MADE N AMER CA

Page 82

Page 83

Page 84

Page 85

If you've noticed an error in this article please click here to report it so we can fix it.

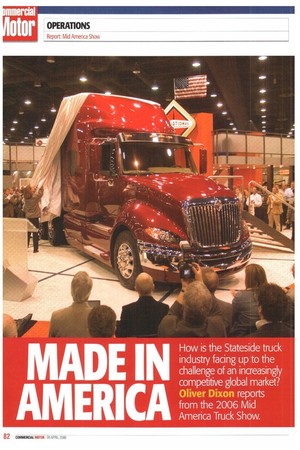

How is the Stateside truck industry facing up to the challenge of an increasingly competitive global market?

Oliver Dixon reports from the 2006 Mid America Truck Show.

lice upon a time, the CV world was a fractured and disjointed place. The Europeans did their thing; the Americans did something else. And everyone else got on with the business of making trucks.

Then came globalisation.The Europeans bought up most of the US truck-building business; the Americans returned the compliment by buying a bit of Europe. Deals were done with the Japanese and the Indians; China, the sleeping giant, awoke and stretched.

It's this notion of a single, fast-globalising industry that you have to keep in mind on entering the Louisville Fairground for the 2006 Mid America Truck Show. Sure, US trucks are still American,but increasingly they are merely the local manifestation of a global product.

Just as UK operators are snapping up Euro-3 trucks ahead of Euro-4, their US counterparts are eager to buy new vehicles ahead of stricter emissions limits that arrive next year. Sales of Class 8 trucks (LGVs with fewer than five axles) are booming and the Louisville site was packed with debutantes as manufacturers vied for a share of the action.

International unveiled the ProStar series; the first addition to its Class 8 line-up for over six years.The new range will be made available in four guises: the entry-level ProStar; the Premium; the Eagle; and the top-of-the-line ProStar Limited. Due to enter full-scale production in 2007, the ProStar range will replace International's 9400 Series.A shorter model due in 2008 will replace the 9200 series.

ProStar cost $300m -Ibm Baughman, International's vice-president and general manager of the heavy truck di vision,says the Prostar represents five years of work and a $300m investment. But it also represents something else, International/Navistar is one of the few nonaligned truck makers left in the US.A series of joint ventures and acquisitions, including tieups with MAN in Europe. Mahinclra in India and MWM in South America, has given it what amounts to global coverage so it is developing a global range. For example, the new MaxxForce engine range will eventually extend from a 2.8-litre straight four to products in the 11-13-litre class.

In time these will be approved for markets including Europe.This is hardly surprising, given the MAN connection. But that link raises questions about International's relationship with lveco, Paccar has plenty to smile about at present: its Kenworth subsidiary was at Louisville to launch the T660. Ken worth general manager Bob Christensen was keen to talk about its improved aerodynamics, fuel economy and driver comfort. Chief engineer Mike Dozier reported that theT660's halogen projector headlamps provide 40% more light than a sealed beam and last three times longer.But the T660 will only be available in 07 emissions guise, ramping up the price by a cool $10,000.

Peterbilt, another Paccar division, was not to be outdone. It showed a line-up of new and re-skinned trucks, including day-cabbed variants of the 387 and 384;a traditionally styled 389 and a 388, which will eventually replace the venerable 379. "Ibis is a landmark occasion for Peterbilt,' said general manager Dan Sobie."Our new line-up of premium trucks is the best we've ever offered, setting new standards for quality, innovation, technology, versatility and styling."

But what of Paccar as a whole? The wait for the MX range proved fruitless; we're now meant to be backing the debut of the Euro pean engine for EPA 10. But there were some PO' signs of European influence —notably an LF in Kenworth colours and a 8x4 leviathan with an XF 95 cab and a serious attitude.This, it seems. is destined for the Chinese market.

We say we are meant Lobe backing the arrival of the MX range for EPA .10.We're not we think it's going to arrive before then, most probably next year in time for EPA 07.

At one level, both Paccar brands were closer than we have seen before at a trade show. Usually both Kenworth and Peterbilt have clearly defined, very separate identities.This year, they were separated by a filing cabinet representing Paccar's spare parts business.

But more significantly, neither brand displayed an engine option —no Cat, no Cummins, no nothing. Not even a DPF We have a sneaking suspicion that Paccar is getting ready to offer the MX very hard in both Peterhilt and Kenworth brands, and isn't quite ready to scare the natives with this shift. And by natives, we mean both customers and suppliers. EPA 07 compliance is now the big issue in the U.S truck market, and to not demonstrate a route to that compliance suggests either a massive oversight — unlikely with Paccar— or something up its sleeve.

Sweden to Kentucky Also from Europe came Volvo's latest offerings, the VN730 and VT830, which are mid-roofed versions of the VN and VT The cabs are some 60Ornm shorter than current fullsized models but they feature a standard 270mm-wide lower bunk with a folding workstation and an upper bunk;or buyers can opt for a full-size lower bunk and storage on the upper rear wall .Both models come with a Volvo 1)12 engine as standard, but the VT830 also can be ordered with the D16.

When I-Shift finally makes the Atlantic crossing it might only be offered with a Volvo engine up front. Given that Volvo is already differentiating on warranty between its own engines and proprietary alternatives.This move, if it happens, will be one more nail in the coffin of the US assembly culture.

North America is a big deal for Daimler Chrysler. It claims to be the world's biggest CV manufacturer, and Freightliner is the biggest fish in the biggest CV basket. Hence the arrival of Andreas Renschler, the big boss, to tell all at the Mid America show.

In truth,'all' isn't very much, at least from a product perspective. We were cordially invited to return next year for the unveiling of a new Class 8 range, but for Freightliner about the only news this year was the launch of rackand-pinion steering on a couple of models.

Western Star showed off its 07 chassis, complete with Stratosphere sleeper. while Sterling gave another unveiling to the diminutive 360 model it developed in collaboration with Fuso.

Not only did Freightliner fail to launch anything new, it actually reduced its domestic range with the news that the Argosy will no longer be offered to US customers. It will continue to be manufactured for export (Australia, New Zealand. South Africa and Chile are all Argosy users) but the US market seems to have ended its fleeting dalliance with cabovers and is once again firmly entrenched in bonneted ('conventional') territory.

Not many years ago,plans to bring the Argosy to Europe caused a certain nervousness, a lot of phone calls and one or two plane rides on the part of M-B executives.That threat's long gone but DairnlerChrysler did have something to talk about in Louisville: its Global Excellence programme that is designed to draw together the strands of its global CV business. A global axle already exists,as do transatlantic transmissions. But the big one is the engine. HDEP (Heavy-Duty Engine Platform) is the cornerstone of this strategy, and its impact is likely to be felt worldwide.

Launching in 2007 in the US and 2009 in Europe,LIDEP is a core engine to which a range of after-treatment systems can be added to ensure emissions compliance with local emissions limits, For a while, it will run in parallel with existing DC products (for example,DC's Series 60 will be run out in markets such as Australia) bin HDEP is very much the unified future for DaimlerChrysler's CV operations worldwide.

HDEP is expected to rely on EGR with SCR after-treatment to meet EPA 10 in the US, where the Stateside Environmental Protection Agency seems to have accepted SCR as a viable system for 2010.This will make life a whole lot easier for the manufacturers— but it might also do terminal damage to the leading engine suppliers.

And it could cause something °fa bloodbath between Freightliner et al and the M-B car business in the US.According to Freightliner CEO Chris Patterson, BlueTec is a"brand with leg" which, presumably,means that he'd like to use it on his trucks. How this will play with a passenger-car division that hasjust launched BlueTec as a premium brand for its S and E-class cars in the l IS remains to be seen, but we suspect there will be some pouting.

So what's to become of the major engine suppliers? Cummins was keeping quiet. It has taken the I SX to a 600hp output and that's about it.C'aterpillar, on the other hand. was shouting from the rooftops.

Caterpillar's ACE RI system is based on EGR with complications. It takes exhaust gas from beyond the diesel particulate filter and re-injects it,rather than taking from just beyond the mani fold.This, Cat asserts, is a good thing, because it involves "cool,clean air". The news that piston rings wear out is not exactly the stuff of panicked newsrooms. But, in the world of C.at,conven don al EGR is a disaster waiting to happen.Without the cool clean air, it seems, we're all doomed.... and so on. After about an hour of this, we were unsure whether we were listening loan engine presentation, a revivalist meeting or a sales pitch for janitorial products. It's just a step from "cool,clean air" to "fresh as a mountain breeze", and ACERI. is either going to work or it isn't. It seems a complex solution to a problem that mayor may not exist.

Cat stalks Europe

This isn't just an American issue — ACERT is Euro-4 and Euro-5 compliant and Cat is said to be talking to European manufacturers and your trucks are within its sights.

This is set to be a big year for the US truck industry but some pundits predict that the peak will be followed by a trough in 2007.-We believe there will be as much as a 40% dropoff in business, and, operationally, we're planning on a 50% drop-off," said Joe McAleese, president and CEO of Bendix Commercial Vehicle Systems.

The US truck market is cyclical and the manufacturers have to deal with this. Accordi lig to many industry insiders these peaks and [roughs are flattening out, but they still exist. The challenge is to make enough trucks when people want them... and to leave well alone when they don't. Al the same time, globalisation is gathering pace, and the US market — in many ways the most staid and traditional on earth —will have to come to terms with this.

The coming years may well see US truck operators being dragged into the 21st century whether they like it or not.Their suppliers are now playing a bigger global game, and the truth seems to be that there is little space, and even less sympathy for a market that wants to stay where it was a decade ago. •