anx Dutch trucks 'British'

Page 28

If you've noticed an error in this article please click here to report it so we can fix it.

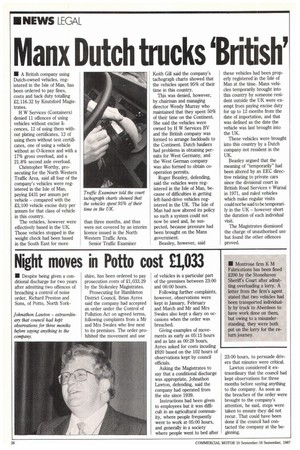

• A British company using Dutch-owned vehicles, registered in the Isle of Man, has been ordered to pay fines, costs and back duty totalling 22,116.32 by Knutsford Magistrates.

H W Services (Containers) denied 11 offences of using vehicles without excise licences, 12 of using them without plating certificates, 12 of using them without test certificates, one of using a vehicle without an 0-licence and with a 17% gross overload, and a 21.8% second axle overload.

Christopher Worthy, prosecuting for the North Western Traffic Area, said all four of the company's vehicles were registered in the Isle of Man, paying 2431 per annum per vehicle — compared with the 23,100 vehicle excise duty per annum for that class of vehicle in this country.

The vehicles, however were effectively based in the UK. Those vehicles stopped in the weight check had been based in the South East for more than three months, and thus were not covered by an interim licence issued in the North Western Traffic Area.

Senior Traffic Examiner Keith Gill said the company's tachograph charts showed that the vehicles spent 95% of their time in this country.

This was denied, however, by chairman and managing director Wendy Murray who maintained that they spent 50% of their time on the Continent. She said the vehicles were owned by H W Services BY and the British company was formed to arrange backloads to the Continent. Dutch hauliers had problems in obtaining permits for West Germany, and the West German company was also formed to obtain cooperation permits.

Roger Beasley, defending, said the vehicles were registered in the Isle of Man, because of difficulties in getting left-hand-drive vehicles registered in the UK. The Isle of Man had now altered its policy so such a system could not now be used and, he suspected, because pressure had been brought on the Manx government.

Beasley, however, said these vehicles had been properly registered in the Isle of Man at the time. Manx vehicles temporarily brought into this country by someone resident outside the UK were exempt from paying excise duty for up to 12 months from the date of importation, and that was defined as the date the vehicle was last brought into the UK.

These vehicles were brought into this country by a Dutch company not resident in the UK.

Beasley argued that the meaning of "temporarily" had been altered by an EEC directive relating to private cars since the divisional court in British Road Services v Wurzal in 1971, and ruled vehicles which make regular visits could norbe said to be temporarily in the UK — however short the duration of each individual visit.

The Magistrates dismissed the charge of unauthorised use but found the other offences proved.