Cost and service remain king

Page 14

Page 15

If you've noticed an error in this article please click here to report it so we can fix it.

Keeping customers satisfied means delivering the goods on time and at the right price, but not always in that order, as June's Trucking Britain Out Of Recession survey proves.

justin.stantonlarbi.co.uk KEEPING THE customer satisfied does not get any easier. and juggling that challenge with all the regulatory demands placed upon a transport business is one that all too many operators failed at during the recession.

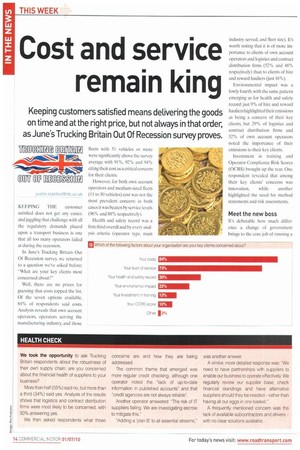

In June's Trucking Britain Out Of Recession survey, we returned to a question we've asked before: "What are your key clients most concerned about?"

Well, there are no prizes for guessing that costs topped the list. Of the seven options available, 84% of respondents said costs. Analysis reveals that own account operators, operators serving the manufacturing industry, and those Heels with 51 vehicles or more were significantly above the survey average with 91 To. 92% and 94% citing their cost as a critical concern for their clients.

However, for both own account operators and medium-sized fleets (11 to 50 vehicles) cost was not the most prevalent concern; in both cases it was beaten by service levels (96% and 88% respectively).

Health and safety record was a firm third overall and by every analysis criteria (operator type. main industry served, and fleet size). It's worth noting that it is of more importance to clients of own account operators and logistics and contract distribution firms (52% and 48% respectively) than to clients of hire and reward hauliers (just 16%).

Environmental impact was a lowly fourth, with the same pattern emerging as for health and safety record: just 9% of hire and reward hauliers highlighted their emissions as being a concern of their key clients. but 29% of logistics and contract distribution firms and 52% of own account operators noted the importance of their emissions to their key clients.

Investment in training and Operator Compliance Risk Scores (OCRS) brought up the rear. One respondent revealed that among their key clients' concerns was innovation, while another highlighted the need for method statements and risk assessments.

Meet the new boss

It's debatable how much difference a change of government brings to the core job of running a transport business, but with the coalition getting its feet under the desk and the emergency budget out of the way. the Tory/Lib Dem combination appears at this very early stage to be more engaged with industry, and with road transport in particular. than the last Labour administration (although that in itself is not saying much).

However, we asked Trucking Britain respondents for their thoughts about the new government in the first half of June. before the first cuts were made and before George Gsbornes first proper engagement as Chancellor of the Exchequer. We asked: how road transport-friendly do you think the new government will be compared to the last?

These were the responses: • Much more friendly 2% • A little more friendly 20% • .About the same 52% • A little less friendly 10% • Much less friendly -6% • Don't know 10% Refleeting New truck registrations are a key indicator of the transport sector's health. A significant majority of respondents (62%) will need to replace vehicles within the next 12 months. Here's the precise breakdown: • Within the next month 12% • In one to three months 9% • In three to six months 14% • In six to nine months 15% • In nine to 12 months 12% However, nearly a quarter (22%) can afford to wait more than a year to purchase replacement trucks.

More than half of all respondents (58%) will replace vehicles with new trucks. while 32% will opt for used. Analysis shows hire and reward hauliers are more likely to buy used (50%), while own account operators will barely look at them (4%). Similarly, its no surprise that the bigger the fleet, the more likely an operator is to avoid used: • One to 10 vehicles 44% new, 39% used • 11 to 50 vehicles 76% new, 31% used • 51 vehicles or more 69% new. 17% used Given the substantially higher cost of buying new at the moment due to exchange rates, we asked those that normally buy new. whether they would consider used vehicles less than three years old and the overall answer is a slight surprise: just 27% said yes. Nearly half of hire and reward hauliers (48%) said they would consider used. but less than a fifth (19%) of own account operators and logistics and contract distribution firms would. Optimism Optimism about the ne months has shot back up apparently ebbing away i previous two months.

In April's and May's si 70% and 68% respectiveb, either very or fairly opt about the next 12 months, compares poorly with Marc ure of '75%, hut the figure fc is a resounding 78%.

And thus the optimism has bounced back in Lander iste ring a score of +55 a d turnaround after May's +39 This turnaround is con] by the number of respoi reporting that their busine already started to recover the recession: 44%. which highest figure since Tri Britain started in Sept, last year.

A further 27% expect businesses to emerge from 1 cession in the next 12 mont]