I t's not easy being an economist. Charged with tracking trends

Page 54

Page 55

If you've noticed an error in this article please click here to report it so we can fix it.

in the economy SD as to pick up the first signs of recession, they face the difficult task of monitoring a broad range of key indicators around the clock—interest rates, retail price movements, manufacturing output, inflation...and carpet sales.

According to some recent newspaper reports, one of the first signs of an economic downturn is a fall-off in demand for floor coverings. Carpets, it seems, always get the cold shoulder when the consumer senses a bumpy ride ahead.

Carpets

Unlikely as it sounds, demand for carpets, and other relatively expensive retail goods, is regarded as a reliable yardstick for the economy, providing a useful early warning signal to other business sectors. The news for the haulage industry is not good: carpet sales have slumped in recent months.

Such has been the level of speculation about the prospect of a looming economic crisis in Britain that some businesses, particularly in sectors where sales and demand have shown no signs of tailing off, have warned that the country is in danger of talking itself into a recession.

This is almost certainly true of some parts of the haulage industry, where changes in the volume of business have so far been confined to normal seasonal fluctuations.

But there are also disturbing signs that the downturn is beginning to bite at some operators. The first reports of job losses and cutbacks have been coming in as hauliers batten down the hatches ready to brave the icy winds of recession.

One haulage company specialising in transporting textiles, Dawson International, which is based in Galashiels in the Border country, is perfectly placed to judge whether things are actually getting worse.

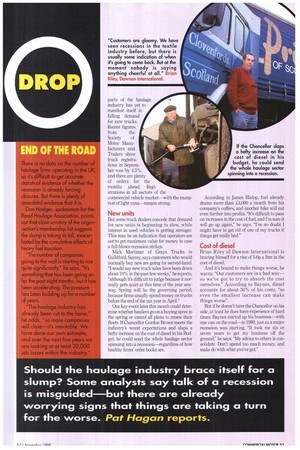

Last month the company was forced to lay off two of its six drivers and sell two of its vehicles after suffering a 50% decline in business since this time last year. Transport manager Brian Riley says that with many textile firms already on short-time working or closing down factories it has been a tough year for the company. "I cannot see any quick return to the good times. We are just cutting back to try to match the work that's around at the moment," he says. "Customers are gloomy. We have seen recessions in the textile industry before, but there is usually some indication of when it's going to come back. But at the moment nobody is saying anything cheerful at all."

Riley says he hopes the cuts the firm has made will see it through to the spring, when the worst of the slump may be over. But if things are not better by March or April, he fears it will have to take more drastic action.

Things do not look quite as bleak for father-and-son outfit Baynes & Son of Llangefni, Anglesey. Owner Michael Baynes admits business has been "a bit quiet" in recent weeks, but denies the firm is experiencing any kind of sustained slump.

Predictions

Nonetheless, the dire predictions that worse is to come have put the company on its guard. Baynes & Son is already considering abandoning plans to replace at least one of the eight vehicles in its fleet this year in case it does start to feel the pinch.

"I am thinking about not buying any," Baynes admits. "We buy one a year normally, although it was four last year." The plan is to run vehicles for longer, extending their life from the normal 600,000 to 700,000 kilometres to a million or more.

In contrast, haulier James Hislop, from Kelso in the Borders region, insists that the last month or so has been the busiest for some time, after a long slack period. "I would say in the past few weeks things have been picking up," he says. "This year has been a bad one for us—things never really picked up again after the new year. Hopefully, the better business we have seen recently is a sign of better times."

But the harsh truth is that Hislop's good fortune might be nothing more than another indication that the economy is on the slide. The company has a contract to move machinery for a firm which snaps up redundant electronic equipment from collapsing engineering businesses, does it up and sells it on.

However, the failing confidence in some parts of the haulage industry has yet to manifest itself in falling demand for new trucks. Recent figures from the Society of Motor Manufacturers and Traders show truck registrations in September rose by 4.3%, and there are plenty of orders for the months ahead. Registrations in all sectors of the commercial vehicle market—with the exception of light vans—remain strong.

New units

But some truck dealers concede that demand for new units is beginning to slow, while interest in used vehicles is getting stronger. This may be an indication that operators are out to get maximum value for money in case a full-blown recession strikes.

Mick Mortimer of Grays Trucks in Guildford, Surrey, says customers who would normally buy new are going for second-hand. "I would say new truck sales have been down about 10% in the past few weeks," he reports, "although it's difficult to judge because it normally gets quiet at this time of the year anyway. Spring will be the governing period, because firms usually spend money on trucks before the end of the tax year in April."

One key event later this month could determine whether hauliers go on a buying spree in the spring or cancel all plans to renew their fleets, If Chancellor Gordon Brown meets the industry's worst expectations and slaps a hefty increase on the cost of diesel in his Budget, he could send the whole haulage sector spinning into a recession—regardless of how healthy firms' order books are.

According to James Hislop, fuel already drains more than £4,000 a month from his company's coffers, and another hike will eat even further into profits. "It's difficult to pass on increases in the cost of fuel, and I'm sure it will go up again," he says. "I've no doubt I might have to get rid of one of my trucks if things get really bad."

Cost of diesel

Brian Riley of Dawson International is bracing himself for a rise of 5-6p a line in the cost of diesel.

And it's bound to make things worse, he warns. "Our customers are in a bad way— so we've got to try to absorb the cost ourselves." According to Baynes, diesel accounts for about 30% of his costs, "so even the smallest increase can make things worse".

But if he doesn't have the Chancellor on his side, at least he does have experience of hard times. Baynes started up his business—with one van on the road—in 1989, just as a major recession was starting. "It took me six or seven years to get my business off the ground," he says. "My advice to others is consolidate. Don't spend too much money, and make do with what you've got" There is no data on the number haulage firms operating in the so it's difficult to get accurate statistical evidence of whether e recession is already forcing closures. But there is plenty of anecdotal evidence that it is.

Dan Hodges, spokesman for the Road Haulage Association, points out that close scrutiny of the organ isation's membership list suggests the slump is taking its toll, exacerbated by the cumulative effects of heavy fuel taxation.

"The number of companies going to the wall is starting to rise quite significantly," he says. "It's something that has been going on. for the past eight months, but it ha been accelerating. The pressure has been building up for a numbe of years.

"The haulage industry has already been cut to the bone," he adds, "so more companies will close—it's inevitable. We have done our own estimate, and over the next five years we are looking at at least 20,000 job losses within the industry