FOOD FOR THOUGHT

Page 57

Page 58

If you've noticed an error in this article please click here to report it so we can fix it.

Robbie Bums is taking over as NFC Distribution Group's managing director. We have been to talk to him about how his company, and his industry, are gearing up for a busy future.

• Once a year, a group of publicans in the South East receive a MORI poll questionnaire. They are not asked who they will be voting for in the next General Election; they are asked how well they think their distribution delivery company is performing. They ponder burning questions such as: "Are your crisps and pork scratchings arriving on time, and in an acceptable condition?"

It is quality control with a difference. Neither the brewery concerned, Whitbread, nor the transport company, NFC Distribution, have any control over the annual assessment. Both companies want — and get — a totally objective view of what is going on.

PUB SUPPLY

For Robbie Burns, who takes over as the new managing director of NFC Distribution this month, the whole exercise is just one more way in which his company can persuade and assure customers that contract distribution works. NFC Distribution and Whitbread have a joint board of directors to run the pub supply company, called Bar Delivery Services, and there appears to be nothing "standard" about the operation.

"I think that there is a growing need in our business for set-ups like Bar Delivery Services," says Burns. "We must clearly define the rules and our performance properly. Distribution managers must not be afraid to look at how well they are doing, and question whether or not their people have been trained and developed properly." Burns approves of bonuses and penalty clauses for overand underachievers — and he is prepared to put his money where his mouth is.

NFC Distribution is continuing to grow within the mighty ranks of the NFC." It has been earmarked as one of the consortium's most promising growth areas, both in terms of organic and acquisitive development. Burns obviously relishes the challenge of pulling the distribution group together: "We're a relatively new group in the NFC," he says. "In effect, we're only two years old. We were basically put together when the group merged its ongoing distribution activities with SPD, which it acquired from Unilever two years ago."

There are now two arms to the NFC Distribution group: dedicated distribution operation, called Dedicated Contract Distribution, and a shared resources operation called SPD. "The first 18 months were a formative stage for us, I think, when we had to sort things and people out," says Burns. That melting pot was further complicated by a new round of acquisitions.

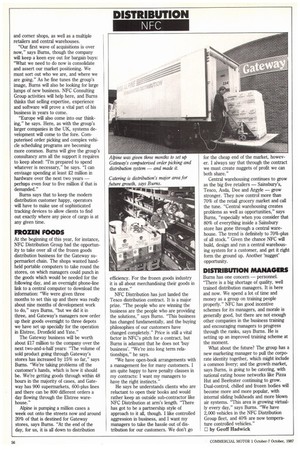

A refrigerated distribution company called Alpine was bought in October 1986, followed by all of Birds Eye Walls' distribution activities. The two reefer operations were quickly merged into one, called Alpine Refrigerated Distribution, and that operation now has three major contracts: Lyons Maid, Birds Eye Walls and Findus. Next into the fold came NFC group member GDL, which has traditionally been confectionery-based and is centred around confectioners, tobacconists and newsagents.

GDL is now being strategically repositioned by NFC to cover as many "allied grocery products as possible", such as nappies (it already distributes for Peaudouce and Robinsons of Chesterfield), biscuits and firms like Filofax. Logistically this is an extremely complicated part of the distribution market to serve. The company has to distribute to rapid replenishment and small consignment outlets such as convenience stores and corner shops, as well as a multiple retailers and central warehouses.

"Our first wave of acquisitions is over now," says Burns, though the company will keep a keen eye out for bargain buys: "What we need to do now is consolidate and assert our market positioning. We must sort out who we are, and where we are going." As he fine tunes the group's image, Burns will also be looking for large lumps of new business. NFC Consulting Group activities will help here, and Burns thinks that selling expertise, experience and software will prove a vital part of his business in years to come.

"Europe will also come into our thinking," he says. Here, as with the group's larger companies in the UK, systems development will come to the fore. Cornputerised order picking and complex vehicle scheduling programs are becoming more common. Burns will give the group's consultancy arm all the support it requires to keep ahead: "I'm prepared to spend whatever is necessary," he says. "I can envisage spending at least £2 million in hardware over the next two years — perhaps even four to five million if that is demanded."

Burns says that to keep the modern distribution customer happy, operators will have to make use of sophisticated tracking devices to allow clients to find out exactly where any piece of cargo is at any given time.

FROZEN FOODS

At the beginning of this year, for instance, NFC Distribution Group had the opportunity to take over all of the frozen goods distribution business for the Gateway supermarket chain. The shops wanted handheld portable computers to take round the stores, on which managers could punch in the goods which would be needed for the following day, and an overnight phone-line link to a central computer to download the information: "We were given three months to set this up and there was really about nine months of development work to do," says Burns, "but we did it in three, and Gateway's managers now order up their goods overnight to three depots we have set up specially for the operation in Elstree, Dronfield and Yate."

The Gateway business will be worth about £17 million to the company over the next two-and-a-half years: "The volume of sold product going through Gateway's stores has increased by 15% so far," says Burns. "We're taking problems off the customer's hands, which is how it should be. We're getting goods through within 48 hours in the majority of cases, and Gateway has 900 supermarkets, 600-plus lines and there can be 800 different orders a day flowing through the Elstree warehouse."

Alpine is pumping a million cases a week out onto the streets now and around 20% of that is destined for Gateway stores, says Burns. "At the end of the day, for us, it is all down to distribution efficiency. For the frozen goods industry it is all about merchandising their goods in the store."

NFC Distribution has just landed the Tesco distribution contract. It is a major prize. "The people who are winning the business are the people who are providing the solutions," says Burns. "This business has changed fundamentally, and the buying philosophies of our customers have changed completely." Price is still a vital factor in NFC's pitch for a contract, but Burns is adamant that he does not 'buy business'. "We're into long term relationships," he says.

"We have open-book arrangements with a management fee for many customers. I am quite happy to have penalty clauses in my contracts: I want my managers to have the right instincts."

He says he understands clients who are reluctant to open their books and would rather keep an outside sub-contractor like NFC Distribution at arm's length. "There has got to be a partnership style of approach to it all, though. I like controlled aggression in business, and I want my managers to take the hassle out of distribution for our customers. We don't go for the cheap end of the market, however. I always say that through the contract we must create nuggets of profit we can both share."

Central warehousing continues to grow as the big five retailers — Sainsbury's, Tesco, Asda, Dee and Argyle — grow stronger. They now control more than 70% of the retail grocery market and call the tune. "Central warehousing creates problems as well as opportunities," says Bums, "especially when you consider that 80% of everything inside a Sainsbury store has gone through a central warehouse. The trend is definitely to 70%-plus of all stock." Given the chance NFC will build, design and run a central warehousing system for a customer, and get it right form the ground up. Another 'nugget' opportunity.

DISTRIBUTION MANAGERS

Burns has one concern — personnel. "There is a big shortage of quality, well trained distribution managers. It is here and now. We spend a lot of time and money as a group on training people properly." NFC has good incentive schemes for its managers, and morale is generally good, but there are not enough other companies in the business training and encouraging managers to progress through the ranks, says Burns. He is setting up an improved training scheme at the moment.

What about the future? The group has a new marketing manager to pull the corporate identity together, which might include a common livery; and the growth market, says Burns, is going to be catering, with national eating house networks like Pizza Hut and Beefeater continuing to grow. Dual-control, chilled and frozen bodies will become more and more popular, with internal sliding bulkheads and more blown air systems. "This area is growing virtually every day," says Burns. "We have 2,000 vehicles in the NFC Distribution Group fleet, and 40% are now temperature controlled vehicles."

E by Geoff Hadwick