EMPTY SEATS ON ME :ANDWAGON

Page 33

Page 34

Page 35

If you've noticed an error in this article please click here to report it so we can fix it.

No domino effect has followed from Texaco's switch to contract hire. Tim Blakemore, investigates why other oil companies retain their own fleets

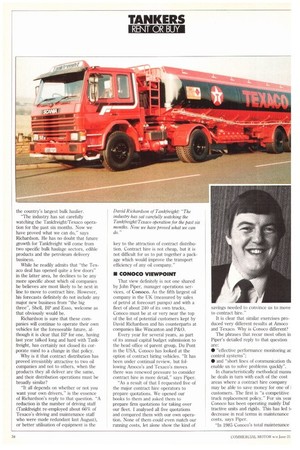

Had it been Texaco's intention to be ked about in the board rooms of rival companies, it could hardly have chosen nore effective means than last year's cision to hand over responsibility for its tire road distribution operation to .nkfreight, the National Freight Consorrn bulk haulage subsidiary. Some puns saw the move, which followed hard Wincanton's winning of a major ntract from Amoco, as signalling the irt of a large-scale trend towards ntract distribution in the whole oil instry. In the event that has not hapned.

One man who might be expected to ire been surprised and disappointed at !. absence so far of any domino effect, is David Richardson, Tankfreight's marketing and sales director. On the contrary, while he is not at all surprised, he is evidently well satisfied with his company's general growth over the past 12 months, which has taken it to the position where, with 850 vehicles (the Texaco contract involves 250) it can claim to be the country's largest bulk haulier.

"The industry has sat carefully watching the Tankfreight/Texaco operation for the past six months. Now we have proved what we can do," says Richardson. He has no doubt that future growth for Tankfreight will come from two specific bulk haulage sectors, edible products and the petroleum delivery business.

While he readily admits that "the Texaco deal has opened quite a few doors" in the latter area, he declines to be any more specific about which oil companies he believes are most likely to be next in line to move to contract hire. However, his forecasts definitely do not include any major new business from the big three", Shell, BP and Esso, welcome as that obviously would be.

Richardson is sure that these companies will continue to operate their own vehicles for the foreseeable future, although it is clear that BP for one, having last year talked long and hard with Tankfreight, has certainly not closed its corporate mind to a change in that policy.

Why is it that contract distribution has proved irresistibly attractive to two oil companies and not to others, when the products they all deliver are the same, and their distribution operations must be broadly similar?

"It all depends on whether or not you want your own drivers," is the essence of Richardson's reply to that question. "A reduction in the number of driving staff (Tankfreight re-employed about 66% of Texaco's driving and maintenance staff who were made redundant last August), or better utilisation of equipment is the key to the attraction of contract distribution. Contract hire is not cheap, but it is not difficult for us to put together a package which would improve the transport efficiency of any oil company."

• CONOCO VIEWPOINT That view definitely is not one shared by John Piper, manager operations services, of Conoco. As the fifth largest oil company in the UK (measured by sales of petrol at forecourt pumps) and with a fleet of about 240 of its own trucks, Conoco must be at or very near the top of the list of potential customers kept by David Richardson and his counterparts at companies like Wincanton and P&O.

Every year for several years, as part of its annual capital budget submission to the head office of parent group, Du Pont in the USA, Conoco has looked at the option of contract hiring vehicles. It has been under continual review, but following Amoco's and Texaco's moves there was renewed pressure to consider contract hire in more detail," says Piper.

"As a result of that I requested five of the major contract hire operators to prepare quotations. We opened our books to them and asked them to prepare firm quotations for taking over our fleet. I analysed all five quotations and compared them with our own operation. None of them could even match our running costs, let alone show the kind of savings needed to convince us to move to contract hire."

It is clear that similar exercises produced very different results at Amoco and Texaco. Why is Conoco different?

The phrases that recur most often in Piper's detailed reply to that question are: • "effective performance monitoring ar control systems"; • and "short lines of communication th enable us to solve problems quickly".

In characteristically methodical mann( he deals in turn with each of the cost areas where a contract hire company may be able to save money for one of customers. The first is "a competitive truck replacement policy." For six yeat Conoco has been operating mainly Daf tractive units and rigids. This has led t, decrease in real terms in maintenance costs, says Piper.

"In 1985 Conoco's total maintenance

11 was only 2% more than it was in )80. In the same five-year period the PI has increased by 40%" he explains. Conoco has 21 depots in the UK. Ten these have their own workshop and ,ur have their vehicles maintained under ars repair and maintenance contract. [hat gives us one important control and onitoring system," says Piper. "We can A objectives for our own transport engi:ers. To remain competitive they have I maintain their vehicles at the same )st per kilometre, or preferably lower, on the cost of Daf's R and M contract." On initial or "front-end price" of .hicles, Piper says that "none of the Nitract hire companies could give us any ore competitive terms on buying hicles than we already get from the anufacturers."

Similarly, they could do nothing on de'eciation, by extending vehicle life. onoco already works on an eight-year truck life. Texaco's contract with Tankfreight is initially for six years, which is linked to Tankfreight's policy of threeyear buy-back deals with the manufacturers of its tractive units.

Turning to driver productivity, the factor which had played such an important part in the TanIcfreightflexaco contract, Piper says that Conoco "has not had the same problems as some other oil companies. Yes, of course, we occasionally have industrial relations problems, but our short lines of communication help us to solve them quickly." He is full of praise for the "tremendous co-operation" given by Conoco drivers in the company's annual review of its individual driver productivity scheme.

He believes there is a clear link between driver productivity and market share among oil companies. "Our sales volumes are increasing rapidly, so is our productivity. The oil companies which have gone to contract hire are in the opposite position, with static productivity and declining market share."

Conoco's information on individual vehicle and driver costs comes from a computerised costing system with software, a modified version of Microdrive, supplied by Freight Computer Services. Piper says that the contract hire companies which recently submitted quotations to him were "astounded with the level of detailed costing information this gives us on the performance of trucks and drivers. It seems, surprisingly, that many of our competitors do not have such information available to them."

The evidence provided by the FCS system and the contract hire company quotation exercise would seem to give Conoco a watertight case currently for owning and running its own vehicles in preference to contract hiring them. Not quite watertight enough for an ever-cau, tious transport engineer like John Piper who values practical experience with vehicles and systems in his own fleet above any other kind of evidence.

His ultimate "monitoring and control system" is that 12 of Conoco's trucks, based at a depot in Scotland, are not owned by the company but contract hired. Should the day ever come when their running costs become lower than those of owned trucks, then a change of Conoco policy is likely soon to follow.

The subject of safety is never far from the thoughts of any fleet manager in the oil and petroleum industry. The signs of a trend towards contract hire has raised questions in some people's minds about what effect it may have on safety standards. John Piper is among them.

He is certainly not about to suggest that contract hired tankers are less safe than owned ones, but he does express concern about the possible tong-term effect of any major shift to contract hiring on the current self-enforced safety standards and in particular on the training of engineers to maintain those standards. He refers specifically to the Institute of Petroleum's Panel C, "a body of engineers from petroleum companies which meets to draw up codes of practice on subjects like vehicle and workshop design." This panel has recently produced a code of practice on the topical subject of bottom-loading and vapour recovery. "Who would do this if the panel no longer existed?" asks Piper. Not surprisingly, David Richardson strongly refutes any suggestion of a trend towards contract hiring of tankers having any detrimental effect on safety standards.

"Our safety standards are the highest in the industry," he asserts. "We are very experienced in moving nasty products around. We are not asking anyone to cut corners on safety."