mwer excise duty avours 6 x 2 units

Page 5

If you've noticed an error in this article please click here to report it so we can fix it.

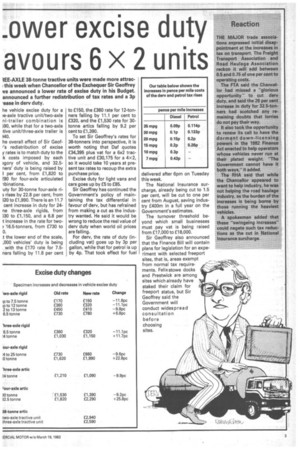

IEE-AXLE 38-tonne tractive units were made more attracthis week when Chancellor of the Exchequer Sir Geoffrey ve announced a lower rate of excise duty in his Budget. announced a further redistribution of tax rates and a 3p 'ease in dery duty.

he vehicle excise duty for a ie-axle tractive unit/two-axle ni-trailer combination is 590, while that for a two-axle tive unit/three-axle trailer is 340.

he overall effect of Sir Geofr's redistribution of excise y rates is to match duty to the k costs imposed by each gory of vehicle, and 32.5ners' duty is being raised by 3 per cent, from £1,820 to 390 for four-axle articulated ibinations.

uty for 30-tonne four-axle ririses by 22.8 per cent, from 520 to £1,990. There is an 11.7 cent increase in duty for 24ne three-axle rigids, from )30 to £1,150, and a 6.8 per t increase in the rate for two 16.5-tanners, from £730 to 0.

t the lower end of the scale, ,000 vehicles' duty is being with the £170 rate for 7.5ners falling by 11.8 per cent to £150, the £360 rate for 12-tonners falling by 11.1 per cent to £320, and the £1,530 rate for 30tonne artics falling by 9.2 per cent to £1,390.

To set Sir Geoffrey's rates for 38-tonners into perspective, it is worth noting that Daf quotes £34,395 plus vat for a 6x2 tractive unit and £30,175 for a 4x2, so it would take 10 years at present tax rates to recoup the extra purchase price.

Excise duty for light vans and cars goes up by £5 to £85.

Sir Geoffrey has continued the Government's policy of maintaining the tax differential in favour of derv, but has refrained from making a cut as the industry wanted. He said it would be wrong to reduce the real value of dery duty when world oil prices are falling.

For derv, the rate of duty (including vat) goes up by 3p per gallon, while that for petrol is up by 4p. That took effect for fuel delivered after 6pm on Tuesday this week.

The National Insurance surcharge, already being cut to 1.5 per cent, will be cut to one per cent from August, saving industry £400m in a full year on the Government's estimates.

The turnover threshold beyond which small businesses must pay vat is being raised from £17,000 to £18,000.

Sir Geoffrey also announced that the Finance Bill will contain plans for legislation for an experiment with selected freeport sites, that is, areas exempt from normal tax requirements. Felixstowe docks and Prestwick are among sites which already have staked their claim for freeport status, but Sir Geoffrey said the Government will conduct widespread consultation before choosing sites.