The Effects of

Page 110

Page 111

If you've noticed an error in this article please click here to report it so we can fix it.

THE NEW TAXES

The Amountsto be Added to the Cost of Operating Various Types of Goods Vehicle. The Influence of Mileage Upon

Inflated Expenditure

By " S.T.R."

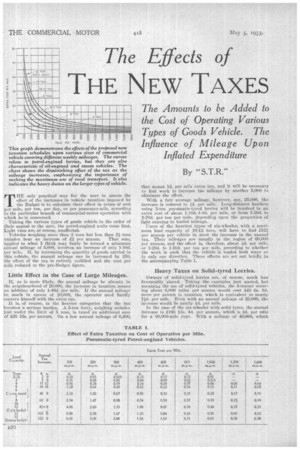

This graph demonstrates the effects of the Proposed new taxation schedules upon various sizes of commercial vehicle covering different weekly mileages. The curves relate to petrol-engined lorries, but they are also characteristic of oil-engined and steam vehicles. The chart shows the diminishing effect of the tax as the mileage increases, emphasizing the importance of snaking the maximum use of road transport. It also indicates the heavy duties on the larger types of vehicle.

T HE only practical way for the user to assess the effect of. the increases in vehicle taxation imposed by the Budget is to calculate their effect in terms of cost per mile, per ton, per day, or per passenger-mile, according to the particular branch of 'commercial-motor operation with

which he is concerned. •

Taking the various types of goods vehicle in the order of their appeal to the user, the petrobengined units come Iirst. Light vans are, of course, unaffected. Vehicles weighing inure than 2 tons but less than 21 tons unladen, bear an increase of £2 per annum, That sum, applied to what I think may fairly be termed a minimum annual mileage of 5,000, involves an increase of 'only 1-100. per mile. If, by increasing the. quantity Of _goods carried in this vehicle, the annual mileage can be 'increased by 350, the effect of the tax is entirely nullified and _the cost per mile reduced to the pre-Budget figure.

Little Effect in the Case of Large. Mileages.

If, as is more likely, the annual mileage be already in the neighbourhood of 20,000, the increase in taxation, means an Addition of only 1-400. Per mile. If the annual mileage be much in excess of 20,000, the operator need hardly concern himself with the extra tax. It is, of course, in the heavier categories that the tax becomes a serious burden. A 5-ton lorry, weighing unladen

'

just under the limit of 5 tons is taxed an additional sum of 26 16s, per annum. On a low annual Mileage of 6,400, that means id. per mile extra tax, and it will he necessary to find work to increase the mileage by another 5,000 to eliminate the effect. With a fair average mileage, however, say., 25,000, the increase is reduced to Id. per mile. Long-distance hauliers using 5-ton pneumatic-tyred lorries will be involved in an extra cost of about 1-10d.-1,8d. per mile, or from 1-50d. to 1-20d. per-ton per mile, depending upon the proportion of light running to loaded mileage._ Users of the heaviest types of six-wheeler, with a maximum load capacity of 10-12 tons, will have to find 1122 per annum per vehicle to meet the increase in the annual lax. Their mileages are usually in the region of 60,000 per annum,. and the effect is, therefore, about Id. per mile, or 1-200. to 1400. per ton per mile, according to whether the work is such that the vehicle is loaded both ways or in only one direction. These effects are set out briefly in the accompanying Table I.

Heavy Taxes on Solid-tyred Lorries.

Owners of solid-tyred lorries are, of course, much less favourably placed. Taking the examples just quoted, but assuming the use of solid-tyred vehicles, the 5-tonner covering about 6,000 miles per annum would cost £43 Os. 80. more per annum in taxation, which is equivalent to nearly per mile. -Even with an annual mileage of 25,000, thc increase' would be nearly id. per mile. In the case of the six-wheeler with solid tyres, the annual increase is £166 Vs. 40. per annum, which is id. per mile for a 60,000-mile S'ear. With a mileage of 40,000, which s' A six-wheeled steamer is taxed at £150, instead of £48, an increase of £102. In other words, there is an addition of id. per mile on a 20,000-mile year, or half that amount if the annual mileage be 50,000.

is all that is legally practicable with a solicl-tyred machine, the extra cost per mile is 1d.

A 6-ton steamer on pneumatic tyres, formerly taxed at £48 per annum, now Involves the payment of £90 per annum-an increase of £42, which, on a 20,000-mile year, is equivalent to id. per mile.

The tax on an oil-engined vehicle weighing 21tons un laden is to be £35, an increase of £7 per annum. In addition, however, there is a tax of 1.3. per gallon on fuel. In that case, assuming a consumption at the rate of 20 m.p.g. and an annual mileage of 5,000, the total increase in cost per mile is nearly 0.4d. If the annual mileage be 20,000, the increased cost per mile is reduced to 0.13d., say, id.

The annual tax on a 6-ton oil-engined vehicle is increased from £48 to £120. Such a machine will probably average 10 m.p.g., so that it bears taxation on account of fuel alone of 1-10d. per mile. The additional tax, on an annual mileage of 5,000, will be equivalent to .3id. per mile, and the total increase in cost is, therefore, 3.6d. per mile. If the annual mileage be 50,000, the total increase in cost per mile will be only 0.464.

From £48 to £225 a Year.

In the ease of the largest type of oil-engined vehicle, the 12-ton six-wheeler, the maximum increase in taxation is imposed. From £48 the duty is to jump to £225, an increase of £177. Even on an annual mileage of 00,000, that sum is equivalent to an increase in operating cost of nearly ad. per mile. Then there is the addition involved in the tax on the fuel. Assuming an average consumption rate of 6 m.p.g., that means a rise of id. per mile in the' running costs above that due to the extra amount of annual tax.

A point arises here which deserves considerable emphasis. The figures I am quoting show the increased cost of operating the particular types of vehicle named, brought about by the new scales of taxation. They are valueless as means for comparison as between one type of vehicle and another.

In the case, for example, of the oil-engined vehicles, it is still a fact that the fuel economy achieved, as compared with petrol-englifed machines of corresponding capacity, is much more than that needed to offset the increase in taxa

tion, except where the annual mileage is very small. It should be understood that I am not making any comparison of total .cost, but only statements of relative effects of the increases in taxation.

Users of trailers have to find rather large sums for taxation, in proportion to those in which they have hitherto been mulcted. So far as current practice is concerned, the bulk of trailer-drawn traffic occurs in conjunction with vehicles which weigh, unladen, more than 4 tons. On all 8136 vehicles a tax of £20 per annum will have to be paid. (It may be that the new scales of taxation will bring about the increased employment of smaller units with trailers.)

At present, a 6-ton pneumatic-tyred lorry, hauling a trailer, pays in taxation £54 per annum, whether it be propelled by steam, petrol or oil. On a mileage of 5,000 per annum, that is 2.64. per mile; • for 10,000 miles, 1.34. per mile ; and for 20,000 miles, 0.65d. per mile.

Under the new scale, the total licence duties will be £110 for the steam wagons and petrol lorries with trailers, and £140 for the oil-eng,ined vehicle and trailer. If the annual mileage be 5,000, the former sum represents 5.34. per mile, and the latter 6.74. per mile. For 10,000 and 20,000 miles per annum the corresponding figures are 2.654. and 3.354. per mile, and 1.334. and 1.884. per mile.

Extra Costs, of Steamers per Mile.

The increases, as compared with the present taxation. are :-Steam or petrol vehicle with trailer, 5,000 miles per annum, 2.7d. per mile; 10,000 miles, 1.354.; and 20,000 miles, 0.084. Oiler, 5,000 miles, 4.1d. per mile; 10,000 miles, 2.054.; and 20,00U miles, 1.234.

In the case of oil-engined vehicles, there is a further allowance to be made in respect of the new tax on the fuel consumed. The actual amount will depend upon the rate of consumption, but it is likely to be in the neighbourhood of 1-10d. to 1-8d. per mile.

Electric vehicles usually cover small annual mileages and, in consequence, the effect of the comparatively moderate increases in taxation are correspondingly pronounced. A vehicle of this type, weighing, unladen, less than 2 tons, will be subject to a tax of £20, instead of £13. If its annual mileage be 4,000, the extra cost per mile will be nearly id.

Usually, however, electric-vehicle costs are calculated on a time basis and the increase is more conveniently stated to approximate to 38. per week.