The Economics of

Page 42

Page 45

If you've noticed an error in this article please click here to report it so we can fix it.

LIGHTWEIGHT BODYWORK

Factors to be Considered': (a) Taxation ; (b) Legal Speed Limit ; (e) Earning Capacity, The Use of Lightweight Bodywork Gives Advantages in All Three

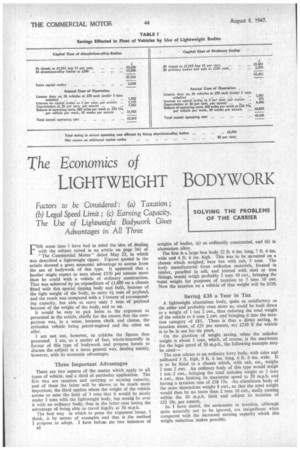

FOR some time I have had in mind the idea of dealing with the subject raised in an article on page 361 of "The Commercial Motor" dated May 23, in which was described a lightweight tipper. Figures quoted in the article showed a great economic advantage to accrue from the use of bodywork of this type. It appeared that a haulier might expect to earn about £550 per annum more than he could with a vehicle of ordinary construction. That was achieved by an expenditure of £1,600 on a chassis fitted with this special tipping body and built, because of the light weight of the body, to carry 6i tons of payload, and the result was compared with a 5-tonner of corresponding capacity, but able to carry only 5 tons of payload because of the weight of the body, and so on.

It would be easy to pick holes in the argument as presented in the article, chiefly for the reason that the comparison was, in a sense, between chalk and cheese, the orthodox vehicle being petrol-engined and the other an oiler.

I am not out, however, to criticise the figures thus presented. I am, as a matter of fact, whole-heartedly in favour of this type of bodywork and propose herein to discuss the subject in a more general way, dealing mainly, however, with its economic advantages.

Three Important Advantages

There are two aspects of 'the matter which apply to all types of vehicle, and a third of particular application. The first two are taxation and carrying or earning capacity, and of these the latter will be shown to be much more important; the third applies where the weight of the vehicle comes so near the limit of 3 tons that it would be nicely under 3 tons with the lightweight body, but would be over it with an ordinary body, thus in the latter case losing the advantage of being able to travel legally at 30 m.p.h.

The best way in which to press the argument home, I think, is by means of examples and that is the method I propose to adopt. I have befove me two instances of a8 weights of bodies, (a) as ordinarily constructed, and (b) in aluminium alloy.

The first is a large box body 22 ft. 6 ins, long, 7 ft. 6 ins. wide and 6 ft. 6 ins. high. This was to be mounted on a chassis which weighed, bare but with cab, 5 tons. The body manufactured from orthodox materials, framed in timber, panelled in ash, and jointed with steel or iron fittings, would weigh probably 2 tons 10 cwt., bringing the total weight for purposes of taxation to 7 tons 10 cwt. Now the taxation on a vehicle of that weight will be £120.

Saving a Year in Tax A lightweight aluminium body, quite as satisfactory as the other and probably even more so, could be built down to a weight of 1 ton 2 cwt., thus reducing the total weight of the vehicle to 6 tons 2 cwt. and bringing it into the taxation category of 1.85. There is thus a direct saving, in taxation alone, of £35 per annum, say £210 if the vehicle is to be in use for six years.

On the question of weight saving, when the unladen weight is about 3 tons, which, of course, is the maximum for the legal speed of 30 m.p.h., the following example may be cited:— The case relates to an ordinary lorry body, with sides and tailboard 3 ft. high, 9 ft. 6 ins. long, 6 ft. 6 ins. wide. It is to be fitted to a chassis which, with cab, etc., weighs 2 tons 2 cwt. An ordinary body of this type would weigh 1 ton 2 cwt., bringing the total unladen weight to 3 tons 4 cwt., thus limiting its maximum speed to 20 m.p.h. and having a taxation rate of £38 15s. An aluminium body of the same dimensions weighs 8 cwt., so that the total weight would then be no more than 2 tons 10 cwt., easily coming within the 30 m.p.h. limit and subject to taxation of £32 10s. per annum.

As I have stated, the economies in taxation, although quite naturally not to be ignored, are insignificant when compared with the increased earning capacity which this weight reduction makes possible. The van, the heavier of the two vehicles, is covering 1,200 miles per week, working six days and running regular journeys of 100 miles each way. For the sake of argument I will assume, in the first place, that the vehicle be fully loaded each way. It conveys, therefore, 12 loads each week, which means that the lightweight vehicle carries 12 times 1 ton 8 cwt. per week more than the other (1 ton 8 cwt. being the saving in weight). That is a total of not less than 16 tons 16 cwt. per week additional load capacity. If I take £2 per ton as the rate—and that is not unreasonable—the equivalent earning capacity is £33 12s. per week. Even if this vehicle were loaded only one way, the additional revenue is £16 16s. per week. Suppose I split the difference and say that the extra earning capacity is £25 per week or £1,250 per annum.

Now, in considering the smaller 'machine, there is a different aspect. The More heavily constructed vehicle is able to cover,' say, 120 miles per {lay without greatly exceeding the legal limit of 20 m.p.h, (The daily mileage depends upon the kind of work.) Suppose it be loaded to half capacity and the rate be 6d. per ton-mile. Assume that the load he 2 tons 16 'cwt. The daily ton-mileage is thus 168. This figure is obtained by multiplying 60 miles, half the total distance, by 2 tons 16 cwt, of load. That is 840 ton-miles per five-day week, the revenue from which is £21.

The vehicle with the lightweight body should, because of its permissible increase in speed, be able, in proportion, to run 180 miles per day and because of the decrease in unladen weight can carry as much as 4 tons without overloading. Its ton-mileage on that basis is 360 per day or 1,800 per week, bringing in a revenue of £45. That is a gain of £24 15s. per week or £1,237 10s. per annum.

It should be borne in mind that these considerably increased earnings do not involve any addition to the running costs beyond those due to the greater first cost of the body itself. To that factor I am going to refer in a moment, but otherwise the figures thus given are actually net earnings. If an ordinarily constructed body could earn no profit at all in the circumstances in which it is operated. the substitution of a lightweight body would make it a most profitable vehicle.

Profit and Loss

Now to summarize the foregoing conclusions. The first vehicle gains for its owner £35 per annum in taxation and £1,250 in increased earning capacity, a total of £1,295 per annum. The second one gains £6 5s. in taxation and £1,237 1.0s. in earnings; a total of £1,243 15s. Now I must take into consideration the debit, that is to say the effect on the foregoing figures of the increased first cost.

Here I can only be approximate, because the prices of vehicle bodies vary considerably. In the assumptions made, however, I have erred on the high side with regard to cost. An ordinary van constructed in the orthodox fashion, with oak and ash framing, etc., as described above, would cost about £250, whereas Ihe'aluminium-alloy body might cost as much as £650. The difference of £400 affects two items of operating costs, namely, interest and depreciation. Taking interest at 3 per cent., that would amount to £12 per annum. Depreciation over a five-year life would be a further £80, so that the extra cost would be no more than equivalent to £92 per annum, which is small when it is compared with the extra earnings and the savings in taxation.

As to the second machine, a substantial platform body with high hinged sides and tailboard would cost about £100, and one with an aluminium body about £300, the difference being 1200. The item of interest on that account is approximately £6 per annum and the depreciation over five years' life, £40 per annum, a total of £46 only..

Fewer Vehicles for Same Work

The figures which appear below were given to ine some time ago by a manufacturer of aluminium-alloy bodies. I have revised them and brought them up to date. He took the case of a fleet of 30 vehicles having orthodox bodies, each carrying 6 tons 10 cwt., that load bringing the gross weight up to the rated capacity of the machines concerned. The total payload is 195 tons.

It is suggested that these 30 vehicles be replaced by 26 using tfie same chassis and having aluminium-alloy bodies, each weighing 1 ton less than the ordinary type of body.

Advantage is taken of the reduction in weight to add to the payload so that each vehicle carries 7 tons 10 cwt. The total is the same as before, namely, 195 tons.

Questions may arise as to whether there i5 any additional maintenance cost to be allowed for as a set-off against the profit-earning capacity of aluminiumbodied vehicles.

The answer, so far as experience shows, is that maintenance costs are likely to be less. I have in mind, in particular, an aluminium-alloy body built for a personal friend of mine for use in milk haulage in 1939. That vehicle has been in continuous use since then and its mileage by now must be approaching 300,000. In this connection it can be pointed out that there is no liability to rust or rot. Moreover, aluminium provides a good foundation for paint, requiring little preparation. Even if an aluminium-bodied vehicle meets with an accident, the material still shows to advantage. In a woodbodied vehicle, splintering and splitting take place and renewal is often a costly operation. With aluminium the material would probably bend, but could be straightened, Moreover, even if a section be damaged beyond repair, a stock section can be fitted quickly and by ,unskilled labour. A final point is that when the body is discarded, it commands an appreciable value as scrap.

I am not, of course, overlooking the fact that there is on the market a vehicle with a chassis, as well as body, of aluminium alloy. This vehicle, with a loading platform 23 ft. long by 7 ft. wide, weighs, unladen, only 2 tons 18 cwt. and has a payload capacity of 6 tons.

It is possible, with aluminium-alloy • bodywork, to fit 36-in. by 8-in. tyres to a normal 5-ton or 6-ton chassis and still keep within the unladen limit of 3 tons. That is an important point, because 34-in. by 7-in. tyres are well known to be overloaded on a normal vehicle weighing slightly under 3 tons unladen and loaded with 6 tons.

One well-known manufacturer goes so far in his catalogue, when referring to a 5-tonner, as to state that the chassis rating is 8 tons 14 cwt. gross weight, whereas the tyre rating is 8 tons 5 cwt. With 36-in. by 8-in. tyres, the cost per mile for tyres is only half the normal, and in many cases less than half the normal, in his experience, -with 34-in. by 7-in. tyres. That is an extra, and important, point that should be borne in mind when considering the advantages of aluminium-alloy bodies.