STATE OF THE UNION

Page 96

Page 97

If you've noticed an error in this article please click here to report it so we can fix it.

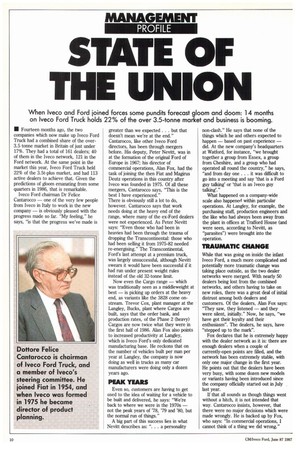

• Fourteen months ago, the two companies which now make up Iveco Ford Truck had a combined share of the over3.5 tonne market in Britain of just under 17%. They had a total of 161 dealers; 40 of them in the Iveco network, 121 in the Ford network. At the same point in the market this year, Iveco Ford Truck held 22% of the 3.5t-plus market, and had 113 active dealers to achieve that. Given the predictions of gloom emanating from some quarters in 1986, that is remarkable.

Iveco Ford chairman Dr Felice Cantarocco — one of the very few people from Iveco in Italy to work in the new company — is obviously pleased with the progress made so far. "My feeling," he says, "is that the progress we've made is greater than we expected. . but that doesn't mean we're at the end." Cantarocco, like other Iveco Ford directors, has been through mergers before. His deputy, Peter Nevitt, was in at the formation of the original Ford of Europe in 1967; his director of commercial operations, Alan Fox, had the task of joining the then Fiat and Maginis Deutz operations in this country after Iveco was founded in 1975. Of all these mergers, Cantarocco says, "This is the best I have experienced."

There is obviously still a lot to do, however. Cantarocco says that work needs doing at the heavy end of the range, where many of the ex-Ford dealers were not experienced. As Peter Nevitt says: "Even those who had been in heavies had been through the trauma of dropping the Transcontinental: those who had been selling it from 1975-82 needed re-energising." The Transcontinental, Ford's last attempt at a premium truck, was largely unsuccessful, although Nevitt swears it would have been successful if it had run under present weight rules instead of the old 32-tonne limit.

Now even the Cargo range — which was traditionally seen as a middleweight at best — is picking up orders at the heavy end, as variants like the 3828 come onstream. Trevor Cox, plant manager at the Langley, Bucks, plant where Cargos are built, says that the order bank, and production rates, of the Phase 2 (heavy) Cargos are now twice what they were in the first half of 1986. Alan Fox also points to increased productivity at Langley, which is Iveco Ford's only dedicated manufacturing base. He reckons that on the number of vehicles built per man per year at Langley, the company is now doing as well in trucks as many car manufacturers were doing only a dozen years ago.

PEAK YEARS

Even so, customers are having to get used to the idea of waiting for a vehicle to be built and delivered, he says: "We're back to where we were in the 1970s — not the peak years of '78, '79 and '80, but the normal run of things."

A big part of this success lies in what Nevitt describes as: ". . . a personality non-clash." He says that none of the things which he and others expected to happen — based on past experience — did. At the new company's headquarters at Watford, for instance, "we brought together a group from Essex, a group from Cheshire, and a group who had operated all round the country," he says, "and from day one . it was difficult to go into a meeting and say 'that is a Ford guy talking' or 'that is an Iveco guy talking'."

What happened on a company-wide wale also happened within particular operations. At Langley, for example, the purchasing staff, production engineers and the like who had always been away from the plant in offices at Trafford House (and were seen, according to Nevitt, as "parasites") were brought into the operation.

TRAUMATIC CHANGE

While that was going on inside the infant Iveco Ford, a much more complicated and potentially more traumatic change was taking place outside, as the two dealer networks were merged. With nearly 50 dealers being lost from the combined networks, and others having to take on new roles, there was a great deal of initial distrust among both dealers and customers. Of the dealers, Alan Fox says: "They saw, they listened — and they were silent, initially." Now, he says, "we have got their loyalty and their enthusiasm". The dealers, he says, have "stepped up to the mark".

Fox declares that he is extremely happy with the dealer network as it is: there are enough dealers when a couple of currently-open points are filled, and the network has been extremely stable, with only one major change in the first year. He points out that the dealers have been very busy, with some dozen new models or variants having been introduced since the company officially started out in July last year.

If that all sounds as though things went without a hitch, it is not intended that way. Cantarocco insists, however, that there were no major decisions which were made wrongly. He is backed up by Fox, who says: "In commercial operations, I cannot think of a thing we did wrong." Cantarocco hastens to point out that "this is not because we are so clever — just that we had a lot of experience of this kind of thing. We had made our mistakes in the past." The two cultures have not, of course, merged completely.

Nevitt points out that while Langley, for instance, continues to make a product line completely different from that made in the Iveco plants, it would not make sense to try to impose one system on the other. Parts for Cargos still come from Daventry, for instance, while an Iveco Ford dealer buys parts for Italian-sourced models from the same source he buys those vehicles from in the first place — Iveco UK in Winsford, Cheshire. They do share a common ordering system, however.

PRODUCT LINES

The Iveco Ford management goes to great lengths to emphasise that things like that are not going to change: there are clearly no plans to integrate the manufacturing or design of the Cargo and Iveco lines. As Fox puts it: "Having Cargo as a separate product line is no different from the rest of the Iveco set-up where there are separate product lines." Nor is there any intention of replacing Cargo with an Italian, French or German product.

Cantarocco says: "The production life of Cargo is not an issue. Cargo as a product is so up-to-date and modern it would be completely wrong to consider what its lifetime is." He reminds anyone pursuing this line of thought that there are far older products, both within the Iveco empire (the 1950s-designed 680, for instance) and outside it than the Cargo, which was launched in 1981.

Fox follows up by saying: "We're doing a lot of development work on it — and we still have a few aces in the hole." He sees a long-term future for the British product and its role in home and export markets: "While I can continue to sell Cargos, the company will continue to make them," promises Fox.

There is an equally bullish outlook on the future of the whole Iveco/Ford agreement. The initial agreement has always been seen by outsiders as being of limited duration, but Cantarocco says that is wrong. "It's a longer agreement than four or five years," he says. "The two shareholders have not established a date for the expiration of the agreement." Just for how long the agreement lasts, or how it develops in the future, is, he says, purely a matter for the two shareholders (Ford and Iveco) and is not something on which the Iveco Ford management can or will be drawn. In the meantime, he says, the shareholders are "very happy" with what the company is doing.

The part of the future which does concern the Iveco Ford management is the making of trucks and the selling of trucks on the British market. Although there has been a great deal of recent publicity over the market shares obtained by the two major combined groups here (Iveco Ford and Leyland Daf), Fox says that market share is not his primary goal.

"We do not believe that we've finished growing," he says, but market share is not the god. We are only interested in making commercially sensible progress." All three agree that there is no point in losing money by buying market share: "We don't want to destroy our competitors and destroy ourselves at the same time," says Cantarocco.

MARKET NICHE

The aim is to sell many more trucks, especially heavy trucks, in the future, and Fox points to new models like six-wheeled Cargos, eight-wheeled Ivecos and the Turbostars as means of achieving that. Each has its own market niche, he says, noting that: "We are very, very lucky how complementary they are." Cantarocco says that it was important right from the beginning to avoid conflict and confusion in the market, and claims that that aim has been achieved. "Each part of the product range can be related to a specific section of the market," he says. Nevitt adds that with the two ranges available: "We could really cherry-pick — and that's what happened."

With the dealer network and the product line in place, the next big aim for the Iveco Ford management is to make money. Noting that: "You can find very few truck companies profitable throughout Europe," Cantarocco says that for him: "It would be a big success to improve the profitability of the company in 1987."

While he is confident that the results achieved by Iveco Ford "will not be too bad" this year, and that the losses associated with the start-up of the company are over, he allows that it would be optimistic to count on reaching the black in 1987 — "but it's not something we would discount," he says.

Cantarocco stresses that the company envisages that the UK operations will be profitable in the future. Fox puts a lot of that down to the "young, dynamic" team which is in place, and Cantarocco agrees. "It's people — you can have the best technology in the world, but without ople there is no chance," he says. LJ by Allan Winn