Been Without Knowledge of the Way to Assess Operating Costs, and Analyses Three Forms it Has Issued When Asking Hauliers to Justify Increases in Rates

FROM time to time, operators have expressed dissatisfaction with the constitution of the Joint Milk Haulage Committee. In particular, they have taken exception to the inclusion on that committee of dairy representatives, It has been suggested that these members had no " collection" interests themselves,. in which case they would almost certainly be in opposition to the hauliers. From the nature of the dairymen's position in the industry, they would be concerned more with their own margins and cemuneration than that which can be allowed to hauliers, and this would mean a majority of the committee against the transport operators. ,

There is something here which is not easy to understand. In the first place, the costs of haulage are borne by the producers. A sum of money is put on one side by the Milk Marketing Board. this fund being calculated from deductions made, at standard rates per gallon, from producers' accounts with the Board. That being so, a fractional increase in the rates paid to one small haulier is not going to affect the price, which the dairyman is going to ask for his milk.

Generally Neutral

He should, therefore, be neutral in his attitude towards this question of haulage rates, except in a general sense. If, for instance, there were to be considerable increases in ,rates awarded to all milk hauliers, then the sum involved woStld be much larger than it is now, and no doubt some of, the increased cost would, in some way, have to be paid hy the dairyman as well as by the milk consumer. That, hoWever, is not the case. Moreover, many dairymen are directly iinterested in the amount paid for haulage, as they perform that work themselves, and some of them have grievances similar to those of hauliers, inasmuch as they find it difficult to obtain a rate sufficient to cover their costs.

In delving into the developMent of the procedure of 'the Board in dealing with milk hanliers. I have come to the conclusion that it has been without even an elementary knowledge of the way to assess the cost of operating commercial vehicles. No doubt this accounts for the unreasonable attitude which has been adopted when dealing with the question of rates.

Having made that statement I most justify it, and I do so simply by reference to a series of three forms which • has been issued, over a period of years, by the Board in

• response to hauliers' requests for increased rates. it was intended that the haulier should complete the form as a means of justifying his application for, an increase.

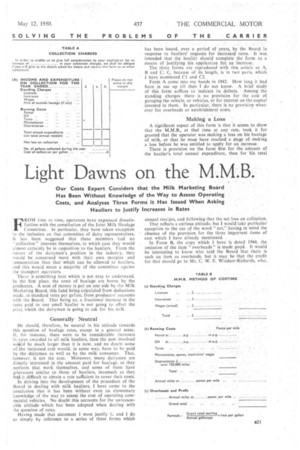

The three forms are reproduced with this article as A, B and C; C. because of its length, is in two' parts, which I have numbered Cl and C2.

Form A came into my hands in 1942. How long it had been in use up till then I do not know. A brief study of this form suffices to indicate its defects. Among the standing charges there is no 'provision for the cost of • garaging the vehicle, or vehicles, or for interest on thecapital invested in them. In particular, there is no provision whatever for overheads or establishment costs.

Making a Loss

A significant aspect of this form is that it seems to show that the M.M.B., at thae time at any rate, took it for granted that the operator was Making a loss on his' haulage of milk, or that he must have reached a stage of.making a loss before he was entitled to apply for an increase.

There is provision on the form first for the amount of the haulier's total annual expenditure, then for his total annual receipts, and following that the net loss on collection. That reflects a curious attitude, but I would take particular exception to the use of the word "net,"having in mind the absence of the provision for the three important items of cost which I have already mentioned,

In Form B, the copy which I have is dated 1944, the omission. of the item "overheads" is made good. It would be interesting to know who told the Board that there is such an item as overheads, but it may be that the credit for that should go to Mr. C. W. E. Windsor-Richards, who,

towards the close of 1943, drew nip a schedule of estimated costs for operating vehicles on the collection and delivery, of milk. from brill to first destination under normal conditions.

Them is provision for that item, but, in fact, the provision was more nominal than real. It will be observed that the form reads: " (c) overheads and profit. annual miles at d. per mile." The allowance made to cover overheads and profit was lid. per mile.

It needs little calculation and hardy any precise knowledge of what overheads can be. to realize that lid. per mile to cover those two items is a farce.

Take the case of a vehicle running 290 miles per week. The allowance for overheads and profit, bearing in mind the "and profit" would total Li 10s. per week, whereas it would be impossible to keep the overheads alone down to so low a figure in rea lity.

Even at 480 miles per week, the allowance for overheads and profit would be only D. Mr. Windsor-Richards, in his excellent summary of costs, arrived at a figure of £162 10s, per annum per vehicle for overheads alone, and that to my mind was a, modest estimate even then, and likely to be exceeded to-day.

The bare operating costs of a 5-tormer running 480 miles per week will exceed 10d. per mile; overheads, again on a modest estimate, 3d. per mile: total Is. Id. per mile for all-in costs. It is reasonable to reckon 15 per cent, on cost as the minimum profit which a handier ought to earn, that is a further 2d., so that according to these figures, overheads and profits should be 5d. rer mile.

Form B has been in use until quite recently.

Circular Letter

Two milk hauliers called 'upon me a short time ago to discuss the subject of appeals to the Joint Committee. One of them showed me a circular letter which he had received from the Road Haulage Associatioa, it; which it was stated that the Milk Carriers Functional Group Committee, considering the question of presentation by milk hauliers of cases involving an alteration in rates to the Joint Committee, expressed concern at the manner in which one or two recent cases had been put forward. Members who have been notified that their cases will have to he heard by. the Joint Committee are recommended to contact either Mr. J. Ferguson, the group national secretary, or Mr. R. P. Miers. chairman of the Functional Group Committee, so that 'proper advice can be given

The letter went on to state that the Committee feels moststrongly that the conduct of a case before the Joint Cornn22 mittee by any person who is not acquainted with the milk industry might have serious consequences. Efficient machinery has been set up .by the Joint Committee to deal with these cases, andit..41felf .40 any members who do. not make use of the machinery May 'do great harm. The M.M.B. is, at the present time, reviewing the haulage rates of a number of miliChauliers, and it Would be appreciated if any haulier so concerned would contact either Mr. Ferguson or Mr. Miles if in doubt as to the correct procedure, or if in any difficulty in order to obtain the maximum benefit-, available. I endcrse the recommendation in the letter:

The lathe; visitor produced' form "C." This, apparently, is the 1950 edition of the M.M.B.'s cffort to obtain information from those operators who wish to have their haulage rates revised.

Hot Under the Collar

My first reaction was that if I were asked to give such intimate details of my business, should get hot under the collar. One of my two friends passed the comment that we were by now almost a totalitarian state and that we ought have to expect to put up with that sort of thing. The other, whilst agreeing in principle with my comment, said that the position here is that the customer says in effect: "If you can justify a higher rate, we will pay you a higher rate," and that might well be said by any customer.

The haulier can choose for himself whether or i not he will disclose his costs If he does not, then he does not get the better rate. It is always up to him hi

with the M.M.B., or any other customer, to say: "I am not satisfied with the Tate and will no longer carry your traffic unless you pay me what I ask" Then it is up to the MM. B. or the customer, either to pay him his rate or dis continue his services. If it thinks it can get from other • sources suitable vehicles at the rate it is prepared to pay, then presumably it will do so. If it has no alternative but to employ the carrier in question, then presumably it will pay whatever rate he asks.

Now to turn to Form C. The difference between that and • Forms A and B indicates that the education of the M.M.B. proceeded apace after 1944. So far as vehicle costs are Concerned, the information asked for is the 'same. There is a little more detail required, such as information about the unladen weight of the vehicle, but the items as enumerated are unaffected.

The big difference is to be nr,ted on C2, where not only do we find maintenance dean with at some length, but a real acknowledgment of overhead costs, including provision for cost of garage or rent.

The only item which is still omitted from the account is interest on capital invested in the vehicle. Although I know that there are differences of opinion as to the fairness of including that item, I hold that interest on capital outlay is a fair item to include in the operating cost of a commercial vehicle, when that cost is being assessed as a basis for the calculation of rates.

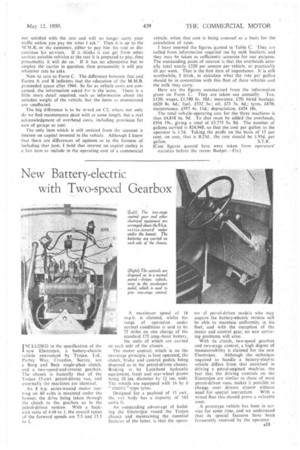

I have inserted the figures qaoted in Table C. They are culled from information supplied me by milk hauliers, arid they may be taken as sufficientiv accurate for our purpose. The outstanding point of interest is that the overheads actually. total nearly £320 per annum per vehicle, or practically £6 per week. That is the first item of importance.. It is stilt worthwhile, I think, to calculate what the rate per gallon should be in connection with this fleet of three vehicles and

the milk they carry. •

Here are the figures summarized from the information given on Form C. They are taken k out annually. Tax, £120; wages, £1,580 6s. 10d.; insurance, £70; hired haulage, £620 8s. 6d.; fuel, £532 -3s.; oil, £33 5s. 64.; tyres, £470; Maintenance, £957 4s. I ld.; depreciation, £434 18s.

The total vehicle-operating cost for the three machines is thus £4,818 6s. 9d. To that must be added the overheads, £956 19s., giving a total of £5,775 5s. 9d. The number of gallons carried is 824,960, so that the cost per gallon to the operator is 1.7d. Taking the profit on the basis of 15 per cent, on cost, that is 0.25d., the rate should be I.950. per gallon. S.T.R. [Cost figures quoted here were taken from operators' statistics before the recent Budget.---Fol