YOU TAKE TH INO ROAD

Page 62

Page 63

If you've noticed an error in this article please click here to report it so we can fix it.

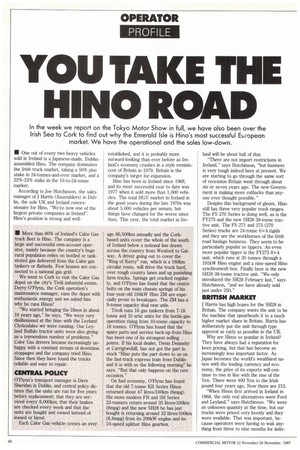

In the week we report on the Tokyo Motor Show in full, we have also been over the Irish Sea to Cork to find out why the Emerald Isle is Hino's most successful European market. We have the operational and the sales low-down.

• One out of every two heavy vehicles sold in Ireland is a Japanese-made, Dublinassembled Hino. The company dominates the Irish truck market, taking a 50% plus stake in 24-tonnes-and-over market, and a 22%-23% stake in the 10-to-24-tonne market.

According to Joe Hutchinson, the sales manager of J Harris (Assemblers) in Dublin, the sole UK and Ireland concessionaire for Hino, "We're now one of the largest private companies in Ireland". Hino's position is strong and well IN More than 90% of Ireland's Calor Gas truck fleet is Hino. The company is a large and successful own-account operator, mainly because the country's huge rural population relies on bottled or tankstored gas delivered from the Calor gas tankers or flatbeds. Few houses are connected to a national gas grid.

We went to Cork to visit the Calor Gas depot on the city's Ti viii industrial estate. Derry O'Flynn, the Cork operation's maintenance manager, runs the depot with enthusiastic energy and we asked him why he runs Hinos?

"We started bringing the Hinos in about 10 years ago," he says. "We were very disillusioned at the time with the Leyland Clydesdales we were running. Our Leyland Buffalo tractor units were also giving us a tremendous number of problems." Calor Gas drivers became increasingly unhappy with a constant stream of downtime stoppages and the company tried Hino. Since then they have found the trucks reliable and easy to repair.

CENTRAL POLICY

O'Flynn's transport manager is Dave Sheridan in Dublin, and central policy dictates that the units are run for five years before replacement; that they are serviced every 8,0001cm; that their brakes are checked every week and that the units are bought and owned instead of leased or hired.

Each Calor Gas vehicle covers an aver established, and it is probably more outward-looking than ever before as Ireland's economy crashes in a style reminiscent of Britain in 1979. Britain is the company's target for expansion.

Hino has been in Ireland since 1968, and its most successful year to date was 1977 when it sold more than 1,000 vehicles. The total HGV market in Ireland in the good years during the late 1970s was about 5,000 vehicles per annum, but things have changed for the worse since then. This year, the total market in Ire age 80,500km annually and the Corkbased units cover the whole of the south of Ireland below a notional line drawn across the country from Wexford to Galway. A driver going out to cover the "Ring of Kerry" run, which is a 180Icm circular route, will drive the truck hard, over rough country lanes and up punishing farm tracks. Springs get cracked regularly, and O'Flynn has found that the centre bolts on the main chassis springs of his four-year-old 194kW Hino ZM are especially prone to breakages. The ZM has a 9-tonne capacity dual rear axle.

Tivoli runs 16 gas tankers from 7-18 tonne and 10 artic units for the bottle-gas operation rising from 10-tonne capacity to 18 tonnes. O'Flynn has found that the spare parts and service back-up from Hino has been one of its strongest selling points. If his local dealer, Denis Dennehy at Carrigtwohill, has not got the part in stock "Hino puts the part down to us on the fast-track express train from Dublin and it is with us the following morning" he says. "But that only happens on the rare occasion."

On fuel economy, O'Flynn has found that the old 7-tonne KB Series Hinos returned about 47 litres/1001cm (6mpg). His more modern FH and SH Series 32-tonners return around 35 litres/100Icm (8mpg) and the new SH28 he has just bought is returning around 32 litres/100km (8.8mpg) from its 200kW engine and its 10-speed splitter Hino gearbox. land will be about half of that.

"There are not import restrictions in Ireland," says Hutchinson, "but business is very tough indeed here at present. We are starting to go through the same sort of recession Britain went through about six or seven years ago. The new Government is making more cutbacks than anyone ever thought possible."

Despite this background of gloom, Hino still has three very popular truck ranges. The FS 270 Series is doing well, as is the FY275 and the new SH28 38-tonne tractive unit. The FS 271 and 275 (270 Series) trucks are 24-tonne 6 x4 rigjds and they are the workhorses of the Irish road haulage business. They seem to be particularly popular as tippers. An even more popular tipper is the FY275 8x4 unit, which runs at 30 tonnes through a 191kW Hino engine and a nine-speed Hino synchromesh box. Finally here is the new SH28 38-tonne tractive unit. "We only introduced the SH28 February last," says Hutchinson, "and we have already sold just under 250."

BRITISH MARKET

J Harris has high hopes for the SH28 in Britain. The company wants the unit to be the machine that spearheads it to a much higher market share in Britain. Harris has deliberately put the unit through type approval as early as possible in the UK.

Why are Hinos so popular in Ireland? They have always had a reputation for keen pricing, but that has become an increasingly less important factor. As Japan becomes the world's wealthiest nation with the leading currency and economy, the price of its exports will continue to rise in line with the rise of the Yen. There were 400 Yen to the Irish pound four years ago. Now there are 213.

"When Hinos first arrived in Ireland in 1968, the only real alternatives were Ford and Leyland," says Hutchinson. "We were an unknown quantity at the time, but our trucks were priced very keenly and they were available. That was important, because operators were having to wait anything from three to nine months for deliv ery. I think it is fair to say we revolutionised the business."

WINNING FRIENDS

Harris' spare parts reputation has won it many friends in Ireland over the years. The company says that it is seldom caught out over non-available spares. "Even if we are short of a part," says Hutchinson, "we can whip it off the assembly line." Today, Harris has a network of 10 dealers around north and southern Ireland, and each carries a full range of spares. Harris never stocks less than £4 million worth of spares.

Most operators will also point to the rough and ready reliability of Ilinos. They are rugged in design and inherently simple to repair. Tough leaf-spring suspension helps them get about a country that does not have 'a single stretch of motorway anywhere, and which relies on potholestrewn country roads for many of its major routeways. The same operators will agree that years ago, their strong six-and eight-wheel Hinos easily carried more than the 22-tonne legal limit for six wheelers and the 25-tonne limit for eight wheelers. The weight law was not enforced then and the Hinos worked hard carrying payloads that the Irish transport industry still will not disclose.

Not everything is stacked in Hino's favour, however. Not only is the Yen rising, the Continentals are also moving in. Volvos, Scanias and Mercedes can be seen on the roads in increasing numbers alongside Hinos. Mitsubishi is doing well in the lower weight 7-14-tonne range, especially with the Canter. Ford and Renault Dodge also remain strong long-term presences.

Three important factors could help stimulate a stodgy Irish truck market in the future. Firstly, the haulage business in Ireland has .been deregulated in line with an EEC directive, and the old restrictive licence scheme has gone. New haulage entrepreneurs are springing up all the time. Secondly, contract hire and leasing deals are only just beginning to gain acceptance. Thirdly, more and more owner drivers are coming onto the scene. 0 by Geoff Hadwick