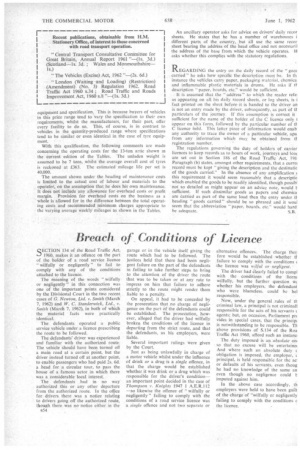

Moving Contractors' Plant

Page 121

Page 122

If you've noticed an error in this article please click here to report it so we can fix it.

The legal implications of operating a tractor and trailer in moving contractor? plant are discussed in a reply to .a reader

kREADER writes that he is proposing to purchase " a heavy tractor and drawbar trailer" for the movement of contractors' plant and asks for advice on several ;al aspects which could arise in their operation. Briefly, the ader requires to know whether the police would have to be allied if the gross train weight did not exceed 75 tons and oviding the maximum width did not exceed 9 ft. 6 in. He ttes that the tractor would be taxed as "a light locomotive"

d asks whether it would be possible to claim a weight lowance in respect of the excise duty paid relative to the :ight of a power winch and ground anchor fitted to the ictor. Additionally, he asks whether fixed ballast' must be aluded in the declared unladen weight, and adds that it is oposed to fit about three tons of ballast to the tractor, with 'ditional weights as required when moving heavy loads_ A further point raised by the reader is whether it would in order to tow two laden trailers, providing the axle :ights were not exceeded. He has in mind the use of a fiat tiler to carry a small scraper and behind this a 45/60.-ton :II trailer, with an overall length of about 30 ft., and laden th a small bulldozer. .

Regarding notification of the police, this would not at present .,necessary unless the width of the vehicle exceeded 8 ft. or

e journey involved a tram route. This latter !imitation would iw, of course, apply only in a few cases.

VRILST the information given is not quite sufficient for a finite view to be taken of the question of excise duty, it is .ely that the vehicle may be classifiable as a " haulage hide" within the terms of the Third Schedule to the Vehicles xcise) Act, 1962. This is a vehicle. "which is constructed .d used on public roads for haulage solely and not for the irpose of carrying or having superimposed upon it any load cept such as is necessary for its propulsion or equipment." oty would be payable according to the unladen weight of the hick (which would include the weight of the winch and ound anchor), regardless of the number of trailers towed.

To obtain the "haulage vehicle" rate, the winch and ground chor would have to be fitted for the purpose of assisting e vehicle in its function as a haulage vehicle. This would pend on the circumstances' of the case. If this additional uipment is not fitted with this object in view, the vehicle mild be classifiable as a "goods vehicle," duty being payable cording to the rate provided in the Fourth Schedule to the 62 Act, with liability to additional trailer duty.

Having regard to the decision of the High Court in the case London County Council v. Hay's .Wharf Cartage Co., Ltd. )53), the carriage of ballast to assist the propulsion of the hide or to render it fit for the purpose of haulage does not ialidate classification as a "haulage vehicle," but the ballast, fixed, must be included in the calculation of the vehicle's laden weight for the purpose of assessing duty.

The position regarding the possibility of towing two laden tilers is complex because of the interaction of Section 69 of e Road Traffic Act, 1960, Regulation 66 of the Motor Vehicles onstruction and Use) Regulations, 1955, and Article 14 of a Motor Vehicles (Authorization of Special Types) General -der, 1955. From the information given by the reader it is

not clear whether the "locomotive" complies with the regulations or is used under Article 14.

In brief the position is as follows. If the " locomotive " complies with the regulations, and so does the trailer carrying the small scraper, the combination is legal. But if the " locomotive " is operated under the Order and does not comply with the regulations, the combination is only legal if both trailers are "special types." As it is not clear whether the small scraper is an "abnormal indivisible load" this may well not apply. Even if it does, the combination would. be legal only if one trailer were loaded (with an abnormal load) or, alternatively, if both were loaded and all weight regulations were complied with, including the limit of 40 tons on the gross weight of trailers drawn by a "locomotive,"

1J OES a commercial traveller carrying samples in an estate car have to have a C licence for his vehicle, and is it then limited to -30 m.p.h.? " asks another reader.

In reply to this type of query; it must be clearly established at the outset that the "estate car" referred to comes within the category of a dual-purpose vehicle as defined in the First Schedule to the Road Traffic Act, 1960. Additionally, it must be understood that the samples mentioned are, in fact, genuine samples and not goods for sale or delivery by the traveller whilst acting as .driver.

By definition, a dual-purpose vehicle is one constructed or adapted for the carriage of both passengers and goods. When carrying the latter it is considered to be a goods vehicle and must therefore comply with, all regulations which govern the operation of goods vehicles. There is, however, an exemption provided in the Road and Rail Traffic Act (Exemptions) Regulations, 1957, whereby a goods vehicle solely confined to the carriage of travellers' samples is exempt from the need for an A, B or C licence.

Speed restrictions applicable to specific types of vehicle are determined by their construction and not by the licence under which they operate or the use to which they are put. For the purpose of speed limitations dual-purpose vehicles, coming within the legal definition already' referred to are classed in the same group as private cars and, have, therefore, no specific limitations other than those which apply generally in built-up areas. In contrast, small vans are classed as goods vehicles and therefore, at present, are restricted to a maximum speed of 30 m.p.h. at all times.

A N operator in Eire asks for further information regarding the details given in the 1961 edition of" The Commercial Motor Tables of Operating Costs" relative to a diesel-engined, 13-ton, articulated six-wheeler, averaging 600 miles per week. He asks what is the chosen unladen weight for this particular vehicle and for further information regarding tyre and maintenance costs.

When dealing with the operating costs of vehicles of this type and price range, difficulty undoubtedly arises in deterrnining what could be reasonably considered to be "average" a53 equipment and specification. This is because buyers of vehicles in this price range tend to vary the specification to their own requirements, whilst the manufacturers, for their part, offer every facility to do so. This, of course, is in contrast to vehicles in the quantity-produced range where specifications tend to be similar or even identical in the case of tyre equipment.

With this qualification, the following comments are made concerning the operating costs for the 13-ton artic shown in the current edition of the Tables. The unladen weight is assumed to be 7 tons, whilst the average overall cost of tyres is reckoned at £363. The estimated mileage life per set is 40,000.

The amount shown under the heading of maintenance costs is limited to the actual cost of labour and materials to the operator, on the assumption that he does his own maintenance. It does not include any allowance for overhead costs or profit margin. Provision for overhead costs on the business as a whole is allowed for in the difference between the total operating costs and recommended minimum charges appropriate to the varying average weekly mileages as shown in the Tables.

An ancillary operator asks for advice on drivers' daily recor sheets. He states that he has a number of warehouses i different parts of the country, but all use the same recor sheet bearing the address of the head office and not necessaril the address of the base from which the vehicle operates. H asks whether this complies with the statutory regulations.

R.EGARDING the entry on the daily record of the " gooc carried" he asks how specific the description must be. In th instance the vehicles carry paper, packaging material, chemica and inflammable plastic materials in drums. He asks if a description " paper, boards, etc." would be sufficient.

It is assumed that the " address " to which the reader refel as appearing on all his daily record sheets, or log sheets, is i fact printed on the sheet before it is handed to the driver an is not an entry made by the driver, subsequently, as part 'of a particulars of the journey. If this assumption is correct it sufficient for the name of the holder of the C licence only I appear on this form, followed by the particular number of it C licence held. This latter piece of information vvonld enab any authority to trace the owner of a particular vehicle, apa from any information which may be obtained from ti registration number.

The regulations governing the duty of holders of carrier licences to keep records as to hours of work, journeys and lela are set out in Section 186 of the Road Traffic 'Act, .196 Paragraph (b) states, amongst other requirements, that a currei record must be kept "giving the description, and the destinatic of the goods carried." in the absence of any amplification'.i this requirement it would seem reasonable that a descriptic which enabled the goods to be readily identified, though possibl not so detailed as might appear on an advice note, would t sufficient. If such dissimilar goods as papers and ehemica are carried as part of the same load then th.e entry under ti heading "goods carried" should be so phrased and it wou seem that the abbreviation "paper. boards, etc." would hard

be adequate. S.13.