EllOm lorry tax bombshell

Page 4

If you've noticed an error in this article please click here to report it so we can fix it.

'Sheer hypothesis' this figure, say hauliers

LORRIES were in debt to the British taxpayer to the tune of £110 million during the past year, according to figures just released by the Department of the Environment.

The figures, which were not revealed in the recent Transport Policy Green Paper, show that goods vehicle taxation fell some 20 per cent short of the bill that had to be picked up for highway costs.

But the Road Haulage Association and the Freight Transport Association this week attacked the calculations, which they labelled as being "loaded against the lorry" and "sheer hypothesis."

They were clearly worried that the figures would be used to back up the argument in the Green Paper that the lorry is not paying its way. The document suggests that taxes be increased to a level which would put up the operating costs for all commercial vehicles by 5 per cent and for some of the heaviest by 15 per cent.

Their fears have been given substance by the reaction of several MPs to the announcement.

Mr Ronald Atkins, the new chairman of Labour's backbench transport committee, pressed for a delay in the phasing out of rail freight subsidies.

He said that rail freight subsidies should remain until heavy lorries paid the full costs they imposed on the roads and • the environment. And another MP, Mr Ron Lewis, commented : "The road hauliers have had their roads on the cheap."

But they won no' support from Dr John Gilbert, the Minister for Transport. He said that the Government saw no case for general and continuing subsidy to any form of freight transport.

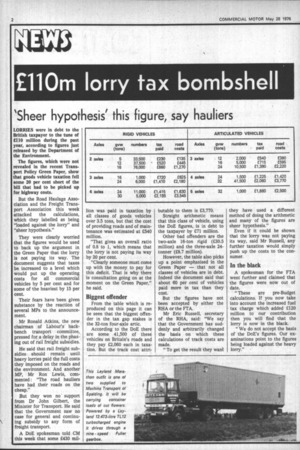

A DoE spokesman told CM this week that some £430 mil lion was paid in taxation by all classes of goods vehicles over 3.5 tons, but that the cost of providing roads and of maintenance was estimated at £540 million.

"That gives an overall ratio of 0.8 to 1, which means that the lorry is not paying its way by 20 per cent.

"Clearly someone must come up with the money to pay for this deficit. That is why there is consultation going on at the moment on the Green Paper," he said.

Biggest offender

From the table which is reproduced on this page it can be seen that the biggest offender in the tax gap stakes is the 32-ton four-axle artic.

According to the DoE there are some 41,500 of these vehicles on Britain's roads and they pay £2,060 each in taxation. But the track cost attri butable to them is £3,770.

Straight arithmetic means that this class of vehicle, using the DoE figures, is in debt to the taxpayer by £71 million.

Other bad offenders are the two-axle 16-ton rigid (£30.5 million) and the three-axle 24tonner (£8.7 million).

However, the table also picks up a point emphasised in the Green Paper — that not all classes of vehicles are in debt. Indeed the document said that about 60 per cent of vehicles paid more in tax than they cost.

But the figures have not been accepted by either the RHA or the FTA.

Mr Eric Russell, secretary of the RHA, said: "We say that the Government has suddenly and arbitrarily changed the basis on which these calculations of track costs are made.

"To get the result they want they have used a different method of doing the arithmetic and many of the figures are sheer hypothesis."

Even if it could be shown that the lorry was not paying its way, said Mr Russell, any further taxation would simply push up the costs to the consumer.

In the black

A spokesman for the FTA went further and claimed that the figures were now out of date.

"These are pre-Budget calculations. If you now take into account the increased fuel tax charge which added £120 million to our contribution then you will find that the lorry is now in the black.

"We do not accept the basis of the DoE's figures. Our examinations point to the figures being loaded against the heavy lorry."