TAX Are

Page 28

Page 29

If you've noticed an error in this article please click here to report it so we can fix it.

we paying enough?

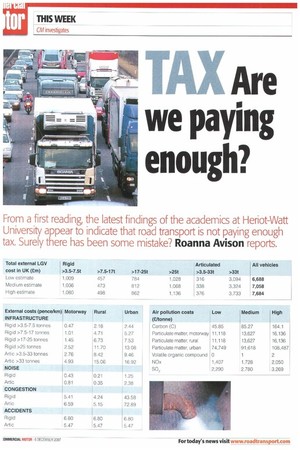

From a first reading, the latest findings of the academics at Heriot-Watt University appear to indicate that road transport is not paying enough tax. Surely there has been some mistake? Roanna Avison reports.

The road freight industry in the UK is already operating on very tight margins, but as congestion and green issues come to the forefront of the political and social agenda, should the industry be paying more to cover the costs?

This was the question asked by HeriotWatt University in its report Internalising the External Costs of Road Freight Transport in the UK.

While the title of the report might seem rather complicated, the basic idea is that haulage operators currently pay for their internal costs, such as fuel, VET) and vehicle maintenance, but the wider costs associated with congestion, infrastructure and the environment are paid for by tax payers. The report asks how much of this external cost could and should he covered by road haulage operators, therefore internalising them.

Road freight accounts for 83% of all freight tonnage moved in the UK and 64% of tonnekilometres (t-km).

The author of the report, Alan McKinnon, logistics professor at Heriot-Watt, says that if road freight were disrupted for only a few days the consequences to the country would be disastrous.

Despite the enormous economic and social benefits road freight transport yields, it also adds to congestion and infrastructure damage, and produces greenhouse gases and other air pollutants.

Incentives needed

The European Commission's 'fair and efficient pricing' policy aims to ensure that all damage caused by road traffic is paid for in the price of transport. It suggests that polluters are obliged to pay the marginal social cost of their activities, but they should be given incentives to reduce the negative effects of their activities.

The report aimed to work out how much these external costs are costing the UK and calculate the proportion already paid for by the road haulage industry.

The contribution trucks make to the cost of providing, operating and maintaining road infrastructure is not an externality as such, but has to be calculated to determine its share of road freight taxation. From the remaining taxes the environmental and congestion costs should be recovered.

Ieriot-Watt estimates the external costs of LGVs in the UK to be 17.1bn a year, based on medium emission levels.

The heaviest articulated vehicles over 33 tonnes carry 72% of all road t-km and are responsible for only 47% of all the external costs of road freight transport. But rigids account for 48% of the external costs while carrying only 24% of total t-km.These figures show that larger, heavier trucks have lower external costs per tonne-km.

Of the overall external costs attributed to LG Vs 40% comes from congestion, 23% from infrastructure, 19% from accidents, 15% from air pollution and greenhouse gas emissions and 2% front noise.

The report found that the duties and taxes paid by transport operators cover an average of 67% of the total external costs created by British-registered LGVs.

But there were marked differences depending on the size of the vehicle. Rigids up to 7.4t covered only 55% of their external costs; rigids between 7.5t and 16.9t were at 68%; rigids between 17t and 24.9t were at 60"/.; while rigids over 25t were at 79% .Artics below 33t were at 72% while artics over 33t were at 67 % Trucks pay their way

The report states that if congestion is taken out of the equation, the taxes currently paid by UK road haulage operators exceed the value of all the external costs for all LGVs apart from artics over 331 — and they cover 99% of their costs. In 2006 the average truck in the UK paid 12% more in duties and taxes. than its allocated infrastructural and environmental costs (excluding congestion costs).

McKinnon says this is the first time a report shows this, and as trucks get cleaner with improving Euro standards in theory they will pay for even more. "Hauliers will accept the need to pay towards the infrastructure and the environment, but congestion is a different matter. Hauliers will ask .why should we be held responsible for congestion?'; if there was sufficient infrastructure there would not be any congestion," he says.

Despite this reasonably positive outlook, McKinnon says that in the light of recent reassessments of the impact of climate change these estimates might he too optimistic. He points out the Stern report suggests the cost of carbon should be around £265 per tonne,which is roughly three times higher than the values used to calculate the figures in the report. Using this figure would reduce the amount of external costs already being paid for the road haulage sector to 49 `Yo.

Foreign trucks using the UK's roads also place a burden on infrastructure and add to congestion and air pollution, but they do not pay VED in the UK and pay very little fuel duty in the UK, so their external costs are hard]) covered by the tax and duties they pay.

Heriot-Watt estimates that for foreign. registered vehicles, congestion constitute 30% of their external costs, followed b) infrastructure wear (29%), air pollution (20%) accidents (20%) and noise (1%).

If the estimated 1,058 million vehicle-km rur by foreign-registered trucks in 2006 had beer using diesel purchased in the UK, an extra £177m in duty would have been collected 1..1) the UK exchequer. As most trucks spend less than two days in the UK, full internalisatior of the external costs of foreign LGVs in tht UK would raise around £300m. However, thc report says it can be safely assumed that mosundertake their haulage work in the UK witt fuel purchased outside the UK.

And IJK operators fare well when comparec to the rest of Europe, according to Europear Environmental Agency figures from 2002 which show that in Britain 88% of external cosu have been internalised,whereas countries suet as Poland, Greece and Luxembourg managt only 30%.

But just because the UK is doing reasonabl well at present does not mean things shoulc not change.

Distorting the market

The report concludes that if the polluter-pay! principle were applied more rigorously tc the road freight transport sector then it coulc distort the market, ln fact, it says that ironically the UK's highe. fuel duty means that local operators pay mon of their external costs,but also that the market i: opened up to foreign competition that doesn't The report goes on to say that even thougl duties and taxes in the UK are very high they would need to be 50% higher again tc fully cover all the external costs of the ma( freight sector.

If the government were to provide additiona road space and/or use traffic managemen measures to relieve congestion, costs woult be reduced and the degree of internalisatioi increased, the report concludes.

Given the importance of road freigh transport to the national economy, this wouh probably prove a more effective transpor strategy than taxing LGVs more heavily. Am the more operators are taxed, the less likel: they are to be able to afford to upgrade thei trucks to more efficient and environmental], friendly versions. •

• To see the full report log onto wwvi. greenlogistics.org