BIG FLEETS:

Page 58

Page 61

If you've noticed an error in this article please click here to report it so we can fix it.

Low Overheads

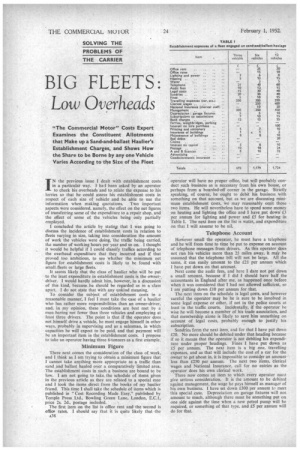

"The Commercial Motor" Costs Expert Examines the Constituent Allotments that Make up a Sand-and-ballast Haulier's Establishment Charges, and Shows How the Share to be Borne by any one Vehicle Varies According to the Size of the Fleet

IN the previous issue I dealt with establishment costs in a particular way. I hal been asked by an operator to check his overheads and to relate the expense to his lorries so that he could assess his establishment costs in respect of each size of vehicle and be able to use the information when making quotations. Two important aspects were considered, namely, the effect on the net figures of transferring some of the expenditure to a repair shop, and the effect of some of the vehicles being only partially employed.

I concluded the article by statins that I was going to discuss the incidence of establishment costs in relation to fleets varying in size, taking into consideration the amount of work the vehicles were doing, 'the traffic being carried, the number of working hours per year and so on. I thought it would be helpful if I could classify traffics according to the overhead expenditure that they incurred and if that proved too ambitious, to see whether the minimum net figure for establishment costs is likely to be found with small. fleets or large fleets. It seems likely that the class of haulier who will be put to the least expenditure in establishment costs is the ownerdriver. I would hardly admit him, however, in a discussion of this kind, because he should be regarded as in a class apart. I do not state that with any unkind meaning.

To consider the subject of establishment costs in a reasonable manner, I feet I must take the case of a haulier who has rather more responsibilities than an owner-driver, and, in my opinion, these conditions are best met by a man having not fewer than three vehicles and employing at least three drivers. The point is that if the operator does not himself drive a vehicle, he must engage himself in other ways, probably in supervising and as a salesman, in which capacities he will expect to be paid, and that payment will be an important item in the establishment costs. I propose to take an operator having three 6-tonners as a first example.

Minimum Figure There next comes the consideration of the class of. work, and I think as I am trying to obtain a minimum figure that

I cannot take anything more appropriate as a traffic than sand and ballast hauled over a comparatively limited area. The establishment costs in such a business are bound to be low. I am not going to take the schedule of items given in the previous article as they are related to a special ease and I took the items direct from the books of my haulier friend. This time I shall take the schedule of items which is published in "Cost Recording Made Easy," published by Temple Press Ltd., Bowling Green Lane, London, E.C.1, price 2s. 2d., postage included.

The first item on the list is office rent and the second is ear rates. I should say that it is quite likely that the A36

operator will have no proper office, but will probably conduct such business as is necessary from his own house, or perhaps from a boarded-off corner in the garage. 'Strictly speaking, of course, he ought to debit his business with something on that account, but as we are discussing minimum establishment costs, We may reasonably omit those two items. He will nevertheless have to spend some money on heating and lighting the office and I have put down. 13 per annum for lighting and power. and £5 for heatingin Table I. The ncxt item on the list is water, and expenditure on that I will assume to be nil.

Telephone Account However small the operator, be must have a telephone and he will from time to time be put to expense on account of telephone messages from drivers. As this operator does not run his vehicles more than 25 miles away, it my be assumed that the telephone bill will not be large. All the same, it can easily amount to the £21 per annum which I have put down on that account.

Next come the audit fees, and here I dare not put down a small amount, because if I did I should have half the accountants in England after me, as happened once before when it was considered that I had not allowed sufficient, so I am. putting down £10 per annum for that.

The next item on the schedule is legal costs, and however careful the operator may be he is sure to be involved in some legal expense or other, if not in the police courts at least in the traffic courts. Incidentally, if the operator be wise he will become a member of his trade association, and that membership alone is likely to save him something on account of legal costs, probably enough to justify his subscription. Sundries form the next item, and for that I have put down £20. No more should be debited under that heading because if so it means that the operator is not debiting his expenditure under proper headings. Fines I hare put down as 15 per annum. The next item is a big one, travelling expenses, and as that will include the cost of a car for the owner to get about in, it is impossible to consider an amount less than £250 per annum. The next two items, Clerical wages and National Insurance, call for no entries as the operator does his own clerical work.

There now comes an item to which every operator must give serious consideration. It is the amount to be debited against management; the wage he pays himself as manager of his own business. I have set down £300 per annum to meet this special case. Depreciation on garage fixtures will not amount to much, although there must be something put on one side against the time when a new petrol pump will be required, or something of that type. and £5 per annum will do for that.

TIe next item, subscriptions to associations, is en expeaditure which is well worthwhile; for three vehicles the tniount is somewhere about £7 per annum. Bank charges are going up a bit, and I am probably being rather stringent in allowing only £12.

Ferries, weighbndges, parking, etc., cost nothing as none is necessary. I am also going to assume that this particular operator does not owe anything on account of hire purchase interest. For printing and stationery, which incluies expenditure on log sheets, time sheets, hill heads and envelopes, I am going to put down £5 per annum. Insurance of buildings should be small, and II per annum will probably be enough. Maintenance of buildings I have taken to be £8 for each year. Bad debts and claims do not exist in connection with a business which is concerned mainly with the haulage of sand and ballast.

Most small operators have a little loan outstanding, hence the inclusion of .E5 per annum un'der the heading of interest on capital. Postage is allotted £12 per annum and A and B licences £8 per annum. A Man hauling sand and ballast over a small radius and in personal contact with his customers will not need to advertise, and he will certainly not need to pay any premiums on account of goods in transit.

. £14 Per Week

The total will surprise many operators: £692 per annum must appear tremendous when, as is so often the case, the operator will tell you casually that his establishment costs are either nit or so insignificant that .he need not take any notice of them. If he thinks the matter over, he will have to agree that there is not much wrong either with the individual items of the total, and if he realizes that this means that his expenditure on that non-existent item, establishment costs, is nearly £14 per week, he will be inclined to go through some of his recent receipts on account of work done to find out whether he is making a profit. For that £692 he runs three vehicles, so that each vehicle is costing £231 per annum or £4 12s. per week in overheads.

Now let us consider an operator working under conditions similar to those just described, but having six 6-tonners instead of only three. It is likely that this haulier will find it imitracticable to do all the clerical work himself. In any case, he will need to be out and about for a greater percentage of his time as he will need to be more energetic in chasing business when he has six vehicles on the road instead of only three. It follows that he will need premises to house his clerical assistant, so that we have to make a substantial addition for the first two items, office rent and office rates. We must allow £25 per year for office rent and £15 for rates.

For the same reason, expenditure on lighting and power and heating and water will be greater•than in the previous case. If the reader "looks at the appropriate column in Table I he will see what increases I consider to be necessary. The telephone bill will inevitably be higher, because the telephone is largely used for contacts with customers and although it does.not follow that an operator has twice as many customers when he has twice as many vehicles, it does mean that he will have to be nearly twice as busy to keep those vehicles fully engaged.

Further Additions For audit fees I suggest £12 instead of £10 and legal costs will probably be doubled, £30 instead of .£15. Sundries I put at £30 instead of 120. Fines, twice as much with six vehicles as with three, £10 instead of £5. Travelling expenses Will naturally increase but not by 100 per cent., and I think that the addition of £50' to the £250 set down in column I will meet the case. I have put down £250 " for clerical wages and £10 for National Insurance.

It is only reasonable that the manager, who in this case is the owner, should expect a little more money for looking after six vehicles than for, three,but' we will assume that he is modest In his requirements and that 1350will suffice. The amount set aside on account of depreciation and garage fixtures can remain the same. Subscriptions to associations must 'increase, as the amount is usually based on the number of machines, and bank charges will go up because they are in proportion to the amount of money handled.

I still think that there should be no charge on account of ferries, weighbridges and parking, and that there is nothing to put down under the heading of interest on lice purchase. Printing and stationery will increase, say, from £5 to £7; insurance of buildings may stay the same; maintenance of buildings also the same; and we can assume that there are no bad debts and no claims.

No Advertising It may be that he has had to borrow a little more money to keep the business going and to acquire some of the six vehicles, so I have increased the interest on capital from £5 to £8. Postage will increase, but not by 100 per cent. A and B licences will go up in proportion, £8 to £16, but I still maintain that there is no need for any expenditure on advertising and certainly none for goods-in-transit insurance.

The total of all these expenses is £1,179 and that works out at £197 per vehicle per annum approximately, which is equivalent to £3 19s. per week per vehicle, as against £4 12s. per week per vehicle which is what we found to be the case for the man with three vehicles.

If the reader accepts these fignres, and he can take it from me that they are reasonably accurate, he will appreciate that whilst it may be true to say that the bigger the concern the greater the establishment expenses, it does not follow that it is equally true to say that the bigger the company the more the establishment expenses per vehicle. I think it is there that so many operators go astray in their reckonhig of establishment costs, for it is the figure of cost per week per vehicle that is important, not that of the total expenditure of establishment costs.

The amounts of the various items which would apply in the case of an operator running 12 6-tonners are set down in the final column of Table I. Here again, the increases are not wholly pro rata with the number of vehicles, The operator's expenditure on rent for his office is nothing like twice as Much when he runs 12 vehicles as it was when he ran only six, and the majority of the items is similar in that respect. The total does not rise in direct proportion to the number of vehicles, and it follows, therefore, that so far as we have gone in this matter it is a reasonable conclusion that establishment costs per vehicle are somewhat less with a large fleet than with a small one.

Alternative Method ' Since I wrote the previous article, I have been discussing the significance of providing for establishment costs in the repair departtpent, and it has been suggested to me that an alternative method of dealing with this is as follows:—

The establishment costs as a whole should be totalled as described in that article, and a portion of the total allocated to the repair department, thefigure being based on the floor area. For instance, if the total floor area of the building were 50,000 sq. ft. and the repair department occupied 5,000 sq. ft., one tenth of the establishment costs should be debited against the repair department and be included as such in ascertaining the amount spent on maintenance.

Assuming that the foregoing details apply to the organiza tion with which I dealt in the previous article where establishment costs were shown to be £7,340, then £734 should be taken and allocated . to" maintenance, leaving 16,606 for establishment costs to be speed over the' fleet.

According to the other method where estimates were made for the proportion of the total of each item to be debited against the repair shop, we arrived at a total of £587. The difference is not so great as to be of much importance and I would say that either method of calculating the amount to debit against the repair department would be satisfactory. S.T.R.