The year ahead

Page 8

Page 9

If you've noticed an error in this article please click here to report it so we can fix it.

The latest Trucking Britain survey demonstrates plenty of optimism among transport operators, but some are more optimistic than others By Justin Stanton WELCOME TO 2013 — and welcome to the good times, at least for some! December's Trucking Britain highlights operators in a broadly positive frame of mind.

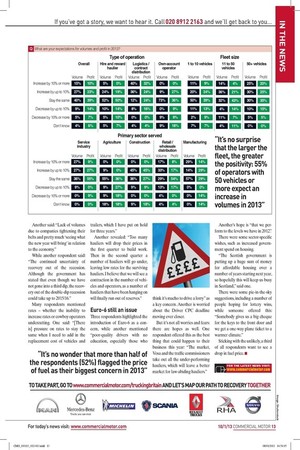

Nearly half of the survey respondents (42%) expect volumes to increase in 2013 and a third expect an increase in profit, while only 14% expect a decrease in volumes and 21% a decrease in profit. The analysis (above right) makes for happy reading, comparing the 2013 outcome with data for the three previous years.

The analysis on the opposite page highlights the outlook for 2013 broken down by type of operation, fleet size and primary sector served, and reveals some harsh truths.

It's no surprise that the larger the fleet, the greater the positivity: 55% of operators with 50 vehicles or more expect an increase in volumes in 2013, compared with 31% of fleets with one to 10 vehicles; and 45% of operators with 50 vehicles or more expect an increase in profit in 2013, compared with 33% of fleets with one to 10 vehicles.

But, crucially, the analysis by type of operation reveals that logistics and contract distribution • • • • • • • • • • • • • • • • • firms are overwhelmingly accentuating the positive: more than threequarters of them (76%) expect an increase in volumes in 2013, while only 8% expect a decrease. More than half (56%) expect an increase in profit, while only 16% expect a decrease.

In contrast, only 29% of hire or reward hauliers expect an increase in volume, while 15% expect a decrease. And only 9% of ownaccount operators expect a boost in volumes.

A more positive outlook Analysis by primary sector served shows almost universal positivity, with the notable exception of operators in the agriculture sector: by volumes, only 9% expect an increase and 18% expect a decrease; and by profit, none expect an increase, but 45% expect a decrease.

Having garnered respondents' views about volumes and profit, we then asked them about their fears for 2013: it's no wonder that more than half of the respondents (52%) flagged the price of fuel as their biggest concern. But it's not the only worry: many highlighted the impact of late-paying customers and large debts, while others mentioned the rising cost of maintenance.

Some respondents took a strategic view: "Any further decline in business has a big impact because we work for all different businesses all round the country," said one.

• • • • • • • • • • • • • • • • • Another said: "Lack of volumes due to companies tightening their belts and pretty much 'seeing what the new year will bring' in relation to the economy."

While another respondent said: "The continued uncertainty of recovery out of the recession. Although the government has stated that even though we have not gone into a third dip, the recovery out of the double-dip recession could take up to 2015/16."

Many respondents mentioned rates — whether the inability to increase rates or cowboy operators undercutting. One said: "[There is pressure on rates to stay the same when I need to add in the replacement cost of vehicles and trailers, which I have put on hold for three years."

Another revealed: "Too many hauliers will drop their prices in the first quarter to build work. Then in the second quarter a number of hauliers will go under, leaving low rates for the surviving hauliers. I believe that we will see a contraction in the number of vehicles and operators, as a number of hauliers that have been hanging on will finally run out of reserves."

Euro-6 still an issue Three respondents highlighted the introduction of Euro-6 as a concern, while another mentioned "poor-quality drivers with no education, especially those who think it's macho to drive a lorry" as a key concern. Another is worried about the Driver CPC deadline moving ever closer.

But it's not all worries and fears: there are hopes as well. One respondent offered this as the best thing that could happen to their business this year: "The market, Vosa and the traffic commissioners take out all the under-performing hauliers, which will leave a better market for law-abiding hauliers."

Another's hope is "that we perform to the levels we have in 20127 There were some sector-specific wishes, such as increased government spend on housing.

"The Scottish government is putting up a huge sum of money for affordable housing over a number of years starting next year, so hopefully this will keep us busy in Scotland," said one.

There were some pie-in-the-sky suggestions, including a number of people hoping for lottery wins, while someone offered this: "Somebody gives us a big cheque for the keys to the front door and we get a one-way plane ticket to a warmer climate."

Sticking with the unlikely, a third of all respondents want to see a drop in fuel price. • Optimism still high OPTIMISM LEVELS fell again in December to 46, making it the second consecutive month that the optimism index has fallen — October's 58 slipped to 52 in November, before falling last month.

Of the respondents, 73% said they were either very optimistic or fairly optimistic about their business's prospects over the next 12 months, while 27% were either not very optimistic or not at all optimistic.

Logistics and contract distribution firms were, by some margin, the most positive in December, registering a 96/4 optimistic/ not optimistic split (against 82/8 in November).

Hire or reward hauliers were slightly less positive with a 67/34 split (compared with 68/28 in November). Own-account operators suffered a severe drop from 73/25 in November to 54/45 in December.

• The next Trucking Britain survey is now online. We want to know how your operation performed in Q4 2012. Go to commercialmotor. com/truckingbritain to take part.