Cost Recording Made Easy

Page 46

Page 47

If you've noticed an error in this article please click here to report it so we can fix it.

SOLVING THE PROBLEMS OF THE CARRIER

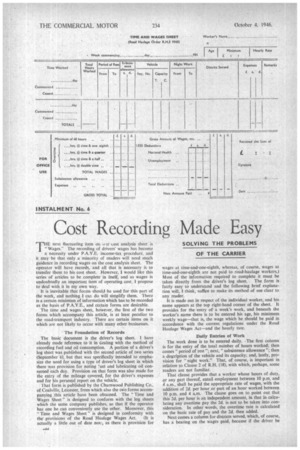

THE HE next fluctuating item on o rr cost analysis sheet is Wages." The recording of drivers' wages has become a necessity under P.A.Y.E. income-tax procedure, and it may be that only a minority of readers will need much guidance in recording wages on the cost analysis sheet. The operator will have records, and all that is necessary is to transfer them to his cost sheet. However, I would like this series of articles to be complete in itself, and as wages is undoubtedly an important item of operating cost, I propose

to deal with it in my own way. ,

It is inevitable that foinis should be used for this part of the work, and nothing I can do will simplify them. 1 here is a certain minimum of information which has to be recorded as the basis of P.A.Y.E., and certain forms are desirable.

The time and wages sheet, however, the first of the two forms which accompany this article, is at least peculiar to the road-transport industry. There are certain items on it which are not likely to occur with many other businesses.

The Foundation of Records

The basic document is the driver's log sheet. I have already made reference to it in dealing with the method of recording fuel and oil consumption. A portion of a driver's log sheet was published with the second article of two series (September '6), but that was specifically intended to emphasize the need for using a type Of driver's log sheet in which there was provision for noting :'uel and lubricating oil consumed each day. Provision on that form was also made for the entry of the mileage covered, for the driver's expenses and for his personal report on the vehicle.

that form is published by the Charnwood Publishing Co., of Coalville, Leicester, from which also the two forms accompanying this article have been obtained. The " Time and Wages Sheet" is designed to conform with the log sheets which the same company publishes, so that if the operator has one he can conveniently use the other. Moreover, this " Time and Wages Sheet" is designed in conformity with

the provisions of the Road Haulage Wages Act. (It is actually a little out of date nov, as there is provision for wages at time-and-one-eighth, whereas, of course, wages at time-and-one-eighth are not paid to road-haulage workers.) Most of the information required to complete it must be taken directly from the driver's log sheet. The form is fairly easy to understand and the following brief explanation will, I think, suffice to make its method of use clear to any reader.

It is made out in respect of the individual worker, and his name appears at the top right-hand corner of the sheet. It provides for the entry of a week's work, and beneath the worker's name there is to be entered his age, his minimum weekly wage—that is, the wage which he should be paid in accordance with the current regulations under the Road Haulage Wages Act—and the hourly rate.

Daily Entries of Work

The work done is to be entered daily. :The first column is for the entry of the total number of hours worked; then comes " period of rest "; next, "subsistence allowance ''; then a de4cription of the vehicle and its capacity; and, lastly, provision for "night work." That, of course, is important in relation to Clause 2 of R.H. (18), with which, perhaps, some readers are not familiar. That clause provides that a worker whose hours of duty, or any part thereof, entail employment between 10 p.m, and 4 a.m., shall be paid the appropriate rate of wages, with the addition of 2d. per hour or part of an hour worked between 10 p.m. and 4 a.m. The clause goes on to point out that this 2d. per hour is an independent amount, in that in calculating any overtime pay the 2d. is not to be taken into consideration. in other words, the overtime rate is calculated on the basic rate of pay and the 2d. then added.

Next comes a column for districts served, which, of course, has a bearing on the wages paid, because if the driver be

working from a Grade H area into a district of higher grade, his wages are increased accordingly.

Then comes a column for expenses, and, finally, one for remarks. It should be noted that every entry except the actual amount of wages is to be taken from the driver's log sheet.

It is intended, apparently, that the driver, or, possibly, the foreman, should complete this "Time and Wages Sheet?' The portion below is intended "for office use."

On the left-hand side of the lower part of the form, entry is made of the minimum wages, plus overtime at time-anda-quarter, time-and-a-half, or double time, as the case may be, giving "total wages." To that is added subsistence allowance and expenses, giving a gross total.

Then, on the right-hand side, there is space for entering deductions from that gross total, namely, National Health and Unemployment Insurance and Income Tax. Taking the sum of those items from the gross amount of wages, we obtain the net amount to be paid. The lower right-hand corner of the form serves as a receipt.

Difficulty in Recording wages

There is, to my mind, a defect in this form, in that it makes nb specific provision Fer assessing precisely the amount of wages due to a man who is working for some part of the week in an area a grade higher than that where his headquarters are.

Clause 3 of R.H. (18) states that where a vehicle picks.up or sets down a load at a point, or points, where the scale of wages payable is higher than that applicable to the locality in which the worker's home depot is situated, the worker shall be paid for the whole journey at the highest rate of wages applicable to that vehicle, at any of the points where he picks up or sets down.

I must admit that to attempt to include such provision on the sheet would complicate it. Nevertheless, that complication has to be faced either on the form or in the office. The absence of specific provision for it on the form seems likely to involve trouble, and, possibly, some difference of opinion between the worker and the office as to what his precise weekly wages ought to be.

I should be glad if readers who have surmounted that difficulty will let me know how they have dealt with the problem.

Dealing with P.A.Y.E.

We now come to the second of the forms reproduced with this article. This has been devised by the same publisher to help employers to deal with the difficulty of P.A.Y.E. It is known as Record Sheet No. 50," Tax and Wages Record." As can be seen, it is divided into two parts. The first is devoted to the record of income tax, and the second to particulars of wages and deductions.

Having in mind the Government publication, the code book of weekly tax tables, it should be fairly easy to understand. The entries to be made are similar to those called for in that code book. There is in column 3 the gross pay per week, followed by (in column 4) the gross pay to date, and, in column 5, the total tax due to date. That information is an essential to check income-tax amounts already deducted from the worker's wages. There is also a column for "tax deducted in week," and another for "tax refunded in week."

In the second part, dealing with particulars of wages and deductions, we have provision for the gross amount due for the week, which is, of course, the "gross pay in week." plus " tax refunded in week." Then there is provision for recording deductions on account of income tax, national health insurance and unemployment insurance, with a spare column for any other deduction which may be customary in any particular company, a column for total deductions, and, finally, for the net amount to be paid.

What is Gross Pay ?

It is important to note that the actual amount paid to the driver, according to the other form, is not the amount to be entered on this sheet as the gross pay in the week, because the sum which the driver receives includes subsistence allowance and expenses, which are not to be taken into account when assessing the income tax.

This article would not be complete without reference w another form which the Charnwood Publishing Co. has

evolved in connection with wage. It embodies all the information for which provision is made in the two forms which are reproduced herewith, but there is space for other entries which are, 4 think. essential There are columns for entering the employer's contribution in respect of national health insurance and pension, and unemployment insurance. These, I have always stressed, are important items of the operating cost of a vehicle, and, but for these two columns in the third form, they might possibly be overlooked. This third form has the same defect as that already mentioned in connection with the first one.

The forms reproduced with this article are the copyright of the Charnwood Publishing Co: If any reader wishes to use them he should purchase supplies from that concern and not attempt to have them printed for himself. S.T.R.