Quarterly review

Page 10

If you've noticed an error in this article please click here to report it so we can fix it.

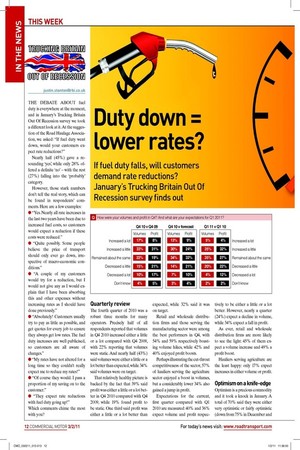

The fourth quarter of 2010 was a robust three months for many operators. Precisely half of all respondents reported that volumes in Q4 2010 increased either a little or a lot compared with Q4 2009, with 22% reporting that volumes were static. And nearly half (43%) said volumes were either a little or a lot better than expected, while 34% said volumes were on target.

That relatively healthy picture is backed by the fact that 39% said proit was either a little or a lot better in Q4 2010 compared with Q4 2009, while 19% found proit to be static. One third said proit was either a little or a lot better than expected, while 32% said it was on target.

Retail and wholesale distribution irms and those serving the manufacturing sector were among the best performers in Q4, with 54% and 59% respectively boasting volume hikes, while 42% and 40% enjoyed proit boosts.

Perhaps illustrating the cut-throat competitiveness of the sector, 57% of hauliers serving the agriculture sector enjoyed a boost in volumes, but a considerably lower 34% also gained a jump in proit.

Expectations for the current, irst quarter compared with Q1 2010 are measured: 40% and 36% expect volume and proit respec

tively to be either a little or a lot better. However, nearly a quarter (24%) expect a decline in volume, while 34% expect a fall in proit.

As ever, retail and wholesale distribution irms are more likely to see the light: 45% of them expect a volume increase and 49% a proit boost.

Hauliers serving agriculture are the least happy: only 17% expect increases in either volume or proit.