10. Depreciation must be realistic

Page 61

Page 62

Page 65

If you've noticed an error in this article please click here to report it so we can fix it.

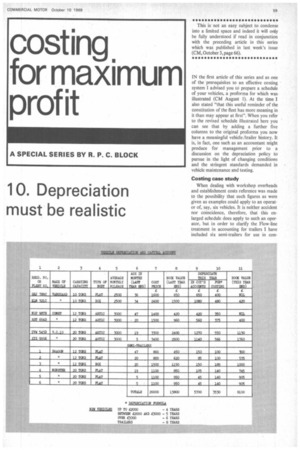

IN the first article of this series and as one of the prerequisites to an effective costing system I advised you to prepare a schedule of your vehicles, a proforma for which was illustrated (CM August 1). At the time I also stated "that this useful reminder of the constitution of the fleet has more meaning in it than may appear at first". When you refer to the revised schedule illustrated here you can see that by adding a further five columns to the original proforma you now have a meaningful vehicle /trailer history. It is, in fact, one such as an accountant might produce for management prior to a discussion on the depreciation policy to pursue in the light of changing conditions and the stringent standards demanded in vehicle maintenance and testing.

Casting case study

When dealing with workshop overheads and establishment costs reference was made to the possibility that such figures as were given as examples could apply to an operator of, say, six vehicles. It is neither accident nor coincidence, therefore, that this enlarged schedule does apply to such an operator, but in order to clarify the Flow-line treatment in accounting for trailers I have included six semi-trailers for use in con junction with this operator's four prime movers.

Indeed, from this stage onwards I shall use this small fleet to amplify performance and operating costs as the principles are the same for all, irrespective of size or use. Particular attention will be paid to the 10-tonner KLM 321C for which a completed Form R.B.6 will be introduced later on.

A similar study will be made into the performance and operating costs of a mythical own-account operator's 5-ton van but just now I need to draw your attention to the "vehicle depreciation and capital account" in order to explain its meaning and purpose together with the pitfalls to be avoided through a misunderstanding or misuse of depreciation.

For easy identification I,have numbered the columns from 1 to 11, omitting the "Petrol or Diesel" and "Nature of Work Employed On" columns in the original schedule and in addition "Month and Year First Registered" has been converted to "Age in Months (Last Year End)" as contained in column 6. This provides a useful datum, i.e. the end of a company's last financial year, from which to calculate the ages of all vehicles in service at that time and still in operation. Any new vehicles acquired since should be included in column 6 but substituting "age" by the first operative date. As further evidence a new acquisition would have no entry under column 8.

Each trailer is regarded as a separate capital purchase, thus avoiding any confusion over which trailer belongs to which tractive unit, and this is important in multi-trailer operations.

Columns I to 6 are self-explanatory, accepting that the makes of vehicles included under column 2 are more readily identified with another transport mode.

Column 7 applies to new vehicles and trailers as otherwise the age and cost of secondhand vehicles would have a marked effect on depreciation and the book value at the end of the year.

Column 8 provides the written down value in the company's books of each unit and, as with age, at the end of the last financial year. In comparing the two it can be readily calculated that on a total expenditure of £20,000 (Col. 7) the previous year's book value of £13,800 indicates that the total depreciation over the whole period, i.e. the difference between cost price and last year's book value, was only £6,200.

From this example it can be deduced that there was no uniform depreciation policy; consequently, we can only conclude that the amount provided in previous years has had regard to the gross profit made before depreciation. Many small operators are guilty of this short-sighted practice, and in the case of hauliers it is their undoing as if and when they wish to sell the business or are approached on merger or takeover possibilities, the moment of truth arrives when the assets value in the books will not stand up to sound commercial practice.

Column 9 indicates, therefore, the amount of depreciation to provide in the current year's accounts in order to conform with the depreciation formula used in the Flow-line system as laid down previously and repeated at the foot of this schedule. In this particular year, the "one off" amount to be provided in order to arrive at reasonable market values is /5,700 and which is only £500 short of the total amount provided in previous years.

Racfical step Such a radical step might be questioned by the accountant, but as the objective is to keep in line with prevailing market values and as we are dealing with rapidly depreciating assets in the motive units, it is management's responsibility to advise the accountant of the reasons for accelerating the depreciation rate as partly to reduce replacement periods and primarily to avoid throwing good money after bad in unwarranted repair bills and down-time. Events have overtaken this particular operator and so there is an urgent need to re-appraise both the depreciation and replacement policy.

Column 10 indicates the amount of depreciation to be taken into costing using the "straight line" method in equal annual amounts but within the time scale of the formula proposed.

Column 11 is the resultant of employing the depreciation formula used in Flow-line accounting, and although it may be desirable to adopt the same formula for costing purposes, you will recollect that this would involve a reconciliation between the trading results of one year and another on the grounds that the relatively high write-off rate in the first year, i.e. 40 per cent, would be inconsistent with the amount of depreciation taken in subsequent years.

On the other hand, while the formula used for financial accounting provides the greatest flexibility to management when a decision has to be taken to replace or repair, the "equal instalment" method used in costing presupposes that a vehicle will be retained in service throughout the period in which it is being costed.

Nevertheless, there is no valid reason why the same formula should not be used in both financial accounting and costing, as by the use of the schedule illustrated any difference in the amount of depreciation taken as between one year and another can be readily ascertained.

Finally, do not forget that whatever company depreciation policy is adopted other than the allowances currently provided by the Inland Revenue, it will not make the slightest difference to your liability to tax and so I must reiterate that any book loss or profit on the sale of a vehicle is simply a book entry and not necessarily profit or loss for tax purposes.