What Vehicle Upkeep Costs

Page 54

Page 57

If you've noticed an error in this article please click here to report it so we can fix it.

IN this and the previous article. I am trying to impress the small operator with the importance of making provision in a schedule of expenses for all the 10 items of operating cost. Many small hauliers, whilst they appreciate that there are other items of running cost besides those concerned with fuel and lubricating oil, rarely make proper provision for others such as tyres, maintenance and depreciation. Outlay on these items must, of course, be reckoned with.

The frequency with which the first two items occur is indeed the principal reason why the operator is not prone to overlook or under-estimate them.. The other three to which I have just referred, and which appear in Table I under the heading of "Sinking Fund," occur at fairly long intervals. The haulier is often misled into overlooking provision for them in his cost records. In that way he gets a mistaken idea .of the profits he is earning, and for that reason numbers of small men cut rates and work at prices which are uneconomic. I shall refer to the difficulties created by owner-drivers later.

Many, however, have been shaken when realizing that in the • near future the Licensing Authority may inquire into rates and charges and take cognizance of them in coming to his decision on applications for licences. Operators are now realizing that if they do not know what their costs are, they will not know how to. charge. Because of this, .1 have split the items in Tables I and H, referring to two of them as " Expenditure " and the other three as "Sinking Fund." A sinking fund is devised to ensure ilia"( there is money available when a new set of tyres, an important job of maintenance, or a new vehicle is needed and has' to be paid for.

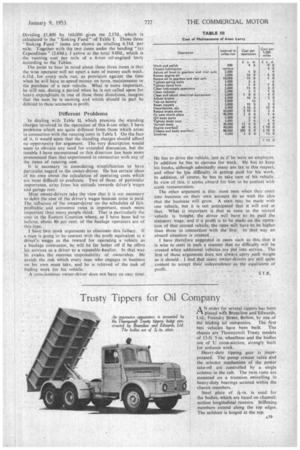

Serious Financial Position How important these three "Sinking Fund" items are may -be gathered as the result of a glance at the amounts set down in Table 1. The expenditure relating to only two items, oil fuel and lubricants, amounts to 2.69d. per mile. The "Sinking Fund" amounts to 6.31d.per mile, so that if the haulier is not making adequate provision for it, he can easily get himself into a serious financial position from which he cannot easily recover.

In the previous article I dealt with the items oil fuel, lubricants and tyres, and I come now to maintenance, concerning which there is the widest difference of opinion as to the amount involved.In "The Commercial Motor" Tables. of OPerating Costs the total provision for maintenance. that is to saysmaintenance (d) and maintenance

A36 (e) together, amounts to 1.80d. per mile. That is equivalent to £3 15s. per week, which seems rather high, and causes inexperienced operators to doubt the truth of the figures in the Tables.

• It is principally with the, idea of converting these doubters that I shall go into detail to assess the cost of

maintenance per mile.. The figures in Table were taken from the -accounts of a small haulier friend of mine, one, who, some time ago, proceeded to take his costs seriously and make provision for recording them, The information,' as I collected it, was not so eality. recorded as might seem by reference to that table. The amounts end • the mileage intervals were extracted -from his cost records, and whilst I have not made any material alteration -to the figures, t have rearranged the items a little to make them easier to Understand. The figures are fairly close to the average amounts which -a small operator has to hid in order to keep his vehicle in good mechanical order and of presentable appearance. .

Decarbonize -Every. 5,000 Miles ?

It may be of interest to indicate 'how I arrive at the amounts in the column "Cost per 1,000 Miles." I take the item "decarbonize, etc.," which in the case of . this operator is carried out every 5,000 miles at a cost of £2 10s. I would remark that the need for decarbonizing . so frequently is not pressing. Nor is the amount £2 10s. what I should have expected. That, however, is by the way. The point which I wish the reader to understand is that, so far as my friend's vehicles are concerned, he prefers to decarbonize at intervals of 5,000 miles and may economize in expenditure by doing some of the work himself.

To obtain an appropriate figure to put in the last cOluinn I divide the amount per 5,000 miles by five, which gives me 10s. All the items have been treated in that way, and the result, £7 10s. per 1,000 miles, is a fair 'amotint to debit against maintenance. It is equivalent to I.80d. per 'mile, which happens to agree with figures contained in the tables.

I come now to depreciation. As stated in the previous article, the assumption is made that the vehicle, an oilengined 6-tortner, cost £2,150 when new. Taking'away the price of a set of tyres, £150, and allowing £200 as the residual value, I get a basic figure of £1,800. as the amount

on which depreciation must be calculated. • I have assumed a life of 160,000 miles for the Nehicle, during whieh period this amount of £1,800 is. written off

Dividing £1,800 by 160,000 gives me 2.17d., which is calculated in the "Sinking Fund" of Table 1. Those three "Sinking Fund" items are shown as totalling 6.3Id. per mile. Together with the two items under the heading "(a) Expenditure" (2.69d.), I arrive at the total 9.00d., which is the running cost per mile of a 6-ton oil-engined lorry according to the Tables.

The point to bear in mind about these three items is that the wise operator will set apart a sum of money each week, 6.31d. for every mile run, as provision against the time when he will have to spend money on tyres, maintenance or the purchase of a new vehicle. What is more important, he will not, during a period when he is not called upon for heavy expenditure in one of these three directions, imagine that the sum he is earning and which should in part be debited to these accounts is profit.

Different Problems , In dealing with Table 11, which presents the standing charges inVolved.in the operation of this 6-ton oiler, I have problems which arc quite different from those which arose in connection with the running-costs in Table L On the face of it, it would seem that the standing charges should afford no opportunity for argument; The very description would seem to obviate any need for extended discussion, but the trouble I have encountered in this direction has been more• pronounced than that experienced in connection with any of Me items of running cost.

It is necessary in considering simplification to have•

• particular regard to the owner-driver. He has certain ideas of his own about the calculation of operating costs which are most difficult to eradicate. Two of these, of particular importance, arise from his attitude towards driver's wages and garage rent.

Most owner-drivers take the view that it is not necessary to debit the cost of the driver's wages because none is paid. The influence of the ownersdriver on the schedules of fair, profitable and economic rates is important, much more important than many people think. That is particularly the case in the Eastern Counties where, as I have been led to believe, about 80 per cent. of the haulage operators are of this type.

I have two stock arguments to eliminate this fallacy. If a man is going to be content with the profit equivalent to a driver's wages as the reward for operating a vehicle as a haulage contractor, he will be far better off if he offers his services as a driver to a reputable 'haulier. In that way he evades the onerous responsibility of ownership. He avoids. the risk which every man who engages in business on his own must take, and he is relieved of the task of finding work for his vehicle.

A conscientious owner-driver does not have an easy time. He has to drive the vehicle, just as if he were an employee. In addition he has to Canvass for work. He has to keep his books, although admittedly many are. lax in this respect, and often he has difficulty in getting paid for his work. In addition, of course, he has to take care of his vehicle. In view of this, it seems absurd for him lobe content with scant remuneration.

The other argument is this: most men when they enter into business on their own account do so with the idea that the business will grow. A start may. be made with one vehicle, but it is, not anticipated that it will end at that. What is important iS that as soon as the second vehicle is bought. the driver will have to be paid the statutory wage,and if a profit is to be Made on the opentiOn of that second vehicle, the rates. will have to he higher than those in connection with the first. In that way an

absurd situationis created. .

I have therefore suggested in cases such as this that it is wise to start in such a-manner that no difficulty will he created when additional "vehieles are put into seivice.. The first of these arguments does not alwayscarry such weight as it should., I find that many Owner-drivers are still quite content to accept theirindependence as the equivalent of profit.

S.T.R.