TO BUY, OR NOT TO BUY

Page 40

If you've noticed an error in this article please click here to report it so we can fix it.

We consider the options. Whether you own your trucks or lease them, it seems that the other man's grass is always greener. Peter Bevins takes a closer look at the figures and the arguments from both sides of the garden fence.

• Transport companies tie up more time and money in their trucks than they should, say the contract hirers who want to win business from you by providing your every vehicle need. No they do not, say the old-fashioned hauliers who like to keep their vehicles on their own balance sheet. To be as reliable and as "in control" as possible, argue the owners, you should buy your trucks.

It is an important debate. The truck is the transport industry's tool of the trade. Probably the best way to decide whether you should buy your vehicles or hire someone else's is to cost it out. There are no hard and fast rules, and every haulier will have different requirements financially and technically, but the bottom line should remain the deciding factor. The sentimental haulier who likes to own all of his vehicles, and give them names, still seems to thrive in the competitive 1980s. More firms are opting to contract 0 out however and even if you feel happy today, will you tomorrow? It is best to reappraise your situation regularly.

When a haulier comes to ponder on how he costs his truck, he usually works out a cost per kilometre figure. Depreciation is occasionally thrown in, but more frequently added on afterwards.

A 7.5 tonne gross box vehicle after discount will cost about £15,000, dependent upon specification but it is unlikely that a young company would contemplate buying a vehicle outright for cash. The money could be better employed in more productive areas of the business such as machinery, premises or sales staff to expand the buisness.

Borrowing from the bank is also inadvisable at this stage as it could tie up a valuable credit line. With so many other options available, your bank should be left in reserve for quick short term borrowing requirements. Therefore more readily available options such as leasing, hire purchase and contract hire should be considered as the options for acquiring your vehicle.

On first impressions, leasing would appear to be the cheapest source of funding but if other factors are considered then this may prove not to be the case. You are only renting the vehicle for a period of time and never own the vehicle. Furthermore, arranging maintenance packages and other support services could push the cost over the original budget for buying a vehicle.

Hire purchase as a means of acquiring a vehicle has more logic to it at this stage as the vehicle immediately becomes an asset of the company and can be retained or sold at the end of the finance period.

Since the abolition of capital allowances in 1984, the contract hire market has expanded quite dramatically and there is no doubt this trend will continue. Not only does the haulier get the use of a vehicle, but also the services that go with it. These include maintenance, road fund licence, tyre replacement, MoT, replacement vehicle safeguards and emergency roadside assistance. There are operational requirements saving management time and money. For a fixed price a buyer can have use of a truck, control its activity and ensure the efficiency of his delivery service.

The contract hire company, as part of its agreement, takes care of the vehicles reliability and availability. Choosing a lease or HP finance deal is only part of the cost to consider. Acquiring a vehicle in this manner leaves too many variables and too much in the hands of different suppliers or support services.

Do not forget that the discounts and commitment for major fleet buyers are generally not available to small vehicle operators. There is little doubt that contract hire companies also receive substantially more favourable discounts from vehicle manufacturers.

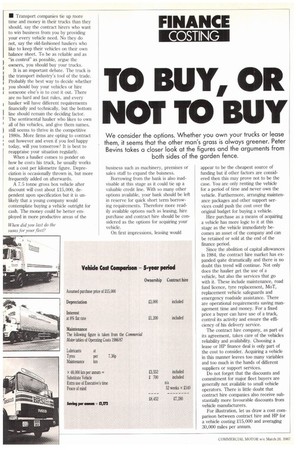

For illustration, let us draw a cost comparison between contract hire and HP for a vehicle costing £15,000 and averaging 30,000 miles per annum.