Tip-toeing back to life after the recession

Page 14

Page 15

If you've noticed an error in this article please click here to report it so we can fix it.

The industry is finally showing faint signs of recovery, according to July's Trucking Britain Out Of Recession survey.

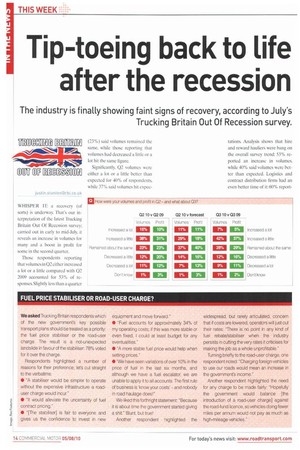

justin.stantontarbt.co.uk WHISPER IT: a recovery (of sorts) is underway. That's our interpretation of the latest Trucking Britain Out Of Recession survey: carried out in early to mid-July, it reveals an increase in volumes for many and a boost in profit for some in the second quarter.

Those respondents reporting that volumes in 02 either increased a lot or a little compared with 02 2009 accounted for 53% of responses. Slightly less than a quarter (23%) said volumes remained the same, while those reporting that volumes had decreased a little or a lot hit the same figure.

Significantly, Q2 volumes were either a lot or a little better than expected for 40% of respondents, while 37% said volumes hit expec tations. Analysis shows that hire and reward hauliers were hang on the overall survey trend: 53% reported an increase in volumes, while 40% said volumes were better than expected. Logistics and contract distribution firms had an even better time of it: 60% report

ed an increase in volumes, and for 57% of them volumes were better than forecast. Own-account operators were slightly behind the curve: 50% reported volume increases, but just 27% said volumes were better than forecast.

Also, the bigger the fleet, the greater the experience of improved volumes: 43% of those operating up to 10 vehicles enjoyed an increase. but the figure increases to 60% and 68% for 11to 50-vehicle fleets and 51-plus vehicle fleets respectively.

By sector, those operators serving the agriculture industry performed best: 68% enjoyed a boost in volumes, and for 50% of them volumes were better than forecast.

But increased volumes mean nothing if not met by improved profitability, thus it is pleasing to report that 41% of all respondents saw profit in Q2 2010 improve against 02 2009; 29% said profit was better than expected.

Analysis provides largely the same outcome as for volumes: hire and reward hauliers are on trend, logistics and contract distribution firms are ahead of the curve, while own-account operators are behind it. And again, the bigger the fleet, the better the performance: from 35% of the up-toW vehicle fleets reporting a profit boost compared with 50% of 51-plus vehicle fleets.

And agriculture is the place to be. with 45% of those serving that sector enjoying a better-than-expected profit boost.

This largely positive outcome for 02 has impacted operators' expectations for 03: nearly half (49%) expect volumes to increase in the quarter compared with 03 2009, and 42% expect a boost in profit.

See next week's issue when we'll look at the ease (or not, as the case may be) with which operators are finding new work, new drivers,new and used vehicles, and finance for capital expenditure.

Optimism

Optimism about the next 12 months remains a fragile commodity. Perhaps the combination of July's heatwave and ltu of England's shocking ance in the World Cup died the waters.

Those who said they very or fairly optimistic next 12 months account' of responses. while thosi not very or not at all accounted for 28% — optimism index score o is a clear drop from which was a return to New Year levels folio scores of +48 and +39 ir May respectively.

However, let's not share of respondents that their business h; started to recover from sion was 43%, just one point down on June's r of 44%, Those saying that the will emerge from the n the next 12 months man level at 27%. •