Fleets are switching to LPG gas

Page 46

If you've noticed an error in this article please click here to report it so we can fix it.

Double excise duty is likely to be the only tax penalty

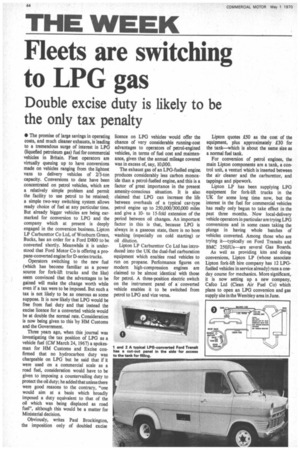

• The promise of large savings in operating costs, and much cleaner exhausts, is leading to a tremendous surge of interest in LPG (liquefied petroleum gas) fuel for commercial vehicles in Britain. Fleet operators are virtually queuing up to have conversions made on vehicles ranging from the lightest vans to delivery vehicles of 2/3-ton capacity. Conversions to date have been concentrated on petrol vehicles, which are a relatively simple problem and permit the facility to use petrol to be retained; a simple two-way switching system allows ready choice of fuel at any particular time. But already bigger vehicles are being earmarked for conversion to LPG and the company which at present is deeply engaged in the conversion business, Lipton LP Carburettor Co Ltd, of Woobum Green, Bucks, has an order for a Ford D800 to be converted shortly. Meanwhile it is understood that Ford Motor Co is offering a propane-converted engine for D-series trucks.

Operators switching to the new fuel (which has become familiar as a power source for fork-lift trucks and the like) seem convinced that the advantages to be gained will make the change worth while even if a tax were to be imposed. But such a tax is not likely to be as onerous as some suppose. It is now likely that LPG would be free from fuel duty and that instead the excise licence for a converted vehicle would be at double the normal rate. Consideration is now being given to this by HM Customs and the Government.

Three years ago, when this journal was investigating the tax position of LPG as a vehicle fuel (CM March 24, 1967) a spokesman for HM Customs and Excise confirmed that no hydrocarbon duty was chargeable on LPG but he said that if it were used on a commercial scale as a road fuel, consideration would have to be given to imposing a countervailing duty to protect the oil duty; he added that unless there were good reasons to the contrary, "one would aim at a basis which broadly imposed a duty equivalent to that of the oil which was being displaced as road fuel", although this would be a matter for Ministerial decision.

Obviously, writes Paul Brockington, the imposition only of doubled excise licence on LPG vehicles would offer the chance of very considerable running-cost advantages to operators of petrol-engined vehicles, in terms of fuel cost and maintenance, given that the annual mileage covered was in excess of, say, 10,000.

The exhaust gas of an LPG-fuelled engine, produces considerably less carbon monoxide than a petrol-fuelled engine, and this is a factor of great importance in the present amenity-conscious situation. It is also claimed that LPG can increase the life between overhauls of a typical car-type petrol engine up to 250,000/300,000 miles and give a 10to 15-fold extension of the period between oil changes. An important factor in this is that, because LPG is always in a gaseous state, there is no bore washing (especially on cold starting) or oil dilution.

Lipton LP Carburettor Co Ltd has introduced into the UK the dual-fuel carburation equipment which enables road vehicles to run on propane. Performance figures on modem high-compression engines are claimed to be almost identical with those for petrol. A three-position electric switch on the instrument panel of a converted vehicle enables it to be switched from petrol to LPG and vice versa. Lipton quotes £50 as the cost of the equipment, plus approximately £30 for the tank—which is about the same size as a normal fuel tank.

For conversion of petrol engines, the main Lipton components are a tank, a control unit, a venturi which is inserted between the air cleaner and the carburettor, and tappings and pipework.

Lipton LP has been supplying LPG equipment for fork-lift trucks in the UK for some long time now, but the interest in the fuel for commercial vehicles has really only begun to take effect in the past three months. Now local-delivery vehicle operators in particular are trying LPG conversions and in some cases taking the plunge in having whole batches of vehicles converted. Among those who are trying it—typically on Ford Transits and BMC 250.TUs—are several Gas Boards.

As well as providing kits and doing conversions, Lipton LP (whose associate Lipton fork-lift hire company has 12 LPGfuelled vehicles in service already) runs a oneday course for mechanics. More significant, it is now setting up a new company, Cafco Ltd (Clean Air Fuel Co) which plans to open an LPG conversion and gas supply site in the Wembley area in June.