Advanced axles from redundant bus plant

Page 72

Page 73

Page 74

If you've noticed an error in this article please click here to report it so we can fix it.

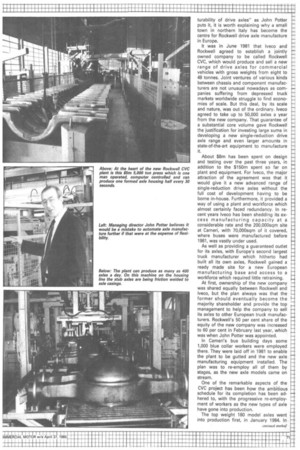

Little could be less exciting than an axle plant. Not according to Tim Blakemore, who visited the Rockwell CVC plant in Italy where an ambitious axle building programme is gathering momentum

THE ROCKWELL CVC Commercial Vehicle Components) plant at Cameri, near Milan, is much more than just another new axle manufacturing facility. I became aware of that long before my recent tour of the plant and interview with its managing director, John Potter.

Evidence of the special nature of Rockwell CVC, the company and its products came from diverse sources. For example, interest in CVC's new metric single-reduction axles is widespread. It extends now even to application engineers at chassis manufacturers with long traditions of building all their own major components.

Moreover, the Cameri plant was deemed important enough for a joint visit by the heads of its joint owners, Giovanni Agnelli, Fiat group supremo and Robert Anderson, chairman and chief executive of Rockwell International which is a giant, multi-faceted corporation with a $9bn turnover. I cannot imagine that axle factory visits normally figure prominently in these gentlemen's diaries.

So what exactly is it that makes Rockwell CVC special? John Potter, an Englishman with a hint of an American accent which is a legacy from the time he spent working for Rockwell in the USA, sums up the CVC project as "a unique opportunity to manufacture a new product at a new plant in a new country, following an exceptionally thorough market research programme."

He might have added that the $150m spent on new equipment at Cameri is the largest ever single investment by Rockwell International outside the USA. He has no doubt that his plant is the most advanced of its kind anywhere in the world, including Japan where the pacesetters in many branches of automotive manufacturing technology are to be found nowadays. But being a realist John Potter knows that none of Rockwell's competitors is standing still; he sees an important aspect of his responsibility as "ensuring that in five years' time we are still ahead".

Before describing some of the ways in which Rockwell has "maximised manufac turability of drive axles" as John Potter puts it, it is worth explaining why a small town in northern Italy has become the centre for Rockwell drive axle manufacture in Europe.

It was in June 1981 that Iveco and Rockwell agreed to establish a jointly owned company to be called Rockwell CVC, which would produce and sell a new range of drive axles for commercial vehicles with gross weights from eight to 48 tonnes. Joint ventures of various kinds between chassis and component manufacturers are not unusual nowadays as companies suffering from depressed truck markets worldwide struggle to find economies of scale. But this deal, by its scale and nature, was out of the ordinary. Iveco agreed to take up to 50,000 axles a year from the new company. That guarantee of a substantial core volume gave Rockwell the justification for investing large sums in developing a new single-reduction drive axle range and even larger amounts in state-of-the-art equipment to manufacture it.

About $8m has been spent on design and testing over the past three years, in addition to the $150m spent so far on plant and equipment. For lveco, the major attraction of the agreement was that it would give it a new advanced range of single-reduction drive axles without the full cost of development having to be borne in-house. Furthermore, it provided a way of using a plant and workforce which almost certainly faced redundancy. In recent years Iveco has been shedding its excess manufacturing capacity at a considerable rate and the 200,000sqm site at Cameri, with 70,000sqm of it covered, where buses were manufactured before 1981, was vastly under used.

As well as providing a guaranteed outlet for its axles, with Europe's second largest truck manufacturer which hitherto had built all its own axles, Rockwell gained a ready made site for a new European manufacturing base and access to a workforce which required little retraining.

At first, ownership of the new company was shared equally between Rockwell and Iveco, but the plan always was that the former should eventually become the majority shareholder and provide the top management to help the company to sell its axles to other European truck manufacturers. Rockwell's 50 per cent share of the equity of the new company was increased to 60 per cent in February last year, which was when John Potter was appointed.

In Cameri's bus building days some 1,000 blue collar workers were employed there. They were laid off in 1981 to enable the plant to be gutted and the new axle manufacturing equipment installed. The plan was to re-employ all of them by stages, as the new axle models came on stream.

One of the remarkable aspects of the CVC project has been how the ambitious schedule for its completion has been adhered to, with the progressive re-employ ment of workers as the new types of axle have gone into production.

The top weight 180 model axles went into production first, in January 1984. In July last year, manufacture of the 160 series axles began, and in January this year the introduction of the 140 and 125 series completed the CVC solo axle lineup. At present the plant has 220 salaried staff and 800 blue collar workers. John Potter expects to re-employ a further 75 later this year.

As lveco goes through the transition from using its own drive axles to using Cameri axles on all on-road vehicles some of the new plant's spare manufacturing capacity is being used to manufacture Iveco axle parts. John Potter estimates that about 20,000 Rockwell axles will be shipped from Cameri this year.

Although the plant has a long history of vehicle production, including cycle and motor cycle production before it began to build buses, clearly the skills established there were not precisely those required in a modern axle plant. Initially the workers were re-trained at lveco's old gear and axle manufacturing sites at Turin, Milan and Bolzanno. Then supervisory staff from these plants came to Cameri to work alongside their colleagues.

All operators were trained to use statistical process control, or operator process control as Rockwell dubs it, whereby each operator records the tolerances of the process for which he is responsible. Only if these tolerances move outside a carefully defined band need he worry about resetting the machine. It is a well established manufacturing control method and John Potter has no doubt that it works. "You can see the scrap rate go down immediately wherever it is applied," he told me.

Mr Potter sums up the priorities of his company in three words: "quality, credibility and productivity". My tour of the Cameri plant, though inevitably brief, left me in no doubt that Rockwell CVC has the ability to deliver on the first and last of these. But what exactly did he mean by "credibility"? "Simply doing what you say you will," was his reply.

One of the things Rockwell CVC has said it will do is to produce a family of European axles, not just modified versions of an American component, which will meet needs now and in the future of operators and manufacturers. Much of the company's credibility must depend therefore on how successful this new family is.

Rockwell spared no effort in establishing exactly what was required in drive axles by European commercial vehicle manufacturers before its new range was designed. Computer models of seven European road test routes were developed and Rockwell says it will simulate any other manufacturer's route if required.

Meanwhile, testing of CVC axles, both on the road, on computer and in the laboratory, continues apace.

John Potter is sure that further weight saving in drive axles will be an important consideration over the next 10 years, as will lower (numerical) ratios in single-reduction axles to suit the latest very low speed engines. "We can already get below 3.0:1, in fact we can get to 2.8:1," he told me. "Whether or not we will need to do so is another matter."