Report predicts 4x4 boom

Page 18

If you've noticed an error in this article please click here to report it so we can fix it.

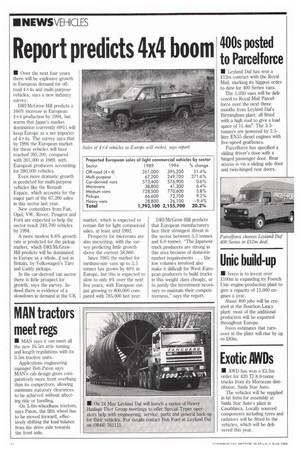

• Over the next four years there will be explosive growth in European demand for offroad 4x4s and multi-purpose vehicles, says a new industry survey.

DRI/McGraw-Hill predicts a 160% increase in European 4x4 production by 1994, but warns that Japan's market domination (currently 69%) will keep Europe as a net importer of 4x 4s. The survey says that by 1994 the European market for these vehicles will have reached 395,200, compared with 261,000 in 1989, with European producers accounting for 280,000 vehicles.

Even more dramatic growth is predicted for multi-purpose vehicles like the Renault Espace, which accounts for the major part of the 67,200 sales in this sector last year.

New contenders from Fiat, Opel, VW, Rover, Peugeot and Ford are expected to help the sector reach 249,700 vehicles by 1994.

A more modest 6.6% growth rate is predicted for the pickup market, which DRI/McGrawHill predicts will be dominated in Europe as a whole, if not in Britain, by Volkswagen's Taro and Caddy pickups.

In the car-derived van sector there is little prospect for growth, says the survey. Indeed there is evidence of a slowdown in demand in the UK market, which is expected to remain flat for light commercial sales, at least until 1992.

Prospects for microvans are also unexciting, with the survey predicting little growth above the current 38,800.

Since 1985 the market for medium-size vans up to 3.5 tonnes has grown by 40% in Europe, but this is expected to slow to only 8% over the next five years, with European output growing to 800,000 compared with 785,000 last year. DRI/McGraw-Hill predicts that European manufacturers face their strongest threat in the sector between 3.5 tonnes and 6.0 tonnes. 'Ile Japanese truck producers are strong in this area because of domestic market requirements . . . the low volumes involved also make it difficult for West European producers to build trucks in this weight class cheaply, or to justify the investment necessary to maintain their competitiveness," says the report.