Borrowed

Page 36

Page 37

If you've noticed an error in this article please click here to report it so we can fix it.

As rental specialists jockey for position there are signs of contraction with major players swallowing up smaller competitors. And now the manufacturers have entered the game...

The middle-ranking players in Britain's hard-fought truck rental market are steadily being hoovered up by the giants. Back in 1994 Ryder snapped up both Unilink and Hallmark; last year Transport Development Group offshoot Swift moved out of its Scottish heartland to swallow Reading-based Adrian Truck Hire before spending £6m on 1JK Vehicle Rental (UKVR) from owner Tom Webb.

The LIKVR strengthens Ryder's hand in the South and South-West, with six additional sites including Bristol, Portsmouth, and Southampton.

Transfleet is also on the acquisition trail: in 1993 it snapped up Rockford and in 1995 it bought Muncipal Vehicle Hire from Jack Allen for £4m.

"Between 1993 and 1994 there was a 24% decline in the number of rental fleets running fewer than 1,500 vehicles in membership of the British Vehicle Rental 8,.. Leasing Association according to the most recent statistics," says Swift managing director Bill Duffy. "That includes car rental fleets too, hut what it does illustrate is the general point that the bigger players are getting bigger. There are going to be fewer rental companies around,"

Conglomerates

However that view is not shared by Willhire managing director, Dirk van Dijl: "You hear this view all the time, that the world's going to end up being run by five huge conglomerates, and I really don't think it's going to happen," he says. "In East Anglia alone we face 126 competitors, and I doubt that they'll all be taken over—or go out of business."

Back in December van Dij1 and his management team bought Willhire from merchant bank Brown Shipley for £8.5m. The team raised 120m with venture capitalists 3i and Ca irnsford Associates, who now share a 40% stake in the business. Van Dill and his colleagues hold a controlling 515 %; Brown Shipley has retained 6.5 The remaining 111.5m is being used to refinance the fleet, and to buy new vehicles. James Lockhart, chairman of Great Bear Distribution, is now also Willhire's chairman and a non-executive director.

From its base at Barton Mills in Suffolk, Willhire runs 18 branches scattered across eastern England, including depots at Peterborough, Cambridge, Bury St Edmunds, Thetford, Newmarket, Ipswich, Colchester, and Chelmsford.

Some 50 of the fleet consists of minibuses and commercial vehicles, including 150 trucks. Van Dill plans to double the number of trucks in the fleet over the next two years, Five years ago the firm made a thumping £2.7m loss. With a track record that includes working as European credit manager for Banque Inclosuez, van Dijl joined in 1990 to help bring Willhire to a break-even point.

The fact that Willhire doesn't have a recent history of bumper profits has probably made a management buyout easier to mount. While the management can see the potential of the business, a prospective third-party purchaser would have had to sell the idea to his own board of directors, says van Dijl. The fact that Willhire hasn't been a goldmine—"we've had a bad balance sheet, but it's now in excellent shape." he says—might have made that task a little difficult.

And 1996 looks like being a fairly flat market for truck rental, says BRS rental director, Gavin Williams: "Things were buoyant in 1994," he reports, "but '95 was difficult. Although we are doing better than we expected so far this year, things are still not so good as we we would like them to be. There has been a lot of defleeting, which at least means rental operators are achieving better utilisation of the vehicles that remain."

John Stocker, Ryder group director of business development, agrees that this year is unlikely to bring massive growth in truck rental: "1994 was a strong year because operators had to hire trucks while they waited for manufacturers to deliver the new trucks they had ordered," he says. "But that's no longer an issue."

Niche market hirers like Cross Rent-aTipper are even less optimistic. "With the cutbacks in housebuilding and the roads programme there's not a great deal of confidence about," says managing director Terry Nunn.

"I don't see margins improving this year so we'll have to improve our efficiency," says van Dijl. "That said, we're fairly lean and mean as we are."

Competition is set to intensify following Scania's move into truck rental through its new subsidiary, Scania Vehicle Management (SVM). From sites in Scotland, Yorkshire, London and the West Country, SVM runs 200 vehicles—a mix of 17-tonne rigids and 32 and 38-tonne tractors Volvo and ERF also run rental programmes through their distributor networks, and Paccar Financial is debating the merits of introducing one through the Foden network.

Not surprisingly, rental companies are coming up with packages designed to take business from each other, and to keep the manufacturers at bay Lex Transfleet, for example, is prepared to offer operators a year-long contract rental option. This entitles them to a reduced rental rate, even if they only hire the truck for, say, three months out of the twelve: "They don't have to have it continuously over the period," says a company spokesman.

BRS has a three-year rental agreement which allows the client to swap his truck for a different model after 12 months, or to bail out of the arrangement entirely without paying any penalty.

Impressed

Van Dijl is not impressed by these schemes. "They all work on the theory that once the customer has the truck in his possession, he'll keep it on," he says. "But he won't. He'll send it back when somebody else walks into his office and offers him a deal that's £2 cheaper, and he'll probably tell whoever has hired it to him that it's got to go back because he doesn't like the colour!"

Van Dijl's argument is that packages like these drive rental rates downwards, which is something the industry simply can't afford.

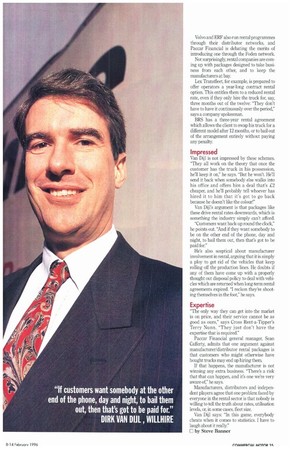

"Customers want back-up round the clock," he points out. "And if they want somebody to be on the other end of the phone, day and night, to bail them out, then that's got to be paid for."

He's also sceptical about manufacturer involvement in rental, arguing that it is simply a ploy to get rid of the vehicles that keep rolling off the production lines. He doubts if any of them have come up with a properly thought out disposal policy to deal with vehicles which are returned when long-term rental agreements expired. "I reckon they're shooting themselves in the foot," he says.

Expertise

"The only way they can get into the market is on price, and their service cannot be as good as ours," says Cross Rent-a-Tipper's Terry Nunn. "They just don't have the expertise that is required."

Paccar Financial general manager, Sean Cafferty, admits that one argument against manufacturer/distributor rental packages is that customers who might otherwise have bought trucks may end up hiring them.

If that happens, the manufacturer is not winning any extra business. "There's a risk that that can happen, and it's one we're very aware of," he says.

Manufacturers, distributors and independent players agree that one problem faced by everyone in the rental sector is that nobody is willing to tell the truth about rates, utilisation levels, or, in some cases, fleet size.

Van Dijl says: "In this game, everybody cheats when it comes to statistics. I have to laugh about it really."

E by Steve Banner

0 Car drivers who pass their tests after 1 July 1996 will be required to take a separate test if they wish to drive anything heavier than a 3.5-tonner. But this won't have an immediate impact on 7.5-tonne rentals, says Simon Kerr, managing director of Eurohire, vice-chairman of the BVRLA's truck committee, and chairman of ECATRA (European Car & Truck Rental Association).

"There will still be a vast army of qualified drivers," he points out. In the long-term he accepts there may be increased interest in 10/11-tonners, and possibly in 3.5-ton tiers with big-capacity bodies to cater for rental customers planning their own household removals. "But that retail market has been in decline for the past five years," he adds.