Down to earth approach to road V airfreight

Page 47

Page 48

Page 49

If you've noticed an error in this article please click here to report it so we can fix it.

There's more to deciding which mode to use than a mere matter of distance. The Dow Group has a foot in both camps. Karen Miles investigates

ROGER DOWSETT has a highly unusual position in the international freight industry — he has one foot planted in each of the rival camps of air and road freight.

He is chairman and founder member of the Stockport-based Dow Group which devotes roughly 60 per cent of its annual £12m turnover to international activities. These are carved up by Dow Freight Forwarding (DFF) and the internationally dominated Dow Freight Services (DFS). Mr Dowset is managing director of DFS too.

In practice OFF will often use DES to carry consignments for its customers, but DFS can find itself losing out on road work. Further, it has often to put up with having the virtues of air freight waved in front of its nose by its sister company.

In other instances, DFF's managing director told me, "road freight will come into its own".

To understand this wrangle I first looked at the road freight service, which runs over 100 deliveries a week to the Continent from its two major depots at Stockport and Swindon. Roger Dowsett explained that the Stockport depot houses 60 per cent of DES's 75 38-tonne vehicles. "Costing is everything," Mr Dowsett said, and so Stockport serves DES's "traditional markets, the long-haul work."

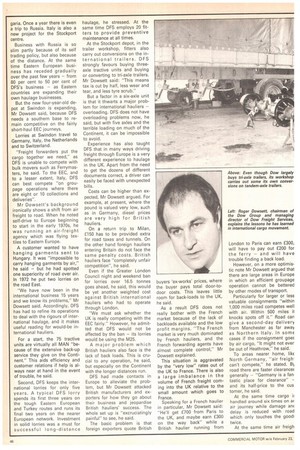

On the longer-haul trips, travelling 180 miles or so more than southern-based hauliers does not matter, he said. So this depot sends lorries to Turkey, Yugoslavia, Hungary, Greece, Poland, Czechoslovakia, Romania, and Bul

garia. Once a year there is even a trip to Russia. Italy is also a new project for the Stockport centre.

Business with Russia is so slim partly because of its self trading policy, but also because of the distance. At the same time Eastern European business has receded gradually over the past few years from 80 per cent to 50 per cent of DFS's business as Eastern countries are expanding their own haulage businesses.

But the new four-year-old depot at Swindon is expanding, Mr Dowsett said, because DFS needs a southern base to remain competitive on the fairly short-haul EEC journeys.

Lorries at Swindon travel to Germany, Italy, the Netherlands and to Switzerland.

"Freight forwarders put the cargo together we need," as DFS is unable to compete with bulk movers such as Ferrymasters, he said. To the EEC, and to a lesser extent, Italy, DFS can best compete "on groupage operations where there are eight or 10 collections and deliveries".

Mr Dowsett's background ironically shows a shift from air freight to road. When he noted self-drive to Europe beginning to start in the early 1970s, he was running an air-freight agency which was flying textiles to Eastern Europe.

A customer wanted to have hanging garments sent to Hungary. It was "impossible to carry hanging garments by air," he said but he had spotted one superiority of road over air. In 1972 he put two lorries on the road East.

"We have now been in the international business 15 years and we know its problems," Mr Dowsett said. Accordingly, DES has had to refine its operations to deal with the rigours of international haulage, and it makes useful reading for would-be international hauliers.

For a start, the 75 tractive units are virtually all MAN "because of the extensive back-up service they give on the Continent." This aids efficiency and customer relations if help is always near at hand in the event of trouble, he said.

Second, DFS keeps the international lorries for only five years. A typical DFS lorry spends its first three years on the tough Eastern European and Turkey routes and runs its final two years on the nearer European network. Investment in solid lorries was a must for successful long-distance haulage, he stressed. At the same time DFS employs 20 fitters to provide preventive maintenance at all times.

At the Stockport depot, in the trailer workshop, fitters also carry out conversions on the international trailers. DFS strongly favours buying threeaxle tractive units and buying or converting to tri-axle trailers. Mr Dowsett said: "This means tax is cut by half, less wear and tear, and less tyre scrub."

But a factor in a six-axle unit is that it thwarts a major problem for international hauliers overloading. DFS does not have overloading problems now, he said, but with five axles and the terrible loading on much of the Continent, it can be impossible to avoid.

Experience has also taught DFS that in many ways driving freight through Europe is a very different experience to haulage in the UK. Apart from the need to get the dozens of different documents correct, a driver can easily be faced with unexpected bills.

Costs can be higher than expected, Mr Dowsett argued. For example, at present, where the pound is valued very low, such as in Germany, diesel prices are very high for British hauliers.

On a return trip to Milan, £150 has to be provided extra for road taxes and tunnels. On the other hand foreign hauliers entering Britain do not face the same penalty costs. British hauliers face "completely unfair competition", he said.

Even if the Greater London Council night and weekend ban for lorries over 16.5 tonnes goes ahead, he said, this would be yet another weighted cost against British international hauliers who had to operate through London.

"We must ask whether the UK is really competing with the EEC fairly." However, he admitted that DFS would not be affected by the ban its lorries would be using the M25.

A major problem which British hauliers also face is the lack of back loads. This is crucial to any operation, he said, but especially on the Continent with the longer distances run.

DFS had made contacts in Europe to alleviate the problem, but Mr Dowsett attacked British manufacturers and exporters for how they go about their business and jeopardise British hauliers' success. The whole set up is -excruciatingly painful" to see, he said.

The basic problem is that foreign exporters quote British buyers 'ex-works' prices, where the buyer pays total door-todoor costs. This leaves little room for back-loads to the UK, he said.

As a result DFS does not really bother with the French market because of the lack of backloads available and the low profit margins. "The French market is very much dominated by French hauliers, and the French forwarding agents have almost complete control," Mr Dowsett explained.

This situation is aggravated by the "very low" rates out of the UK to France. There is also a large imbalance in the volume of French freight coming into the UK relative to the small amount which goes to France.

Speaking for a French haulier in particular, Mr Dowsett said: "He'll get £700 from Paris to the UK, and maybe earn £300 on the way back" while a British haulier running from London to Paris can earn £300, will have to pay out £200 for the ferry and will have trouble finding a back load.

However, on a more optimistic note Mr Dowsett argued that there are large areas in Europe in which an efficient groupage operation cannot be bettered by other modes of transport.

Particularly for larger or less valuable consignments "within 1,000 miles road competes well with air. Within 500 miles it knocks spots off it." Road can give a second-day delivery from Manchester as far away as Northern Italy. In SOME cases if the consignment goes by air cargo, "It might not ever be out of Heathrow," he said.

To areas nearer home, liks North Germany, "air freigh• can't compete," he stated. B\ road there are faster clearance: generally "Germany is a fan tastic place for clearance" and its half-price to the cus tomer, he said.

At the same time cargo in handled around six times on an air journey while damage an delay is reduced with road which only touches the good: twice.

At the same time air freigh with its small loading capacity is unlikely to take any traffic from road in the future. "If airways did well they might take two per cent by putting on more services."

An end to the recession in haulage can be foreseen, he continued. But in the past three years many foreign and British hauliers have gone to the wall. With Europe broadly coming out of the recession "rates are distinctly hardening for international hauliers in contrast to national rates," he said.

In particular the Yugoslavian, Turkish and Italian markets seem to be showing most growth. In the longer term, increasing trade with the EEC, and Eastern bloc further liberalisation will Increase the rates and chances available to British hauliers.

Turning towards the other often competing section of the Dow Group – Dow Freight Forwarding, Mr Dowsett admitted that if DFF considered road to be the most effective way of transporting a customer's consignment to a particular place at a particular time, often it will use its sister company DFS. "We use each other quite a lot," but only if it is the most efficient way. I switched to hearing the praises of air freight when I spoke to DFF managing director Mike Evans. He said he works to give customers the best international freight service at the price they want. Certainly in

Western Europe at least road and air are "very much in direct competition."

However, he said that there are times when road is simply a lesser substitute for the job. Despite the appearance of the express hauliers to Europe, the airlines have not suffered a "vast drop" in freight business. Many customers have been loyal to the airlines and for good reason. Air freight is at its best for high-value consignments up to around 80kg, he said -and that is to any destination near or far. Hauliers have to apply minimum charges on a consignment whatever its size, but for anything up to 80kg airlines will be able to largely eradicate this problem for the customer.

For urgency, air freight is still the best, Mr Evans said. If a spare part is needed urgently it is superior, he thought, "and consignments can be intercepted and obtained within hours".

The long delays in last year's industrial disputes have given air an edge, he pointed out. The lorry blockades and port disputes had been a bonus for air, although no great amount of long-term business had been gained, it was admitted. Air is also more beneficial in avoiding the delays which lorries in parts of Europe face because they are unable to travel on Sundays.

But Mr Evans readily conceded that road freight to the Continent is a major competitive force and improving. The airlines are still dogged with delays at airports he said, and are trying to improve largely by improving their present systems.