In the first of a new series in which CM

Page 32

Page 33

If you've noticed an error in this article please click here to report it so we can fix it.

will examine how the UK's largest haulage companies operate, Miles Brignall puts Tibbett & Britten under the spotlight.

n an age when most hauliers plaster their names across every truck, there are still some operators going about their business without any fuss. In many ways Tibbett & Britten is one of the unsung heroes of British retailing, but unless you read the Financial Times you won't have seen much about the company recently—certainly not in the pages of CM—which indicates that it is simply taking care of business.

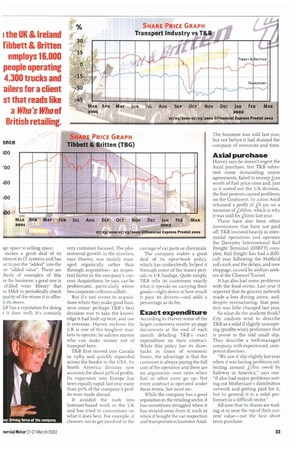

In fact T&B is the second largest transport company quoted on the London Stock Exchange— headed only by Exel and well ahead of rivals such as Christian Salvesen, TDG and Wincanton.

In the UK & Ireland the firm employs 16,000 people operating 4,300 trucks and trailers for a client list that reads like a Who's Who of British retailing. Globally the company has a workforce of 33,000 with moo° trucks.

In 1958 John Tibbett and Frank Britten set up the first company to transport garments on hangers and press them before delivery. By 1973 the firm had expanded into Ireland, more importantly, it had won its first contract with Marks & Spencer. Its first major contract outside the rag trade was awarded by IBM in 1986—the same year the group floated o the London stock exchange.

An impressive record, In steady growth transformed int explosive expansion through th nineties as T&B won busine5 throughout Europe, Nort America and, eventually, the re: of the world. Between 1990 an z000 turnover increased almo! tenfold, from £156m t ii,5o7m—a remarkable recor by any standards. More than ha T&B's income is now generate outside the UK.

Company chairman Joh. Harvey joined the firm in 195, and led its management buyou in 1984. Chief Executive Office Mike Arrowsmith handles th day-to-day running of the grout but at 66, logistics expert Harve is still the driving force.

The company was in the righ place at the right time to help cre ate the retailing revolution of th, past zo years. It made its nam, offering transport and warehous ing for most of the major high street retailers and was at the fore front of the growth of just-in-timi deliveries that allowed shops n reduce their stock levels and tun

ige space to selling space. makes a great deal of its stment in IT systems and has ut to put the "added" into the se "added value". There are ireds of examples of this ss the business; a good one is chilled wine 'library' that vs M&S to periodically check juality of the wines it is offerflits stores.

has a reputation for doing tii does well; it's certainly very customer focused. The phenomenal growth in the nineties, says Harvey, was mainly managed organically rather than through acquisition—an important factor in the company's success. Acquisitions, he says, can be problematic, particularly where two corporate cultures collide.

But it's not averse to acquisitions where they make good business sense: perhaps T&B's best decision was to take the knowledge it had built up here, and use it overseas. Harvey reckons the UK is one of the toughest markets to operate; he salutes anyone who can make money out of transport here.

T&B first moved into Canada in 1989 and quickly expanded across the border to the USA. Its North America division now accounts for about 30% of profits. Its expansion into Europe has been equally rapid; last year more than 50% of the company's profits were made abroad.

It avoided the rush into lntemet-based work in the UK and has tried to concentrate on what it does best. For example, it chooses not to get involved in the

carriage of car parts or chemicals.

The company makes a great deal of its open-book policy, which has undoubtedly helped it through some of the leaner periods in UK haulage. Quite simply, T&B tells its customers exactly what it spends on carrying their goods—right down to how much it pays its drivers—and adds a percentage as its fee.

Exact expenditure

According to Harvey some of the larger customers receive 50-page documents at the end of each month detailing T&B's exact expenditure on their contract. While this policy has its drawbacks in times of economic boom, the advantage is that the customer is always paying the full cost of the operation and there are no arguments over rates when fuel or other costs go up. Not every contract is operated under these terms, but most are.

While the company has a good reputation in the retailing sector, it has sometimes struggled when it has strayed away from it, such as when it bought the car inspection and transportation business Axial. The business was sold last year, but not before it had drained the company of resources and time.

Axial purchase

Harvey says he doesn't regret the Axial purchase, but T&B inherited some demanding union agreements, failed to recoup fim worth of fuel price rises and, just as it sorted out the UK division, the fuel protests caused problems on the Continent. In 2000 Axial returned a profit of ki.5m on a turnover of 116 6m, which is why it was sold for /6 om last year.

There have also been other investments that have not paid off. T&B invested heavily in intermodal operations and operates the Daventry International Rail Freight Terminal (DIRFT) complex. Rail freight has had a difficult year following the Hatfield rail crash and the delays, and now stoppage, caused by asylum seekers at the Channel Tunnel.

It has also had some problems with the food sector. Last year it reported that its grocery network made a loss during z000, and, despite restructuring, that position was little changed last year.

So what do the analysts think? City analysts tend to describe T&B as a solid if slightly uninspiring (profits-wise) performer that is prone to the odd small slip. They describe a well-managed company, with experienced, competent directors.

"We saw it slip slightly last year when it was having problems collecting around f18m owed by Safeway in America," says one. "11 also had major problems sorting out Mothercare's distribution network and getting paid for it, but in general it is a solid performer in a difficult sector."

All note that its shares are trading at or near the top of their current value—not the best short term purchase.