Teaming up for global success

Page 12

Page 13

If you've noticed an error in this article please click here to report it so we can fix it.

• by Brian Weatherley

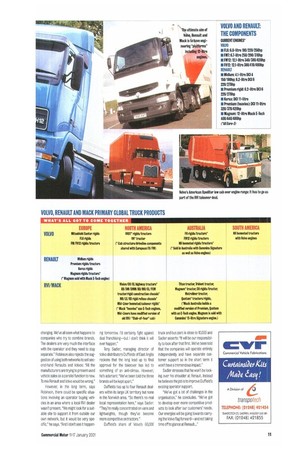

In December Volvo got the Christmas present it had been waiting for when the US Department of Justice blessed its planned acquisition of Renault's commercial vehicle operation. While the takeover had gained EU blessing in September, it still required a "non-competitive" green light in America. Now it's a done deal— barring some minor conditions: • Volvo must sell its last Scania shares; • Volvo Trucks North America must sell its low cabover engine business; • Renault must dispose of its 50% stake in the joint RVI/Sisu sales and marketing operation in Finland; • The joint Renautt/Iveco lrisbus project must be ended within two years.

The deal makes the new Volvo/ Renault combine the world's second largest truck manufacturer after Daimler Chrysler. AB Volvo group boss Leif Johansson says; ''We're eager to quickly implement the strategy for the new truck group and merged powertrain units." Considering the potential savings on component purchase alone, that's hardly surprising.

In its official statement AB Volvo says that after two years "the total integration gains" will amount to some SKr3.5bn (.25.4m). It adds: Over a longer term, the gradual integration of the two companies and their product programmes will yield synerges of approximately another SKr3bn (121.8m) on an annual basis.

Those synergies are already being implemented. According to AB Volvo spokesman Stefan Lorent2son it's all about "platforms": "The intention in the

volume sector is to create a platform of engines, and we're looking at 12 litres." That's logical, as Volvo, Renault and Mack have already moved towards a 12-litre block as their standard heavy truck engine. Thif all three marques will ultimately share a common 12-litre lump, albeit with their own individual ancillaries such as electronics and fuelling systems.

However, those new engines won't appear much before the Euro-4 deadline of 2005, not least as Volvo and Renault have already unveiled their Euro-3 line-up (see top right, next page).

There could well be some engine shar ing before then. Renault currently needs a "big banger" for its flagship tractor after the demise of the Mack E9 500hpplus VS that was originally fitted in the Magnum. Adopting Volvo's 16-litre in-line six could get it out of a hole, although Volvo has yet to confirm when, or even if, its big six will go to Euro-3.

If it doesn't, then Volvo and Renault could both adopt Cummins' 15-litre Signature in Europe—it already powers the FH and Magnum in Australia.

In the longer term ft's inevitable, given Volvo's existing "global" cab policy, that Volvo and RVI will share a cab, or core structure. But as the FH/FM and Premium have plenty of life in them we're looking at a next generation.

For now Renault VI (UK)'s marketing director Euan Harron insists that UK operators will see little upheaval. "Most changes will happen in what I'd call the 'Back-Office' on purchasing and so-on," he explains. "In the short-term everything you see and have from Renault and Volvo will still be there. We've a full range of Euro-3 engines developed for this year and we'll be going ahead with them— they'll be no different.

"The best solutions will be made in the long-term, but I've been personally convinced by all the conversations I've had that the two separate brands and dealer networks will be maintained. The old way of truck manufacturers buying one another and vertically integrating everything only ends up losing customers."

While the Premium and FH have similar life-spans, Renault's Magnum remains a one-off which could ultimately become vulnerable to any future product rationalisation. However, Harron insists: "It will go forward. All the design work is done on it and the next evolutions are planned and part of our product range. Nobody does it like Magnum—it's still a strong seller across Europe."

THE DEALER VIEW

Alistair Robinson is boss of Renault Truck Commercials, which manages BVt's eight wholly-owned UK distributors, currently handling around 45% of all RVI products sold in the UK. In the short and medium term, he says: "I don't see anything changing. We've all seen what happens to companies who try to combine brands. The dealers are very much the t'iterface wtth the operator and they need to stay separate." Robinson also rejects the suggestion of using both networks to sell second-hard Renaults and Volvos: "All the manufacturers are trying to present used vehicle sales as a parallel function to new. To mix Renault and Volvo would be wrong."

However, in the long term, says Robinson, there could be specific situations involving an operator buying vehicles in an area where a local RVI dealer wasn't present. "We might look for a suitable site to support it from outside our own network, but it would be very specific," he says. "And I don't see it happen Ing tomorrow. I'd certainly fight against dual franchising—but I don't think it will ever happen."

Tony Sadler, managing director of Volvo distributors Duffields of East Anglia reckons that the long lead up to final approval for the takeover has led to something of an anti-climax. However, he's adamant: "We've been told the three brands will be kept apart."

Duffields has up to four Renault dealers within its large UK territory but none in the Norwich area. "So there's no real local representation here," says Sadler. "They're really concentrated on vans and lightweights, though they've become more competitive on tractors."

Duffield's share of Volvo's 60,000 truck and bus parc is close to 10,000 and Sadler asserts: "It will be our responsib4ity to look after that first. We've been told that the companies will operate entirely independently and have separate customer support so in the short term I won't have a tremendous impact."

Sadler stresses that he won't be looking over his shoulder at Renault. Instead he believes the job is to improve Duffield's existing operator support

"We've got a lot of challenges in the organisation," he concludes. "We've got to develop ever more competitive products to look after our customers' needs. Our energies will be going towards carrying the Volvo flag forward—and not taking time off to glance at Renault..."