MANAGING WITHOUT

Page 38

Page 39

If you've noticed an error in this article please click here to report it so we can fix it.

RAID

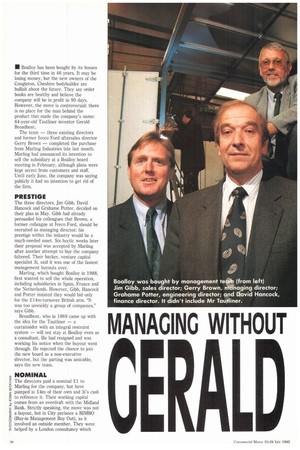

• Boalloy has been bought by its bosses for the third time in 46 years. It may be losing money, but the new owners of the Congleton, Cheshire bodybuilder are bullish about the future. They say order books are healthy and believe the company will be in profit in 90 days. However, the move is controversial: there is no place for the man behind the product that made the company's name: 64-year-old Tautliner inventor Gerald Broadbent.

The team — three existing directors and former Iveco Ford aftersales director Gerry Brown — completed the purchase from Marling Industries late last month. Marling had announced its intention to sell the subsidiary at a Boalloy board meeting in February, although plans were kept secret from customers and staff. Until early June, the company was saying publicly it had no intention to get rid of the firm.

The three directors, Jim Gibb, David Hancock and Grahame Potter, decided on their plan in May. Gibb had already persuaded his colleagues that Brown, a former colleague at Iveco Ford, should be recruited as managing director: his prestige within the industry would be a much-needed asset. Six hectic weeks later their proposal was accepted by Marling after another attempt to buy the company faltered. Their backer, venture capital specialist 3i, said it was one of the fastest management buyouts ever.

Marling, which bought Boalloy in 1988, first wanted to sell the whole operation, including subsidiaries in Spain, France and the Netherlands. However, Gibb, Hancock and Potter insisted they would bid only for the 214m-turnover British arm. "It was too unwieldy a group of companies," says Gibb.

Broadbent, who in 1969 came up with the idea for the Tautliner — a curtainsider with an integral restraint system — will not stay at Boalloy even as a consultant. He had resigned and was working his notice when the buyout went through. He rejected the chance to join the new board as a non-executive director, but the parting was amicable, says the new team.

The directors paid a nominal £1 to Marling for the company, but have pumped in £4m of their own and 31's cash to refinance it. Their working capital comes from an overdraft with the Midland Bank. Strictly speaking, the move was not a buyout, but in City parlance a BIMBO (Buy-in Management Buy Out), as it involved an outside member. They were helped by a London consultancy which helped them put together their proposal to Marling.

The new directors say the company is now in a healthy state. They have made 21 redundancies from the workforce of 300, although they say these were already planned under Marling. They will benefit from rationalisation that had been taking place for the past year — a curtains factory in nearby Holmes Chapel was shut — and this year their fixed costs will be £400,000 less as a result.

Although they say that it was the European subsidiaries that were the biggest drain on resources, they have no plans to bypass the Continental market. We missed a trick in Europe," says Gibb. "Before we were shipping kits to subsidiaries for them to assemble. Now we sell direct to manufacturers such as Schmitz." Gibb believes sister European companies are unnecessary. "Chassis manufacturers simply want the Tautliner brand name and will market it along with their own product," he says, although he admits that the Boa!toy companies on the Continent have served a purpose establishing the name. "The focus of the company is now on the UK market."

They say they are winning substantial orders, particularly for semi-trailer and drawbar bodies. They include 90 for Eddie Stobart, 70 for Pandoro and 50 for Falcon Distribution. Gibb believes there has been a resurgence in business confidence in the industry since the general election. "A year ago if we got an order for four or five, it was a cause for celebration," says Gibb. "Now they're coming in regularly in double figures."

The four directors are keen to exploit the 7.5-tonner market; most of these are sold through to the customer via dealers. During the past six months the company has developed a kit version of its Fineliner curtainsider, a cheaper and lighter variant on the Tautliner (CM 16-22 July). It will licence up to eight local bodybuilders to assemble the kits. "We hope to achieve a synergy of our name and their local reputation and access to the dealer," says Gibb. "So many transactions at that weight are dealer-sponsored. Moving vehicles to Congleton is not attractive — it's like the mountain coming to Mohammed."