How Goodwill Affects Business Value

Page 48

Page 51

If you've noticed an error in this article please click here to report it so we can fix it.

Omissions and Inaccuracies in Book-keeping Creat e False Values and Spell Trouble for the Vendor—or Purchaser—of a Haulage Business IWOULD like to clarify a statement, in the earlier pans• graphs of the previous article, to the effect that the value of the assets of a haulage business could be affected by the goodwill To many readers that may seem to be strange and I am therefore going to elaborate the point here. I will for this purpose take a new example, but one similar to that which I chose in the previous article.

Like the other case, this is one in which the vendor had four vehicles. I will call these A, B, C and D. The whole fleet was engaged regularly on work for one operator, work which by its regularity and the fact that the haulier was regularly engaged by his customer to carry out the work for a year, might in effect be termed a contract, although I must make it clear that it was not operated under an A-contract licence but under an A licence for general haulage.

The traffic was subject to seasonal fluctuations. It will transpire, too, as 1 relate the figures, that the margin of profit was small.

Carelessness in Keeping Records

The first difficulty arose when a request was made for access to figures of cost and revenue. The haulier had been in no way particular to see that his entries were either correct or comprehensive and in the end it was found that all that were available applied during the three months of the busy season.

On his costs side there were operating costs items • only: petrol, oil, wages, National Insurance, Road Fund tax, vehicle insurance, garage rent and depreciation. On the credit side were the amounts received for cartage. The difference between these two was assumed to be net profit.

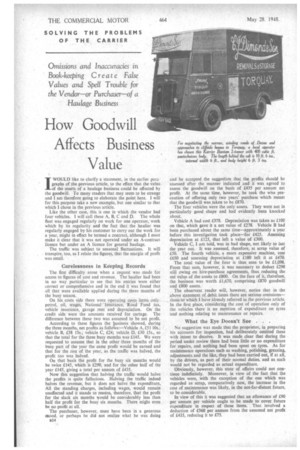

According to these figures the business showed, during the three months, net profits as follows:—Vehicle A, £51 10s.; vehicle B, £38 15s.; vehicle C, £24; vehicle D, £30 15s., so that the total for the three busy months was £145. We were requested to assume that in the other three months of the busy part of the year the same profit would be earned and that for the rest of the year, as the traffic was halved, the profit too was halved.

On that basis the profit for the busy six months would be twice £145, which is £290, and for the other half of the year £145, giving a total per annum of £435.

Now this suggestion that halving the traffic would halve the profits is quite fallacious. Halving the traffic indeed halves the revenue, but it does not halve the expenditure, All the standing charges, including wages, would remain unaffected and it stands to reason, therefore, that the profit for the slack six months would be considerably less than half the profit for the busy six months. There might even be no profit at all.

The purchaser, however, must have been in a generous mood, or perhaps he did not realize what he was doing 814 and he accepted the suggestion that the profits should be assessed after the manner indicated and it was agreed to assess the goodwill on the basis of £435 per annum net profit. At the same time, however, he took the wise precaution of offering only two years' purchase which meant that the goodwill was taken to be £870.

The four vehicles were the only assets. They were not in particularly good shape and had evidently been knocked about.

Vehicle A had cost £378. Depreciation was taken as £100 on that, which gave it a net value of £278. Vehicle B had been purchased about the same time—approximately a year before this investigation took place—for £425. Assessing depreciation at £125, that left a value of £300.

Vehicle C, I am told, was in bad shape, not likely to last the year out. It was assessed, therefore, at scrap value of £50. The fourth vehicle, a more expensive machine, cost £650 and assessing depreciation at £180 left it at £470.

The total value of the four is thus seen to be £1,098. From that sum, however, it was necessary to deduct £298 still owing on hire-purchase agreements, thus reducing the net value of the assets to £800. On the face of it, therefore, the business was worth £1,670, comprising £870 goodwill and £800 assets.

The observant reader will, however, notice that in the above statement of debit items there are serious omissions— those to which _I have already referred in the previous article. In the first place, considering the cost of operation only of the vehicles there is no mention of expenditure on tyres and nothing relating to maintenance or repairs.

What the Eye Doesn't See . .

No suggestion was made that the proprietor, in preparing his accounts for inspection, had deliberately omitted these with intent to deceive. It was made clear that during the period under review there had been little or no expenditure for repairs, and nothing had been spent on tyres. As for maintenance operations such as washing, polishing, greasing, adjustments and the like, they had been carried out, if at all, by the drivers, as part of their normal duties, and as such would not be regarded as actual expenditure.

Obviously, however; this state of affairs could not continue indefinitely. Moreover, in view of the fact that the vehicles were, with the exception of the one which was regarded as scrap, comparatively new, the increase in the cost of maintenance was likely, in the not-far-distant future, to be considerable.

In view of this it was suggested that an allowance of £90 per annum per vehicle ought to be made to cover future expenditure in respect of these items. That involved a deduction of £360 per annum from the assumed net profit of £435, reducing it to £75. Another point which will no doubt already have occurred to the regular reader of these articles is that there is no provision for establishment charges. Now obviously the man in charge, although he was in actual fact the proprietor of the business, would require a wage. Even if we put him on an absolutely irreducible minimum scale he would want at least £100 per annum. .

In addition, and again this was pointed out in the previous article, some provision should be made for a contingency fund to meet the expense of substituting vehicles when any of the four is out of commission. A minimum of €.50 should be set aside for that purpose.

• Clearly, therefore, instead of there being a profit of £435 per annum, the business was being run at a loss of 175 per annum. The contracts were valueless, and without the contracts there was no work for the vehicles.

The value of the vehicles as assets, therefore, could be calculated only on. the basis of what they would fetch in the open market and I could not imagine anyone paying more than £500 for the four, including the scrap one, having in mind their condition. Their value, instead of being £1,098 less £298 hire-purchase debit, or £800, was only £500.

Loss Depreciates Assets

In a business run at a loss, therefore, the assets are depreciated •accordingly and it behoves the investigator to check the operator's statements as to cost of operation and provision for establishment ,charges and contingencies very carefully before he even accepts the value placed upon • the assets. .

There is another matter to which I must refer, Which is more in the form of a cautionary recommendation to the buyer. A good deal of what I have written, up to now,-has been concerned with that item which is sometimes so difficult to assess, namely, .goodwill.

Whatever may have been the assessment, the purchaser nevertheless is, in Making his purchase, assumed to be acquiring that goodwill. At any rate he is paying good money for it and it therefore behoves him to take steps to make sure that it really does pass to him and that matters are not left in such a loose state that the vendor may, intentionally or otherwise, retain a part or even all of it.

The procedure necessary is usually incorporated in the agreement for sale and the essential recommendation that I make here is that the purchaser should make no attempt 'to carry through the transaction without the aid of a solicitor who has had wide experience in this class of work.

He will draw up a form of agreement and 1 do not propose to attempt to indicate the wording and details of such a form. I do, howev.er, suggest that in the agreement the following provisions should be made in some shape or other to preserve the rights of the purchaser.

Conditional on Licensing

First of all, there is the point made in the previous article about ensoring that the purchaser shall have transferred to him or granted to him licences which correspond with those in the possession of the vendor. There should be a clause providing that the purchase shall be completed only upon the grant to the purchaser of a licence under the Road and Rail Traffic Act authorizing the use of said vehicles and that the purchase money shall not be paid until that has come to pass.

Next, the vendor must enter into some agreement with the purchaser that he will not for some specified period after the completion of the purchase, either alone or in partnership with someone else, or even as manager for some other company, take part in the operation of a road haulage business within some specified distance of the base from which he originally operated. That is the clause which protects the goodwill and conserves it to the purchaser.

Yet another clause should be to the effect that the ven.dor agrees to apply to the Licensing Authority and give the purchaser all the help he can in obtaining-the new licences to operate; further, that he will surrender his own licences to the licensing authority as soon as the new licences be granted to the purchaser. It •must be made clear that if the Licensing Authority refuses to grant a licence then the agreement to sell becomes null and void and any deposit which has been paid shall be returned to the purchaser.

Curiously enough the effect of a wrong assessment of goodwill on the value of the assets was made clear in dealing with another inquiry from a man who wrote to tell me that he was going to buy a share in an existing business, There were two partners in this concern and the assets comprised one lorry valued at £450. The business had been acquired by its present owners six months previously. •

They had paid £930 for it, including goodWili, described to me by my inquirer as " a connection." During the six months of its present ownership £120 net profit had been earned • after, as the inquirer stated, allowing £100 for 'depreciation of the vehicle. Data supplied were meagre and I doubted whether the estimate of profit was correct,

I wondered whether all -allowance had been -made for management expenses. overheads and so on, as well as for depreciation. 'the fact that depreciation was mentioned in such an ostentatious manner made me dubious. For the time being, however, let us assume that the profit for the six months is net and let us proceed from that aside.

The first step is to check the initial price paid for the business to see if it be reasonable. Now if £120 net profit be earned in six months and if that be taken as being reasonably indicative of the value of the business. then I can assume that for the purposes of valuing the izoodwill, £240 per annum profit is a fair basis.

Of the purchase price (£930) clearly £450 was intended as payment for the lorry. (That lorry is now valued at £350 and has been depreciated by £100.) Therefore £480 was paid for goodwill, which is equivalent to two years' purchase. In all the circumstances that figure can he taken as reasonable.

To-day, assuming that the goodwill be still the sante, the total value is £830 (£100 less than six months previously) because of the depreciation of the only asset, the vehicle.

Price of a Third Share

I have advised the inquirer first to make sure that the £120 profit really existed after every expense had been allowed, and that if he can assure himself of that he should pay no more than £275 for his third share. That is subject to my criticism of the whole transaction, that there is not enough in a one-lorry business to make profits for three people.

• Now assume for the sake of argument—and it may be fact—that there be not £120 net profit payable for that period of six months. This may well be the case for, as there are already two partners, one of whom presumably drives the vehicle while the other manages the business, it is a moot Point whether both have been paid reasonable wages before the -profit is calculated.

If, as so often happens, they are operating on the principle that their wages are included in the net profits, then a state of affairs far different from the above exists. Obviously £240 per annum profit when all is found is quite insufficient to pay for the wages of a driver and manager. Therefore, instead of the business earning £120 for six months it is actually being run at a loss.

The work upon which the vehicle is engaged is from the point of view of profit earning, worthless, and if the vehicle is to be thrown on the open market for sale, as it probably will have to be in a short time. having in mind that the business is running at a loss, it will probably realize not more than £200, even assuming normal trading conditions.

Here, the result of operating at uneconomic rates has been to reduce the apparent value of the business from approximately £930 six months ago to £200. My recommendation to the inquirer is that he should have nothing whatever to do with the proposition. ST. R.