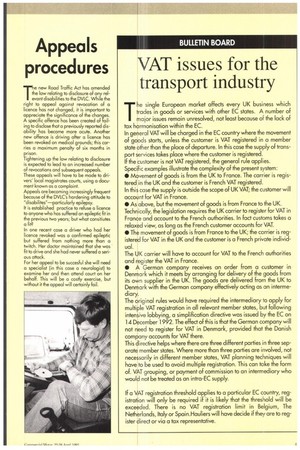

VAT issues for the transport industry

Page 43

If you've noticed an error in this article please click here to report it so we can fix it.

The single European market affects every UK business which trades in goods or services with other EC states. A number of major issues remain unresolved, not least because of the lack of tax harmonisation within the EC.

In general VAT will be charged in the EC country where the movement of goods starts, unless the customer is VAT registered in a member state other than the place of departure. ln this case the supply of transport services takes place where the customer is registered. If the customer is not VAT registered, the general rule applies.

Specific examples illustrate the complexity of the present system: • Movement of goods is from the UK to France. The carrier is registered in the UK and the customer is French VAT registered.

In this case the supply is outside the scope of UK VAT; the customer will account for VAT in France.

• As above, but the movement of goods is from France to the UK. Technically, the legislation requires the UK carrier to register for VAT in France and account to the French authorities. In fact customs takes a relaxed view, as long as the French customer accounts for VAT.

• The movement of goods is from France to the UK; the carrier is registered for VAT in the UK and the customer is a French private individual.

The UK carrier will have to account for VAT to the French authorities and register the VAT in France. • A German company receives an order from a customer in Denmark which it meets by arranging for delivery of the goods from its own supplier in the UK. The goods are delivered from the UK to Denmark with the German company effectively acting as an intermediary. The original rules would have required the intermediary to apply for multiple VAT registration in all relevant member states, but following intensive lobbying, a simplification directive was issued by the EC on 14 December 1992. The effect of this is that the German company will not need to register for VAT in Denmark, provided that the Danish company accounts for VAT there. This directive helps where there are three different parties in three separate member states. Where more than three parties are involved, not necessarily in different member states, VAT planning techniques will have to be used to avoid multiple registration. This can take the form of. VAT grouping, or payment of commission to an intermediary who would not be treated as an intra-EC supply.

If a VAT registration threshold applies to a particular EC country, registration will only be required if it is likely that the threshold will be exceeded. There is no VAT registration limit in Belgium, The Netherlands, Italy or Spain.Hauliers will have decide if they are to register direct or via a tax representative.