U.S. Users Prefer Articulated Vehicles

Page 44

Page 47

If you've noticed an error in this article please click here to report it so we can fix it.

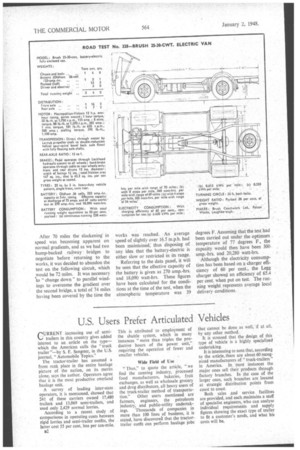

CURRENTincreasing use of semitrailers in this country gives added interest to an article on the type— which the American calls the "truck trailer "—by S. E. Sangster, in the U.S. journal, "Automobile Topics."

The tractor-trailer has assumed a front rank place in the entire haulage picture of the nation, on its merits alone, says the author. Operators agree that it is the most productive overland haulage unit.

A survey of leading inter-state operators, it is mentioned, showed that 241 of these carriers owned 17,480 trailers and 13,069 semi-trailers, and used only 2,429 normal lorries.

According to a recent study of comparisons in operating costs between rigid lorries and semi-trailer outfits, the latter cost 55 per cent, less per ton-mile.

B2 This is attributed to employment of the shuttle system, which in many instances "more than triples the productive hours of the power unit," requiring the operation of fewer and smaller vehicles. that cannot be done as well,' if at all, by any other method.

It is stressed that the design of this type of vehicle is a highly specialized undertaking.

it is interesting to note that, according to the article, there are about 60 recognized manufacturers of " truck-trailers" in America. In most instances the major ones sell their products through factory branches. In the case of the larger ones, such branches are located at strategic distribution points from coast to coast.

Both sales and service facilities are provided, and each maintains a staff of specialist engineers, who can analyse individual requirements and supply figures showing the exact type of trailer to fit a customer's needs, and what his costs will be.

Now 1 am going to assume that the work is such as to provide for a weekly mileage of 800 or 40,000 per annum. The difference between 40,000 and 50,000 is 10,000. so that our depreciation must be increased by 25 per cent. Adding 25 per cent. tG 1.6 we get 2d. per mile as the figure for depreciation.

Another item of operating cost which is calculated directly from the initial expenditure is interest. The interest on £2,500 at 4 per cent. is £100 per annum or £2 per week.

1 shall take it that in order to cover 8,000 miles per week the vehicle is in use and two men are employed for 52 hours per week. Moreover, I am going to take the step of assuming that the schedule of wages laid down in R.H.23 is actually implemented. .

Cost of Wages On that assumption the basic wage for the driver will be £5 14s, per week and with overtime that will amount to approximately £7, to which must be added 10s. per, week to cover the cost of unemployment insurance, National Health Insurance, insurance tinder the Workmen's Compensation Act, and provision for holidays with pay.

The corresponding basic. wage for the mate will be £4 13s. per 44-hour week and for the 52 hours that will be lifted to £5 14s. plus again 10s., giving £6 4s.. The total Weekly wage, therefore. 'for the two men is £13 14s, In addition there will .be subsistence allowances and other expenses which may reasonably be assessed at £2 6s. per week, giving me a grand total of £16. That figure, like the insurance, will be the same for' both types of vehicle and the insurance amounts to £2 5s. per week, assuming that the vehicles are operated under an A licence and are in the habit of journeying between termini situated in thickly populated industrial

areas. •

For garage rent Lam. going to assume 12s. 6d, per week. The tax on a vehicle of this type, assuming that it weighs 71, tons unladen, will be £100 per annum or £2 per week.

The total of our standing Charges for the rigid type eightwheeler is thus £22 17s. 6d. per week.

Now for the running Costs: First I shall assume a fuel consumption of 10 m.p.g. and fuel at Is. 8d., which gives me 2.00d. per mile. For lubricants I am going to use the figure in the current edition of "The Commercial Motor" Tables of Operating Costs, that is 0.22d. per mile.

Running Cost 811:1. a Mile

A set of tyres costs £240 and I am going to assume that an average life of a set is 24,000 miles. That gives me 2.4d per mile for tyres. For maintenance, again I shall take the figure from " The Commercial Motor "Tables of Operating Costs, which is 1.88d. per mile. Depreciation as calculated above is 2d. per mile, thus the total running cost is 8.50d, or Sid. 'per mile.

Now we cen assess this either as a total cost per mile or as a total cost per week and as a matter of fact I think it might be a good idea to give both figures. Eight hundred times 8id. is £28 6s. 8d. Add the £22 17s. 6d. standing charges and we get a total cost of £51 4s. 2d. per week. The cost per mile, easily obtained by dividing the above figure by 800, is 15.36d.

The corresponding calculations for depreciation and tyres in the case of a vehicle and trailer are a little more complicated-. First the initial outlay. An average figure for a maximum load four-wheeler platform-type vehicle to-day is £1,750 and for a trailer £370.

1 he vehicle may be expected to depreciate more rapidly than the trailet and I 'imagine it -would be fair enough to allow 240,000 miles as its life.

A set of slit 36-in. by 8-in. tyres will cost £120 and that deducted from £1,750 gives a net value of £1,630. If I allow a residual value of £160 after the 240,000 miles has been run I get a net amount of £1,470, on which assumption the basic figure for depreciation is I.5d pet mi!e acco,dliv to the method used in my previous calculation, of -this factor.

Reassessing that according to the formula for a vehicle doing 40.000 miles per annum, that 1.5t1 is increased to 1.9d. That is the depreciation for the vehicle alone.

The initial cost of the trailer as I have stated is £370. From that we deduct E80 for the cost of four 36-in. by 8-in, tyres. giving a net figure of £290. 1 assess the life at 300,000 miles, after which I reckon the value to be about £40 so that the net, figure for assessment of depreciation is £250. Spreading £250 over 300,000 miles gives me .2d. per mile for my basic depreciation. Correcting that as before for the annual mileage gives me ,25d, The total figure for &precintion is 2.15deper mile.

. The interest sum is Calculated on the total outlay of £2,120 and amounts to £1 15s. Per week. I can now sum up the operating costs giving the items in detail.

The tax in the case of the vehicle and trailer is less than with the solo vehicle. Assuming that the unladen weight

of the four-wheeler is 44 tons the tax will be £60. The additional tax payable if it is•to be used with a trailer is a further ,i20, the total being £80,so that the tax is £i 12s. per week.

• WageS-and expenses are as .before 06; garage rent 1 am going to •assume to be a little more than for the solo

machine and shall take. 15s, per week. Insurance is £2 5s. and interest £1 15s. That gives me a total of (.22 7s. per week.

Comparative Tyre Charges

As to the running costs, I shall assume that the fuel consumption is the same, also the oil cost at 0.22d. per mile. The vehicle has six 36-in. by 8-in, tyres costing £120 and if it is regularly used foi hauling a trailer the best average mileage is not likely to exceed 20,000, on which basis the cost for tyres will be 1.44d. per mile.

The trailer will have four 36-in. by 8-in, tyres costing £80, but these will last approximately 30,000 miles per set, on which basis the cost is .64d. per mile. The total cost per mile for tyres is thus 2.08d. Depreciation I have already calculated as being 2.15d. per 'mile. Maintenance I take from 'The Commercial Motor" Tables of Operating Costs as being 1.81d. per mile.

The running costs per mile are thus: fuel, 2.00d., lubricants, 0.22de tyres, 2.08d.; maintenance, 1.8 Id: depreciation, 2.15d.; total, 8.26d_ compared with 8id. of the solo machine.

The total of the running costs for 800 miles is thus £27 10s. 8d.. and that added to £22 7s., the total of the standing charges, gives us £49 17s. 8d. per week of 800 miles, which is equivalent to 14.96d. per mile.

The difference in cost, between the two types, according to the above figures, is only 0.4d. per mile or on 800 miles per week 26s. 6d, In other words, it is reasonable to state that the difference is so slight as to be negligible.

In the foregoing calculation, of course, it has been assumed that the vehicle with the trailer is drawing the trailer all the time.. Some additional economy may be possible, however, because (a) of the saving in time owing to the fact that the trailer is left to be unloaded while the vehicle proceeds, and (b) that while the vehicle is running on the latter part of the journey without trailer it is costing less.

The calculation of the advantages of the trailer in those conditions is one which can in fact be made only with a full knowledge of the conditiOns of operation and in a subsequent article I will take one or two examples to show just what might happen.

There is. of course, the case in which the load is no more than 12 tons, which could satisfactorily arid legally be carried on a six-wheeled rigid-type vehicle, and as that would cost less than the &ght-whceler. the advantage there on straight runs e here there is no particular point in us:ne trailer would turn the scale against the vehicle and trailer. That is another point which I must deal with in a subsequent article, in order to do it full justice.