"Customers don't realise that up to 12 people might handle their parcel between collection and delivery at the other end."

Page 35

Page 36

Page 37

If you've noticed an error in this article please click here to report it so we can fix it.

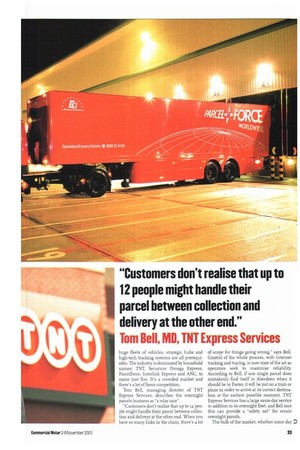

Tom Bell, MD, TNT Express Services

huge fleets of vehicles, strategic hubs and high-tech tracking systems are all prerequisites. The industry is dominated by household names: TNT, Securicor Omega Express, Parcelforce, Interlink Express and ANC, to name just five. It's a crowded market and there's a lot of fierce competition.

Tom Bell, managing director of TNT Express Services, describes the overnight parcels business as "a relay race".

"Customers don't realise that up to 12 people might handle their parcel between collection and delivery at the other end. When you have so many links in the chain, there's a lot of scope for things going wrong," says Bell. Control of the whole process, with Internet tracking and tracing, is now state of the art as operators seek to maximise reliability. According to Bell, if one single parcel does mistakenly find itself in Aberdeen when it should be in Exeter, it will be put on a train or plane in order to arrive at its correct destination at the earliest possible moment. TNT Express Services has a large same-day service in addition to its overnight fleet, and Bell says this can provide a "safety net" for errant overnight parcels.

The bulk of the market, whether same day 0 0 or overnight, is accounted for by business-tobusiness deliveries, much of it on a contract basis. Reliability and punctuality are absolutely key to the success or failure of a parcels operation. Bell says that, like all its main rivals, TNT Express Services is constantly endeavouring to increase speed and efficiency because here—perhaps more than on price—is where they gain the competitive edge. "It's all about engineering time out of the system," he says.

Most of the leading parcels carriers have invested heavily in recent years in order to keep pace with each other. Vehicles and information technology are constantly being updated, but the really big spend is on establishing regional hubs to streamline deliveries and inject a little more efficiency.

TNT Express Services recently opened a L22m hub at Kingsbury Link, near Tamworth in Staffordshire. Located on a 20-acre site, it now runs in tandem with the firm's existing distribution centre at Atherstone. The extra capacity will not only help accommodate the firm's planned growth but will speed deliveries and lend extra flexibility to the TNT operation.

"The new hub gives us a further competitive advantage by shortening the sortation process," says Bell. Since opening the Kingsbury Link hub, TNT has announced a further .t26m investment in new depots and vehicles in the coming year.

Interlink Express, slightly further down the league table of parcels carriers, has also invested in a new hub. This facility, located at Smethwick in the West Midlands, cost Li.5m to build and will be in operation by December. Interlink's new hub shares a site with a sister company, Parceline. Both are owned by Australian company Mayne Niddess Express, and having a hub each on the same site allows

the two firms to share some resources, thus improving efficiency, says group spokesperson Samantha Kennedy.

Perhaps not surprisingly, the biggest spender of recent months has been the Post Office. This year no less than koom has been poured into two new hubs—one international, the other national—for Parcelforce at Coventry. As the UK's biggest parcels carrier, handling oo,000 parcels every day, Parcelforce has to invest to keep ahead. But managing director Chris Kalla-Bishop says his organisation's position as part of the Post Office has limited the company's freedom to invest—until now, that is.

Being publicly owned, Parcelforce has had to seek government approval before executing any expansion or investment plan. Post Office privatisation has long been a prickly topic for the politicians, but, as Kalla-Bishop says: "This is a fast-moving global business, and the Post Office doesn't want to sit here and watch. As of next spring we'll be a public limited company—albeit with a single shareholder, the government."

The Post Office will pay the government a dividend amounting to 40% of profits, leaving the remaining Go% for reinvesting in the business. This means Parcelforce will have about korn a year to spend on acquisitions and expansion without having to consult the

Treasury first.

Some of Parcelforce's rivals grumble about the company's 'unfair advantage". They point out that Parcelforce is not VAT registered, and that it has made L200m in losses in the past eight years—something no private sector company could be allowed to sustain.

Kalla-Bishop's response is that although Parcelforce doesn't levy VAT on its services this gives it little competitive benefit, as most customers are VAT-registered businesses and can reclaim VAT charged by other parcels carriers. "Bear in mind that as we aren't VAT reg istered ourselves we can't reclaim any input VAT. If anything, that puts us at a slight disadvantage," he says.

As for the L200M losses, Kalla-Bishop admits to making a Dim loss last year, but explains that Parcelforce lost ,tt75rn in the early 199os when the Post Office re-allocated a chunk of income from the parcels to the letters business.

Nor is Parcelforce the only public sector parcels carrier in the UK. TNT Express is part of TNT Post Group, an Amsterdam-based organisation acquired in 1996 by the Dutch post office, while Securicor Omega Express is half owned by Deutsche Post, the German postal service.

Kalla-Bishop points this out not simply to level the playing field but also to illustrate the trend for postal services to expand beyond national boundaries, especially in Europe. Parcelforce itself has made several acquisitions in mainland Europe in recent years, and more are to follow, he says.

However, one undeniable peculiarity of Parcelforce's position in the UK is the proportion of private household deliveries it undertakes. This is only to be expected, as the aver

age member of the public with a parcel to deliver will quite naturally take it to one of the 18,500 post offices or sub post offices for despatch. We make a larger than average proportion of domestic and private deliveries," says Kalla-Bishop. But Post Office Counters accounts for less than no% of our total output." Indeed, a quarter of Parcelforce's turnover is generated by international business, and Go% is business to business.

Although business clients comprise the overwhelming majority of customers in the parcels sector, at the smaller end of the market—the same-day couriers—they are the only customers. Jeremy Thompson, managing director of London courier firm Mach n, says his client base is dominated by banks, legal firms, accountants and advertising agencies: "It's entirely business to business," he says. Another characteristic of this type of work is its essentially local concentration, "We will deliver anywhere, but all our customers are located in central London," says Thompson. Unlike the big overnight carriers. Machi does not run the relay race, either: The main difference between us and somebody like Parcelforce is that it's overnight, but we're Instant," says Thompson. "With them, an overnight package is picked up by a local van, taken to a depot, transferred to a trunking vehicle, taken to a hub, then on to a local depot where another local van picks it up and delivers it to the addressee. With us, the person who picks it up also delivers it."

However, the same-day courier operator is ruled by the need to be fast and ultra reliable. Thompson says the customer will often start complaining if the parcel isn't collected within 15 minutes of the phone call.

Barriers to entry at this end of the market are low, especially as nearly all drivers and riders working for courier firms are selfemployed. This is still the most efficient way of running such a business, says Thompson, as it motivates the driver, and earnings of D,000 a week are not uncommon.

In the 19805 there was a proliferation of courier businesses across central London, but Thompson says getting started—and, more important, staying in business—is harder now than ever before. To begin with, costs are higher.

"This is a high-tech business now. Our drivers and riders carry portable computers which send the customer's signature back to our central computer. Our customers can book via the Web," says Thompson. There is also now a Despatch Association by which the industry regulates itself, with a code of practice and standard conditions of carriage.

The same-day courier sector differs from the rest of the parcels market—and indeed from all other road transport businesses—in that there are no fleet overheads, because every driver or rider also owns his or her vehi

cle. Parcelforce, on the other hand, biggest fleet, but owns every single on vehicles outright. With the exception same-day couriers, all companies su same hardships of vehicle excise duty price inflation that afflict the rest oft transport industry.

According to Caroline Brc spokesperson for Securicor Omega the benefits of being in the parcels b are high growth in certain sectors ; home deliveries, increasing globalisat the growth of e-commerce. On the oth it is an overcrowded market, and pri margins are depressed.

"What's life like in this sector? W depends on who you are or where you says Breakwell. "Obviously we're all aff increases in fuel tax, but this will have ; effect on the smaller one-man-ancl type of business than on the big Securicor Omega Express was able to c to provide its services during the fuel

As for margins, Parcelforce's Kalla says return on sales can range from 20% to plus 20%, but the average is y 5-6%. If you're good and target a spec tor, you can do much better."