Do You Know

Page 48

Page 49

Page 50

If you've noticed an error in this article please click here to report it so we can fix it.

WHAT HIRE-PURCHASE REALLY INVOLVES?

One Aspect of Hirepurchase Contract Explained by "The Commercial Motor" Costs Expert. Many Hauliers Labour Under Misguided Ideas About This

Method of Purchase.

SOME of the prevalent ideas about hire purchase are extraordinary. A question arose, recently, in the course of conversation with a haulier, about allocation in cost records of the amount to be paid by way of interest in connection with a hire-purchase transaction. I explained, as I have done, I think, hundreds of times, that such interest is not, strictly speaking, a vehicle cost, but is entirely independent of that. It is, in effect, the equivalent of the interest on a loan taken out to enable a man to carry on his business. It is, therefore, a business cost, establishment cost, or overhead) call it what you will.

The question arose after I had been addressing a meeting of hauliers, in the course of which I had explained that the item "interest on capital outlay," which is customarily debited against vehicle cost, was at the rate of 4 per cent. per annum.

"In that case," said this haulier, the amount of interest which I pay on the loan is the difference between 4 per cent, and the 7i per cent. which the hirepurchase companies charge for the accommodation, According to that," he continued, "it seems to me that I obtain my loan at a very reasonable rate."

• What the Loan Really Costs. •

"It would be," I said, "if the net rate of interest were really 74 per cent, on the actual accommodation. In point of fact the rate of interest may be nearly four times that."

"How do you make that out?" he asked. "According to my understanding it is 71 per cent, per annum on the original amount."

" Exactly," I answered, "and it could really be described as 71per cent. if you held the full amount for the period of repayment and paid it back in one lump sum plus the interest at the end of that time. You do not do so, for you commence to reduce the amount of the loan immediately and it becomes less and less each month, whereas the 74 per cent. per annum remains calculated on the initial sum until you have finished paying off, the instalments." "But it is just the same, isn't it," he asked, "if I obtain the money through the bank?"

"Not by any means," I said, "for if you can obtain the accommodation through your bank by way of overdraft and if you repay the bank, diminishing your overdraft month by month at the same rate as that at which you would repay the hire-purchase company, the bank charges you month by month interest, at 5 per cent, only, on the amount of your overdraft at that time. "If you borrow £120 from the bank and repay it at the end of 12 months, the interest at 5 per cent. is £6 and you repay £126.

"But if you diminish that overdraft by £10 per month, then the interest you pay diminishes accordingly, For the first month, you have had the benefit of the full £120 and the interest is one-twelfth of the £6, that is to say, 10s. During the second month, you owe the bank only £110 and the interest is reduced from 10s. to 9s. 2d. If you pay a further £10 during the second month, then for the third month you are owing the bank only £100 and the interest is 8s. 4d., and so on.

"Now if your hire-purchase transaction involves you in the same amount, that is to say, the repayment of £120 over a period of 12 months, you have to pay at a nominal rate of 74 per cent., which means that you

pay 15s, interest each month, all the time. For the last month, therefore, you pay 15s. interest, although the amount of the loan outstanding is only £10 and the rate of interest per annum for that month is 90 per cent."

" Good gracious, are you sure about that?" he asked,

" Quite," I answered, "but I can prove it in the case of any of your own transactions if you like. Have you got a hire-purchase agreement handy, so that we can

look into it? •

" Yes, I have," he said. "It so happens that I have one, just completed, which came in by post this morning. It refers to that new Blank vehicle I showed you this afternoon.

He looked the papers out and we examined them. The list price of the vehicle, I observed, was £662. The finance company's charges amounted to £60,. making a total of £722. He had paid £182 down, including in that an allowance for a used vehicle. Repayment was to be made at £30 per month.

"Now look here," he said. "I'm paying the finance company £722 altogether. That's the initial payment of R142 and 18 times 230, so that actually they are charging me £60 as interest. Well, I've worked that out and it comes to a little bit more than 9 per cent. for 18 months, That's only 6 per cent. per annum." "You're not very bright," I said.

"Why?" he asked, rather obviously taken aback.

" You've paid the company £182 already. The balance is only £540. The interest is still 460, which is 11.1 per cent. for the 18 months or 7.4 per cent. per annum."

" Oh, I see. I have slipped up a bit there. Still, it is only 71 per cent, isn't it?"

"It would be 7i per cent., as I have already said, if you retained that £540 for the 18 months and paid it back in a lump sum. The correct way to look at this transaction is this.

"The total of £722 is made up of three portions: the initial payment of £182, a loan of £480 and charges of 260. Now you see that you are actually paying interest of £60 on a loan of £480, which is 121pet cent. for the 18 months or 81 per cent. per annum.

• Tabulating the Account •

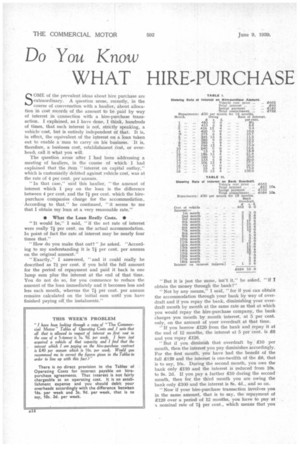

" It is also fair to divide the £30 you are paying each month into two parts, £26 13s. 4d. being an instalment on account of the principal, and £3 Os, 8d. being interest. Now we will set down in tabular form the state of your account, month by month.

For the first month you owe 2,480 and at the end of that month you pay off £26 13s. 4d. and RS 6s. 8d. interest, which is 8* per cent, per annum. During the second month, you owe only £453 6s, 8d., but you still pay the £3 Os. 8d. interest, which is at the rate of 8.8 per cent., and so on, month by month (see Table 1).

" You will note that for the last month you pay at the rate of 150 per cent. per annum, and the average interest, taking the whole 18 months, is a fraction over 29 per cent, per annum.

" But, good gracious, surely that's exorbitant?"

"Not altogether, if you take into consideration all the facts of the case. The hire-purchase companies take considerable risks. What happens, sometimes, is that a man buys a vehicle on terms perhaps the same as yours, works it for all it is worth for six months or so, overloading, speeding and so on, so that at the end of that brief period it is worth little more than its value as scrap. He then ceases his payments and by some means or another evades paying the balance." "But you said I could get the money at the bank at a much less rate of interest."

"1 did not say that you could, for therein lies the difference between a bank and a hire-purchase company. The hire-purchase company lends you money on the vehicle as security and, as I have just shown you, that can be very precarious. A bank will not lend you money on those terms, but only on very substantial security indeed—something which is as safe as the bank. That is why the bank can afford to lend on so much better terms. What they are, you can see by reference to these figures relating to the purchase of just such a vehicle as your present one, assuming that you borrowed the money from the bank at 5 per cent.

per annum. S.T.R.