COBO TANKS ATTACK UK

Page 50

Page 51

Page 52

Page 53

If you've noticed an error in this article please click here to report it so we can fix it.

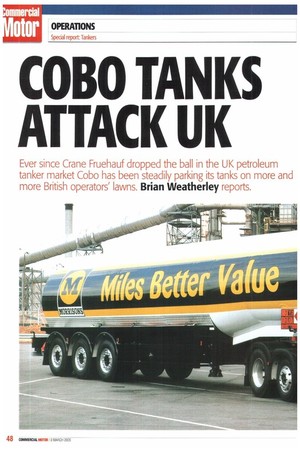

Ever since Crane Fruehauf dropped the ball in the UK petroleum tanker market Cobo has been steadily parking its tanks on more and more British operators lawns. Brian Weatheriey reports.

It's funny how the world turns. Once upon a time if you wanted a petroleum tank trailer in Britain you'd probably go to either Crane Fruehauf or Thompson Carmichael.

Not any more. Six years ago CF's parent company General Trailers shot itself in the foot by ditching home-built max-section tanks in the UK in favour of Continental-style cylindrical tanks from France... not a smart move.Then US tank giant Heil snapped up Thompson Carmichael, instantly becoming market leader— before deciding last year that it could build cheaper tanks in Poland.

However, Heil isn't the only tank maker to pick up the ball fumbled by Fruehauf. Six years ago three directors from Castleford-based Hydraulic Discharge Equipment (HDE) set up the UK arm of Spanish tanker maker Cobo. On the face of it a Spanish tank wasn't the obvious choice as Tony Blakeway, boss of Cisternas Cobo (UK), freely admits: "Previously, a lot of Spanish tanks had received a bad press in terms of quality. We'd done work on Feldbinder tanks through UDE and I always thought their quality was good. But when I saw a Cobo tank !thought this is as good as Feldbinder's.."

Blakeway points out that Cobo is an excellent fit for HDE: "It was a logical progression to move into tanks. Our team has very good skills— our welders and fitters are used to dealing with bulk equipment. We do all the PDIs and any tank repairs., all the systems are fitted by HDE."

Ideal partner However, Cobo was by no means the only manufacturer Blakeway considered:"We looked at a number of companies right across Europe to form a partnership with, including LAG and Merceron.

But we ended up with Cobo, not least because they were more in line with us.This is more like a family business.They wanted to do business through a proper company — other manufacturers would have simply wanted an agency."

Cisternas Cobo (UK) is 25% owned by Cobo in Spain, with 75% owned by the directors of Hydraulic Discharge Equipment.

Blakeway also insists that when it came to selling a product for the UK market Cobo was interested in building a tanker to meet local needs. "They didn't want us to just sell what they made," he explains. "They wanted to sell what we wanted."

Consequently a 'UK' Cobo tanker is noticeably different to a Continental product, having a revised front end with a more robust subframe and rubbing plate, not least to allow for 44-tonne work.

Today Cisternas Cobo (UK) has grown to take second place in the spirit tanker market behind Heil and it's looking to expand its business in the general purpose and chemical tank sectors as well as launching a new range of rigid vehicle tanks.

Cobo's production capacity in Spain is around 400-plus tanks a year.The UK operation currently sells 100-150 tanks a year, but Blakeway says the target is to raise that to at least 200.

Cobo (UK) sales director Terry Morgan confirms: "At the time we started to push tanks out Cobo had a plan coincidental with that to moving into a new factory in 2001 We're now taking up their extra capacity."

And Morgan adds:-The timing was perfect. CF was on the way out and other small manufacturers were struggling. We've seen that over the past two years."

New models

As well as spirit tankers. Cobo is offering stainless GP and chemical tankers as well as bitumen and powder/silo models. Although Feldbinder and Magyar showed new petroleum tanks at last year's CV Show Morgan says: "We see Feldbinder as purely a powder tanker rival. Even if you've got a good one,petroleum tanks is not an easy business to break into. We're in a reasonable position to get there:it's not a short-term thing with us." The size of the petroleum tanker market has certainly changed with Cabo, Indox/Ros Roca and others all chasing Heil for the number-one spot.The same goes for operating cycles.

"Five to six years ago you'd see 300 spirit tankers sold per year," says Blakeway, "Now it's currently around 250.And whereas the big contractors were running tanks for up to seven years in their first life, they're wearing them out a lot quicker on contracts.

"Once a tank did as little as 8,000km in a year. Now it can do anything up to 300,000km triple-shifted."

More importantly for tanker manufacturers, companies are no longer buying to keep their fleet 'fresh'.

"They're only buying when there's a contract to go for," says Blakeway. Morgan explains: -Operators are running fleets a lot more tightly. Now it's down to the wire and if you need any more then it's hired in— that's why the hire companies are doing well."

The ability to offer a max-section tank stands Cobo in good stead with traditional UK buyers. A typical Cabo spirit tanker is a six-compartment 43,000-litre capacity model, with sealed panel electronics and a choice of running gear.

Somewhat ominously, Blakeway says pricing is beginning to follow the same pattern as the dry-freight market which hits everyone in the business: "The margins aren't there that people like Heil are used to —now prices are coming down."

However, Heil's shift to a cheaper labour market in Poland gets short shift from Blakeway. "Logistically you've still got to get it to the customer in the UK. Our factory is 5km from Santander and we're 60 miles from Immingham, so our transport costs are very cheap.They won't find that from Poland."

Ironically, Blakeway says Cobo previously considered taking silo powder tanks from Czech maker ZVVZ (which has since tied up with Heil) but he adds: "We looked at ZVVZ, but logistically I felt it was a nightmare.When you add that to central Poland, it's not a very easy business to control.They can control what comes out of the cloor,but not in between."

Instead, Cobo is exploring other manufacturing possibilities, including a number of countries such as Morocco.

Powder stranglehold

But when it comes to competing in the UK powder tanker arena Blakeway admits: "Feldbinder and Spitzer have a stranglehold that's hard to break. We do 25-30 silo tankers a year. but we'd clearly like to do more and particularly in bitumen and OP "F'eldbinder will find it is the same difficulty in petroleum as we will find it to go into powders."

Last year more than 90% of Cabo UK's sales were in the petroleum sector, having gown from 60%. But Morgan concludes:"We 're just scratching the surface. We've made more inroads into petroleum and bitumen." •