Efficiency: the key to survival The prophets of doom are

Page 14

If you've noticed an error in this article please click here to report it so we can fix it.

out in force, predicting the imminent decline of the UK haulage industry. But do the figures bear out these harbingers? Rob Willock reports.

• If we are to believe the booboys, the state of the nation's haulage industry is dire as operators struggle for survival. The Government's fuel duty escalator will add 6% over inflation each year to the already-high price of diesel; cheap eastern European operators are muscling in on UK contracts; and July's cabotage rule changes could start a new round of competition from abroad.

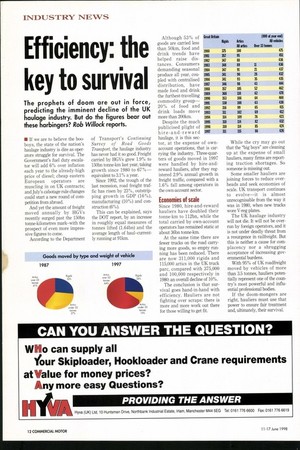

And yet the amount of freight moved annually by HGVs recently surged past the 150bn tonne-kilometres mark–with the prospect of even more impressive figures to come.

According to the Department of Transport's Continuing Survey of Road Goods Transport, the haulage industry has never had it so good. Freight carried by HGVs grew 1.9% to 150bn tonne-km last year, taking growth since 1980 to 67%— equivalent to 3.1% a year.

Since 1992, the trough of the last recession, road freight traffic has risen by 23%, outstripping growth in GDP (16%), manufacturing (10%) and construction (6%).

This can be explained, sags the DOT report, by an increase in roughly equal measures of tonnes lifted (1.64bn) and the average length of haul–currently running at 91km. Although 53% of goods are carried less than 50km, food and drink trends have helped raise distances. Consumers demanding seasonal produce all year, coupled with centralised distribution, have made food and drink the furthest-travelling commodity group20% of food and drink loads move more than 200km.

Despite the much publicised plight of hire-and-reward haulage, it is this sector, at the expense of ownaccount operations, that is carrying the industry. Three-quarters of goods moved in 1997 were handled by hire-andreward hauliers, after they registered 2.9% annual growth in freight traffic, compared with a 1.6% fall among operators in the own-account sector.

Economies of scale Since 1980, hire-and-reward hauliers have doubled their tonne-km to 112bn, while the total carried by own-account operators has remained static at about 36bn tonne-km.

At the same time there are fewer trucks on the road carrying more goods, so empty running has been reduced. There are now 311,000 rigids and 115,000 artics in the UK truck parc, compared with 375,000 and 100,000 respectively in 1980: an overall decline of 10%.

The conclusion is that survival goes hand-in-hand with efficiency. Hauliers are not fighting over scraps: there is more and more work out there for those willing to get fit. While the cry may go out that the "big boys" are cleaning up at the expense of small hauliers, many firms are reporting traction shortages. So someone is missing out.

Some smaller hauliers are joining forces to reduce overheads and seek economies of scale. UK transport continues to evolve—it is almost unrecognisable from the way it was in 1980, when new trucks wore V-reg plates.

The UK haulage industry will not die. It will not be overrun by foreign operators, and it is not under deadly threat from a resurgence in railfreight. But this is neither a cause for complacency nor a shrugging acceptance of increasing governmental burdens.

With 95% of UK roadfreight moved by vehicles of more than 3.5 tonnes, hauliers potentially represent one of the country's most powerful and influential professional bodies.

If the doom-mongers are right, hauliers must use that power to ensure fair treatment and, ultimately, their survival.