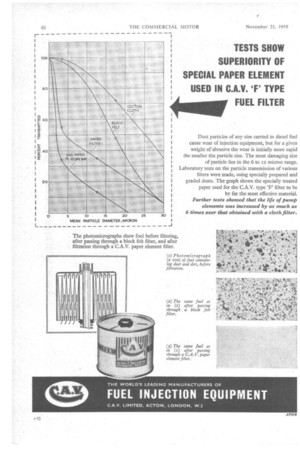

TESTS SHOW SUPERIORITY OF SPECIAL PAPER ELEMENT USED IN C.A.V. 'F' TYPE FUEL FILTER

Page 70

Page 71

If you've noticed an error in this article please click here to report it so we can fix it.

Dust particles of any size carried in diesel fuel cause wear of injection equipment, but for a given weight of abrasive the wear is initially more rapid the smaller the particle size. The most damaging size of particle lies in the 6 to 12 micron range. Laboratory tests on the particle transmission of various filters were made, using specially prepared and graded dusts. The graph shows the specially treated paper used for the C.A.V. type 'F' filter to be by far the most effective material. Further tests showed that the life of pump elements was increased by as much as 6 times over that obtained with a cloth filter.

accumulated towards the second set of tyres will remain with the operator, hence the lower cost per mile in these circumstances.

Similarly, maintenance costs per mile will also be reduced. The previous figure of 3.01d. per mile met not only the cost of weekly servicing, minor repairs and replacements, but also major repairs when they became due. As with tyres, the cost of major repairs was not, in fact, incurred week by week, but was provided for when the occasion arose. As the vehicle is to be replaced after 12 months, the original operator is not responsible for meeting long-term overhauls and the maintenance cost per mile is therefore reduced to 2.07d.

Special Treatment for Depreciation

The calculation of depreciation also needs special treatment and is an item in which there may well be wide variations, because of the prevailing supply of and demand for used vehicles in any particular area. With an initial cost price of £1,250 it will be arbitrarily assumed that £850 could be obtained on resale after 12 months' operation. Unlike the previous method of calculation, the cost of a set of tyres is not deducted, as they have received special treatment in the item of tyre cost. The balance of £400 depreciated over 25,000 miles gives a cost per mile of 3.84d.

These five items of running costs, therefore, total 12.68d. per mile, with a total operating cost per mile of 18.19d. In both cases they are almost identical to the corresponding costs when the vehicle is replaced at five-yearly intervals.

Last week I mentioned that a haulier in the eastern counties had found it worth his while to replace even the heavier class of vehicle every 18 months, partly because of his remoteness from adequate service facilities. The type of vehicle he operated was an 8-ton four-wheeled oiler priced at around £2,750.

Costs for 8-tonner

With an unladen weight of 3 tons 18 cwt., the annual Excise licence would cost £50, or £1 per week. Weekly wages in accordance with R.H.(64). Grade 1, amount to £9 6s. 3d., after allowance has been made for holidays with pay and insurance contributions. Rent and rates are reckoned at II s. per week. The annual insurance premium, calculated as applicable to A-licence operators, for comprehensive cover in a medium-risk area, becomes £136 10s., or £2 14s. 5d. per week.

Interest at the same rate of 3 per cent, adds a further £1 13s. to the standing costs, giving a total of £15 4s. 8d. As this class of vehicle would normally be expected to operate on longdistance runs, the weekly average mileage will be assessed at 1,000, giving a standing cost per mile of 3.66d.

The first item of running costs—fuel—is reckoned at 3.07d. per mile oil a consumption rate of 15 m.p.g. and bulk price of 3s. 10d. per gallon. Lubricants are reckoned at 0.26d. per mile.

Operating under better conditions than the previous example. mileage life per set of tyres can be expected to reach 30,000, although the cost will naturally be increased—to £250. The tyre cost per mile thus becomes 2d., whilst maintenance is reckoned at 2.28d. per mile.

Deducting, as normally, the cost of the initial set of tyres from the price of the vehicle, together with an estimated residual value of 10 per cent., leaves a balance of £2,225 to be written off. Assuming, as before, a vehicle life of five years, this amount will now be depreciated over 250,000 miles, giving a cost per mile of 2.13d. Running costs per mile thus total 9.74d.. which, when added to the standing costs, gives a total operating cost of 13,40d.

Changing the vehicle every 18 months, the mileage life while in the first operator's possession would be 75,000. The five items of standing costs will remain the same, giving a total of £15 4s. 8d. Running costs relating to fuel and lubricants will also be unchanged.

With a mileage life of 30,000 per set of tyres, the first operator would have to purchase two sets, in addition to the initial equipment, during the period of 18 months. These would cost him a total of £500, giving a tyre cost of 1.60d. per mile when the total vehicle mileage was 75,000.

Maintenance Expenses Lower

For the same reason as before, maintenance costs will again be lower at 1.14d, per mile. The increased proportion in the reduction of this item, as compared with the previous example, is considered justified because no exceptional conditions of operation are expected.

Assuming the vehicle is sold for £1,500 after 18 months, the resulting balance of £1,250 depreciated over 75,000 miles gives a depreciation cost per mile of 4d. Running costs total 10.07d. and operating costs 13.73d. per mile. There is thus an increase of 0.33d. per mile compared with the corresponding estimated cost per mile when the vehicle is replaced at 250,000 miles.

• As emphasized last week, no standard formula is available ready-made to enable the precise stage at which it is most economic to replace vehicles to be determined. In differing circumstances, well-established operators adopt policies of both shortand long-term replacement with apparently equal success. Yet to apply similar policies when circumstances were unsuitable could prove most unprofitable. Correct assessment based on prior comparison of estimates, as suggested here (but with details of the 10 items of costs adjusted to individual needs), would avoid the expense of trial-and-error methods. Quantity production manufacture has, however, increased the opportunities of frequent, yet economic, replacement. S.B.