HER E IT'S

Page 48

Page 49

If you've noticed an error in this article please click here to report it so we can fix it.

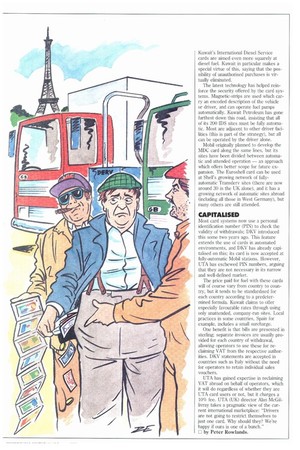

• Although the names on the European filling stations tend to be the same from one country to another, the options for buying fuel on credit on cross-border trips have generally been limited. Many truck drivers have had to carry huge bundles of cash with them, or resort to using ordinary credit cards.

The one universally-known fuel card has been DKV. Its orange symbol, recently updated, remains instantly recognisable throughout Europe and beyond. The card is accepted at 6,000 truck stops in 30 countries, and besides fuel it can be used for recovery, repairs and many other services.

NEW BUSINESS

With the Single European Market now looming, UK fuel suppliers and credit card companies are now waking up to the prospect of new business — as they realise, many more British drivers will soon be refuelling on the Continent.

DKV still sets the pace, however. The West German company behind it, Deutscher Kraftverkehr, has been in business since 1934, and has offered its distinctive credit cards for more than 20 years. It established the pattern of offering a card that was free to users, and gave truck operators control by restricting purchases to journey-related expenses.

There have been other contenders, of course. One of the more successful is UTA, (Union Tank Aschaffenburg), another West German operation. It claims 4,000 sites in 22 countries, and is supported in Britain by BP, which has a stake in the holding company.

Both DKV and UTA have British representation, and can therefore offer their international resources to UK customers. But recently these independent specialists have been facing increased competition from the oil companies, which are naturally keen to encourage captive business.

Shell is the leading contender here; its Euroshell card has been offered in the UK for some years, but last month it was relaunched as part of an aggressive drive by the company to build up its share of international business. The Euroshell card can be used at 3,000 specialist truck sites in 25 countries, and Shell has either a local subsidiary or other strong local links in all of them. For British operators, the two most active international suppliers after Shell are Kuwait Petroleum (the (48 company) and Mobil. Both of these firms offer UK users an international fuel card service tailored to truck drivers' needs.

Now independent British card operators such as Dia!card and Overdrive are entering the European fray. All Star operator PHH has already made its first move by taking over West German card operator Dekra, and more developments can be expected on this front.

Selecting the most appropriate card for your needs is not easy. If terms of business are your chief criterion, there is little to choose between the various suppliers. They all supply the cards free (usually subject to a credit check); they establish credit limits to suit individual operators; they also tend to send bills twice-monthly. Payment is expected without delay; UTA, for instance, uses direct debit.

Nonetheless there are significant differences in how the various cards can be used. DKV has taken the most expansive view, allowing its card to be used not only for spares and service but also for certain ferry crossings and road tolls. It can even be used for paying transit taxes in Austria and Switzerland.

With its relaunched Euroshell card, Shell has introduced a three-tier system. Operators can restrict their drivers to fuel, ferry tickets and tolls; they can include vehicle service and parts; or they can allow drivers to buy anything on sale in service station shops. Shell says that, contrary to expectation, many early takers have opted for the full package.

TOLL SERVICES

Shell's ferry and Loll services are still at an early stage. In practice, only DK'V has a fully-fledged package of agreements in place with bodies such as toll authorities which include the Frejus and Mont Blanc tunnels authorities. DKV has even struck agreements with other domestic card operators to extend its service. For instance, it can obtain the French Caplis card for its British customers, which will pay for most French autoroute tolls. Similarly, it supplies a version of the VIA card for Italy.

UTA is more fuel-specific in its operation, Mobil's Diesel Club cards and Kuwait's International Diesel Service cards are aimed even more squarely at diesel fuel. Kuwait in particular makes a special virtue of this, saying that the possibility of unauthorised purchases is virtually eliminated.

The latest technology has helped reinforce the security offered by the card systems. Magnetic-strips are used which carry an encoded description of the vehicle or driver, and can operate fuel pumps automatically. Kuwait Petroleum has gone furthest down this road, insisting that all of its 200 IDS sites must be fully automatic. Most are adjacent to other driver facilities (this is part of the strategy), but all can be operated by the driver alone.

Mobil originally planned to develop the MDC card along the same lines, hut its sites have been divided between automatic and attended operation — an approach which offers better scope for future expansion. The Euroshell card can be used at Shell's growing network of fullyautomatic Transderv sites (there are now around 30 in the UK alone), and it has a growing network of automatic sites abroad (including all those in West Germany), but many others are still attended.

CAPITALISED

Most card systems now use a personal identification number (PIN) to check the validity of withdrawals: DKV introduced this some two years ago. This feature extends the use of cards in automated environments, and DKV has already capitalised on this; its card is now accepted at fully-automatic Mobil stations. However, UTA has eschewed PIN numbers, arguing that they are not necessary in its narrow and well-defined market.

The price paid for fuel with these cards will of course vary from country to country, but it tends to be standardised for each country according to a predetermined formula. Kuwait claims to offer especially favourable rates through using only unattended, company-run sites. Local practices in some countries, Spain for example, includes a small surcharge.

One benefit is that bills are presented in sterling; separate invoices are usually provided for each country of withdrawal, allowing operators to use these for reclaiming VAT from the respective authorities. DK V statements are accepted in countries such as Italy without the need for operators to retain individual sales vouchers.

UTA has gained expertise in reclaiming VAT abroad on behalf of operators, which it will do regardless of whether they are UTA card users or hot, but it charges a 10% fee. UTA (UK) director Alan McGillivray takes a pragmatic view of the current international marketplace: "Drivers are not going to restrict themselves to just one card. Why should they? We're happy if ours is one of a bunch."

E by Peter Rowlands.