A Haulier's Balance Sheet an

Page 20

Page 21

Page 22

If you've noticed an error in this article please click here to report it so we can fix it.

rofit and ass Account Solving the Problems

of the Carrier

SOME weeks ago I promlsed one of my correspondents

that would write some articles dealing with balance sheets and profit and loss accounts, showing how they should be prepared in order to meet the requirements and conditions of a haulier's business. To fulfil that promise I have had to interrupt an important series of articles on rates assessment.

It is a little difficult, in dealing with a subject of this nature, to decide just how far back to go into the elemerJs of accountancy so as to meet the wishes of the majority of readers. Most of them, I expect, have their own balance sheets, trading accounts, and profit and loss accounts and will have some idea as to what they mean. There are some.'

however, to whom these documents are just Greek. I have,' therefore, come to the conclusion that the best thing to do is to begin by explaining the importance of these two valuable documents; I say " two" because the trading accouqt and the profit and loss account form one.

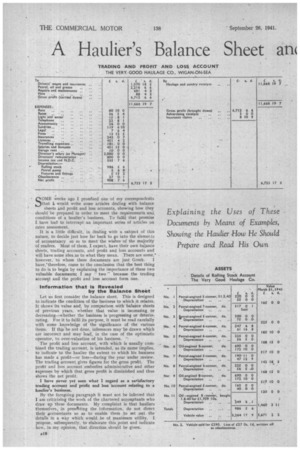

Information that Is Revealed by the Balance Sheet Let us first consider the balance sheet. This is designed to indicate the condition of the business to which it relates. It shows its value and, by comparison with balance sheets of previous years, whether that value is increasing or decreasing—whether the business is progressing or deteriorating. For it to fulfil its purpose, it must be read carefully with some knowledge of the significance of the various items. If this he not done, inferences may be drawn which are incorrect and may lead, in the case of the optimistic operator, to over-valuation of his business.

The profit and loss account, with which is usually combined the trading account, is intended, as its name implies, to indicate to the haulier the extent to which his business has made a profit—or loss—during the year under review. The trading account gives figures for the gross profit. The profit and loss account embodies administrative and other expenses by which that gross profit is diminished and thus shows the net profit.

I have never yet seen what I regard as a satisfactory trading account and profit and loss Account relating to a haulier's husiness.

By the foregoing paragraph ft must not be inferred that 1.am crititipiing the work of the chartered accountants who draw up these documents.. My complaint is that hauliers themselves, in presetting the information, do not direct their accountants so as to enable them to set out the details in a way which would be of maximum utility. I propose, subsequently, to elaborate this point and indicate how, in my opinion, that direction should be given. With this article are reproduced two balance sheets and one trading accsount and profit and loss account. All of them are taken from my files'and relate to actual hauliers' businesses. The figures, however, have been altered so that no secrets are divulged and no confidences violated. The alteration has been made in a way that the significance of the-information is unaffected. The details of the assets of the Very Good Haulage Co.are amplified in a separate document, also reproduced with. this article.

Now, let us deal with the balance sheet. To derive full value from the examination of this document and in order to be able to utilize it to the fullest extent, to judge of the progress the business is makjng, it is rtally necessary to have the statements for two or more successive years available for purposes of comparison. Unfortunately, I do not happen to have the previous year's accounts by me.

When a Business Can Be Said to be Prospering Tbe reader who has his own accounts will appreciate that, in making such comparisons, the first thing to look at is the total. If for the current year that exceeds the previous year's total there is justification for a preli,minaly assump

tion that the business is prospering. .

Such -a conclusion would be confirmed if the individual items be-also progressing in a direction favourable to the business, esptcially if, as is the case in both the examples reproduced, the favourable balance—the excess of assets over liabilities—be steadily increasing.

Judged by any standard, the Very Good Haulage Co. is a sound concern and this is positively indicated by its

balance sheet. Its prosperity is indicated by the extent of the favourable balance and the fact that the balance is growing. It was £2,675 at the end' of the 1939-f940 period and for the.current year bas grown by neasly £1,000 to £3,584. In addition, the assets are nearly all what is called ‘" tangible," only a little more than 10 per cent. -being otherwise represented by the item "-trade. debtors " at £1,057. There is no less than £,528 'cash, 41,697 invested in land, and the rolling stock is probably considerably midisvhlued at £3,671 because, with the exception of the last new Vehicle, indicated on the explanatory details sheet as No. 11, no account appears to have been taken of the appreciation in values due to war conditions.

The position of the Not, So Good Haulage Co. is not quite so sound, although, judging by the growth of the favourable balance, it is progressing and if it continues to .do SO, at the rate indicated will improve. 'In this case, the item " debtors," amounting to £814, is actually 40 per cent. of the total assets and there is only £5 10s. cash.

Rolling-stock Values Higher Through War-time Factors

It is probable, also, that the actual value at to-day's prices of the rolling stock is in excess of that shown in the bara.nce sheet, but the tangible assets are only a little over 50 per cent.. of the total as compared with nearly 90 per cent.in the other case. In assessing the value of a business for the purposes of sale this proportion of tangible assets is an important factor.

Now, to turn to the trading account and profit and loss account. I have stated above that I have yet to see a document of this description, relating to a haulier's busi ness, which is really 'satisfactory, let alone ideal. The example shown is as nearly satisfactory, in fulfilling the functions I have in mind, as any I have seen. It cannot be said, therefore. that I have chosen a bad example to point a mon.d. Even so, it is still far short of the ideal, as I shall demonstrate in another article. Meantime the reader should examine this one, so as to appreciate its usefulness and significance.

The upper portion is the trading accqunt. On the right hand or credit side are shown the gross receipts. Apparently this company has no side lines, derives n substantial profit, for example, from the storage of customers' goods, and, in -consequence, there is only one item on the credit side.

On the debit side are enumerated the obvious items involved in the operation of the haulier's vehicles. The balance, the difference between the total of those items and the gross receipts are entered as gross profit.

In the profit and loss account are entered, on the debit side, all items of expense, other than those already included in the trading account.

On the credit side there is entered the gross 'profit brought down from the trading account aad two small additional items—a sum of £3 resulting from some advertising, possibly on a hoarding on the operator's premises:, and one of £8 10s. 9th raised in connection with some claim under an insurance policy. The total of these three items is £6,723 17s. 3d., and that exceeds the total of expenses on the debit side by £908 75, 6d. which, thus, is tIr net profit as entered in the balance sheet.