TAXING FACTS

Page 44

If you've noticed an error in this article please click here to report it so we can fix it.

The Eurocrats in Brussels have just produced a report telling us we are over-taxed. Reg Dawson pulls out the grisly facts. IN EEC involvement in a problem does not usually raise cheers from the British road transport industry. This time however, things could be different.

The Eurocrats have quarried into the EEC's word mountain and produced a 60 page document which contains everything that the most diligent reader could possibly want to know about vehicles and fuel taxes in the 12 EEC States, and a lot more besides.

British hauliers are shown to suffer the highest rate of Vehicle Excise Duty and the second highest rate of diesel tax among all 12 countries. Though this comes as no surprise it is comforting to have it confirmed in an official Commission document. This document is the foundation of attempts to reduce the wide disparities which exist and some of the figures show the enormous task which lies ahead.

The report does not propose specific solutions. It confines itself to "indicating some lines of action to eliminate distortions in competition". It makes it clear that those distortions bear most heavily on the British haulier. In 1986 he paid 60% above the EEC average in VED for a 38 tonne lorry, and another 60% in fuel tax. It would be unrealistic to expect British tax rates to drop by anything law this.

The report recognises this. It tentatively suggests concentrating on raising low vehicle taxes while leaving higher rates unchanged, "perhaps subject to a standstill arrangement". Few British hauliers would object. The report shows, however, that it is much more complicated than that.

International comparisons are always difficult. Different definitions and diverse statistical bases make precision impossible and variations in exchange rates are yet another complication. The report uses the EEC's artificial European Currency Unit (ECU) in which the Community's accounts are kept.

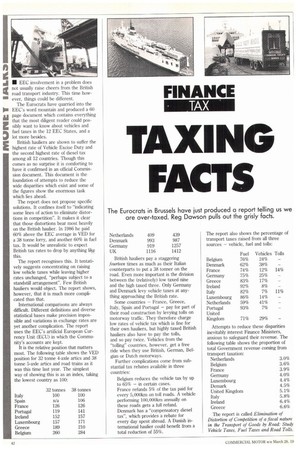

It is the relative position that matters most. The following table shows the VED position for 32 tonne 4-axle artics and 38 tonne 5-axle attics and road trains as it was this time last year. The simplest way of showing this is as an index, taking the lowest country as 100: British hauliers pay a staggering fourteen times as much as their Italian counterparts to put a 38 tonner on the road. Even more important is the division between the (relatively) low taxed nine and the high taxed three. Only Germany and Denmark levy vehicle taxes at anything approaching the British rate.

Some countries — France, Greece, Italy, Spain and Portugal — pay for part of their road construction by levying tolls on motorway traffic. They therefore charge low rates of vehicle tax which is fine for their own hauliers, but highly taxed British hauliers also have to pay the tolls, and so pay twice. Vehicles from the "tolling" countries, however, get a free ride when they use British, German, Belgian or Dutch motorways.

Further complications come from substantial tax rebates available in three countries: Belgium reduces the vehicle tax by up to 65% — in certain cases.

France refunds 5% of the tax paid for every 5,000km on toll roads. A vehicle performing 100,000km annually on these roads gets a full refund.

Denmark has a "compensatory diesel tax", which provides a rebate for every day spent abroad. A Danish international haulier could benefit from a total reduction of 55%.