Operating Costs of Private-hire Coaches

Page 30

Page 31

If you've noticed an error in this article please click here to report it so we can fix it.

Accounting System Similar to that for Goods Vehicles. Some Figures Which Show Present-day and Probable Future Costs

N the article, in last week's issue of " The Commercial Motor," I dealt with some of the problems which attend the operator of motor coaches used on private-hire work.

Inquiries I have received concern the legal aspect, the administrative side, and costs and rates.

In the article referred to—the first of this series—I dealt at some length with the legal aspect of the matter, with particular reference to the definition of private hire as distinct from the use of passenger vehicles as stage coaches and express coaches. I pointed out that the official definition or a coach engaged on private hire was a contract carriage, and that the limitations on the use of coaches for this class of work were strict. It is, therefore, correspondingly important that the newcomer to the business, as is one of my inquirers, should be well acquainted with the legal side before he commences operating.

One of the legal requirements is that the driver of a coach must complete a work ticket in relation to every journey, and that the proprietor of the coach must keep a record of every journey; both the driver's ticket and record must include certain specific items.

It is convenient that the driver's ticket and proprietor's record be on the same form, and it is quite usual for the one form to serve both purposes. In the previous article the layout of a suitable form was reproduced.

Features That Have Been Omitted It will be appreciated by those who are accustomed to the operation of goods vehicles that this work ticket serves a purpose similar to a driver's log sheet. In the same way it can be used as the basis, and the commencement of, the cost-recording system which the operator should introduce.

I observe, however, and with some regret, that in the work ticket, as published last week, there is no provision for the recording of petrol and oil consumed, or of expenses incurred by the driver, as I recommended in the case of a driver's log sheet. I would advise operators commencing this business so to arrange the work ticket that entry of such expenditure can be made on each one.

In dealing with this work ticket and operator's record we pass, automatically, from a discussion of the legal aspect of private hire to the administrative side. Clearly, these records form part of the administration of the business.

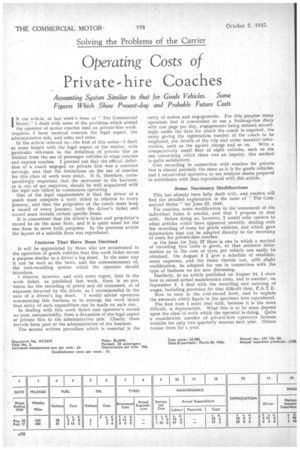

The second written procedure which is essential is the entry of orders and engagements. For this purpose many opeiators find it convenient to use a foolscap-size diary with one page per day, engagements being entered adcordingly under the date for which the coach is required, the entry giving the registration number of the coach to be employed, the details of the trip and other essential -infor mation, such as the agreed charge and so on. With a comparatively small fleet of eight vehicles, such as the one concerning which there was an inquiry, this method is quite satisfactory. Cost recording in connection with coaches for private hire is almost precisely the same as it is for goods vehicles, and I recommend operators to use analysis sheets prepared in accordance with that reproduced with this article.

Some Necessary Modifications This has already been fully dealt with, and readers will find the detailed explanation in the issue of " The Commercial Motor" for June 22, 11_945.

For coaches, some modification in the assessment of the individual items is needed, and that I propose to deal with. Before doing so, however, I would refer readers to other articles which have appeared recently, dealing with the recording of -costs for goods vehicles, and which gave information that can be adapted directly to the recording of costs for private-hire coaches.

in the issue for July 27 there is one in which a method of recording tyre costs is given, so that a-curate information as to the cost of tyres per vehicle can easily be obtained. On August 3 I give a schedule of establishment expenses, and the items therein can, with slight modification, be adapted for use in connection with the type of business we are now discussing.

Similarly, in an article published on August 24, I show how to record actual maintenance costs, and in another, on September 7, I deal with the recording and entering of wages, including provision for that difficult item, P.A.Y.E.

Now to turn to the cost-record form, and to explain the amounts which figure in the specimen here reproduced.

The first item I must deal with, because it is the most difficult, is depreciation. What this is to be must depend upon the class ef work which the operator is doing. Quite a considerable number of private-hire operators licenses vehicles for only two quarterly seasons each year. Others license them for a year. Amongst those who license them for only six months some may cover a mileage as low as 1000 in that period, and others, perhaps, 15,000. The vehicles • which are licensed for a year probably cover 20,000 miles, In assessing depreciation, it is necessary to take these three different sets of conditions into consideration.

Perhaps the first thing we ought to do is to make up our minds as to how much a 32-seater luxury-type coach is going to cost. Judging by the trend of prices to-day, it seems to me that, for a vehicle of good make, with firstclass coachwork, the operator who manages to buy one for less than £2,500 would be lucky. At any rate, I propose to take that figure as a basis.

I will assume that a set of tyres costs £75. That leaves me with a net amount of £2,425 on which to calculate depreciation.

An operator who wishes to compete for the patronage of the usual type of person who likes to take his enjoyment by means ef a motor coach, will have to buy a new one after four years. If I assume that he gets £425 for the old vehicle at the end of that period, that leaves me with a sum of £2,000 to work off, in four years, for depreciation.

It is much more satisfactory to assess depreciation on the basis of pence per mile, in which case, taking the first example, in which the vehicle covers not more than 12,000 miles in a season, the depreciation per mile is 10d.

, Costs on Short-term Use

• Other items of cost are effected by, what I might call, short-term use. There is, for example, the tax, the total net amount of which is £57 12s. per annum, or 21 3s. 3d. per week, If, however, the vehicle be licensed for only two quarterly periods, the tax will be increased by 10 per cent, and will thus be £1 55, 7d. per week. Insurance is more expensive, and I have assessed this on the basis of £150 per annum, which is £2 17s. 8d. per week.

Garage rent has to be paid all the year found, but must he debited against the vehicle over a period of only six months, so that, if the owner pays 15s. per week for garage, we must actually debit the vehicle at the rate of £1 10s. per week.

Then there is the item interest. This will amount to £100 per annum, and as it has to be worked off in six months it is equivalent to £4 per week. These four items--tax, insurance, garage rent, and interest-comprise four out of five standing charges, the fifth being wages. The four are set down at the top righthand corner of the form and amount to £9 13s. 3d. per week.

Finally, there are establishment costs, Over a full year these will probably total £3 per week, in which amount there is some provision for the occasional need to hire other vehicles, either to supplement the operator's own fleet when business is a little more than he can cope with. or to hire a vehicle when one of his machines has broken down. For seasonal operation we must take £4 per week. Turning now to the other figures quoted along the top, of the form, I begin with maintenance. This, at id. per mile, may seem low as compared with the amount quoted in " The Commercial Motor •" Tables of Operating Costs, which approximates to lid. per mile. The reason for the difference is the comparatively short life and small mileage with which I have credited the vehicles I am discussing in this article. Bear in mind, of course, that there is provision for maintenance of bodywork kept in tip-top condition, as well as for chassis repairs, and so on.

The remaining items do not, I think, need explanation beyond that which has already been given in detail in The Commercial Moto': " for June 22.

'The figures given in the body of the form must, obviously, be imaginary, because I am considering what is likely to happen post-war; indeed, I have dated the sheet as being made up during 1946. An operator who keeps his records in this form, and is careful not to let them get behind, will, at least, know how he stands from week to week. Ffe will also nave the satisfaction of realizing that, in these figures, he is providing for the future, not only in the way of maintenance and tyre costs, but for the purchase of a new vehicle when that is required.

All the figures in the form are based on the assumption that we are taking the first example, that of a vehicle covering not more than 12,000 miles in the course of six months, or between .450 and 500 miles average per week.

An important set of figures in the form, as published. relate to the cost per mile. This is nearly is. lld, when the vehicle did 432 miles in the week, and I. 10.1d. when it did 480 miles.

The figures for revenue and profit per week are, of course, even more imaginary than the others. This, however, does not necessarily mean that they are on the high side. Everything depends, as experienced operators well know, on whether the season be good or bad.

Corresponding figures for the second example, in which the vehicle, in a six-monthly, season, covers 1,500 miles, are as follow, taking an average week of 600 miles: Petrol, say, 52 gallons at Is. 10d. per gallon, 24 15s. 4d.;" oil, 4s. 6d.; tyres, 23 155.; maintenance, 21 17s. 6d.; depreciation, 81.1. per mile instead of 10d., because of the increase in mileage run, £20; wages, 26 5s.; employees' insurances-National Health and employer's liability-3s.; standing charges, as before, £9 135. 3d. The total is 246 13s. 7d., which is equivalent to Is. 6.67d. per mile.

Add establishment costs at £4, and we get a total•

expenditure of £50 13s. 7d. during the week. If the revenue is £70 15s 9d. the profit for that week is £20 2s. 2d.

Full-year Operation Now we come to the case of a vehicle operating over a full year, with an assumed mileage of 20,000. The depreciation is now 6d. per mile instead of 8d. or .10d. The biggest alteration comes in respect of the standing charges. The tax is now 41 3s. 3d. per week, insurance £2, garage rent 15s., and interest only 22, giving a total of £5 18s. 3d. per week.

. The establishment costs, assuming that they are now spread over 12, months instead of six, may be taken to be £3 per week, average, instead of 44.

In the summer we can reasonably expect the vehicle to do an average mileage of 480, in which case the weekly cost will be as follews:-Petrol, 41 gallons, £3 15s. 2d.; oil, 3s,; tyres, £3; maintenance, £1 10s.; depreciation, 212; wages, £6; employees' insurances, 3s.; standing charges. £5 18s. 3d. The total is £32 9s, 5d., which is equivalent to Is. 4.23d. per mile..

Adding establishment costs at £3 per week brings the total expenditure to £35 9s, 5d., and, if the revenue is, say, 52 10s. 8d., the profit is £17 Is. 3d.

In the winter we can take a mileage of only 240 per week as applying. Then the costs will he:-Petrol, 2'.1 las. 6d.; oil, 2s_ 6d.; tyres, £1 10s.; maintenance, 15s.; depreciation, £6; wages, £3 5s.; employees' insurances, 3s.; standing charges, 45 18s. 3d. The total is £19 12s. 3d., which is equivalent to Is. 7.58d. per mile, Add establishment costs at £3, and we get £22 125. 3d. as the total expenditure, and if the vehicle earns 230 18s. 6d. time profit is £8 6s. 3d.

So that there may be no misunderstanding, I must be careful to point out that it is not correct for the operator to take the figure for the cost-per-mile, with the addition of profit, as a direct basis for his charges, as there is no provision in that.amount for establishment costs,I propose to,deal, at !length, with this aspect of the matter and with that of charges generally, in a subsequent article. S.T.R.