Turning up the heat

Page 28

Page 29

If you've noticed an error in this article please click here to report it so we can fix it.

Greenhouse gases must be cut, but UK policy struggles to differentiate between essential and elective use. Dominic Perry reports.

iH eatwaves here to stay" says the headline above a recent newspaper article. The accompanying story spells out the likely weather for Europe over the next few years if meteorologists and experts on climate change have got their predictions right. "Nice," you might be thinking. -Quite fancy a good hot summer after all this rain." Unfortunately the torrential rain of the last week or so could well be part of the same phenomenon. The report continues:"The researchers predict that without worldwide cuts in greenhouse gas emissions, the average number of heatwaves... will increase to an average of 2.15 a year." What does this have to do with the transport industry? The clue is in the phrase "without a worldwide cut in greenhouse emissions" — essentially anything given out when fossil fuels, like diesel, are burnt. Crucially this story followed hot on the heels of the findings of the House of Commons Environmental Audit Select Committee, which concluded that the government was not doing enough to cut greenhouse emissions and suggested that fuel duty should be increased to achieve this. This is particularly relevant to transport, where carbon emissions have grown by almost 40% since 1990, in marked contrast to most other sectors of industry. In their report the MPs say: "We urge the government to implement the planned rise in fuel duty at the earliest opportunity and to consider the case for recycling proceeds from future increases in order to subsidise transport spending and low-carbon alternatives to conventional fuels." The bottom line is that the committee thinks that an increase in fuel duty would discourage the use of road transport. However, as is so often the case,it seems to have missed the point that no one runs a truck for fun. Unsurprisingly both trade associations have reacted angrily to the committee's findings. The Freight Transport Association claims it reinforces the case for the introduction of Lorry Road User Charging although the Road Haulage Association is more forthright

Road charging

Its chief executive. Roger King, says: "Once again politicians have lumped Britain's road hauliers, who are already paying the highest fuel taxes in Europe, with the motorist. "Whatever happened to common sense? To increase taxes on road haulage is to put at risk the UK economy. Road transport is at the very base of our economic viability. The committee has ignored the fact that increasing fuel duty will have little impact on the number of freight journeys that are made. The only result will be that those journeys are made by foreign-registered hauliers as opposed to domestic operators." The FTA says the proposal makes its ease for the LRUC, pointing out that a fuel duty rise merely harks back to the hated fuel duty escala tor. Policy director Hookham adds:"The government accepted the need to move away from a flat rate of fuel duty for all vehicles in 2000 and proposed the LRUC instead. "fIt] would decouple the taxation of cars and trucks and is due for introduction in 2008. It would enable the UK's 430,000-strong fleet of trucks, which are the lifeblood of the UK economy, to be taxed in a fairer and more environmentally friendly way as it will be distance based.

However, the report plays down the effect of general road user charging:It will take 10 to 15 years to introduce road charging on a national basis and such a regime would be far more of a blunt instrument than the present system... we therefore see a continuing and important role for an environmental fuel duty strategy over the next decade or more." A warning, then, over the LRUC.

Although the MPs seem to have largely missed the role that trucks play in the economy, they are perceptive to notice that a section of the industry a major influence on the government's thinking: "We appreciate that the shadow of the fuel protests of 2000 still hangs over the government and that it is fearful of a repetition of those events.

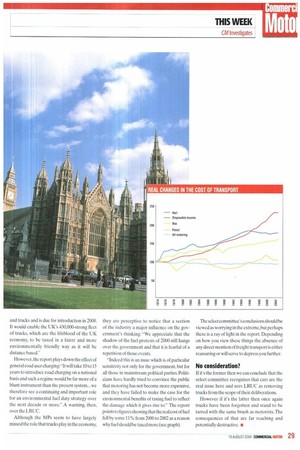

"Indeed this is an issue which is of particular sensitivity not only for the government, but for all those in mainstream political parties. Politicians have hardly tried to convince the public that motoring has not become more expensive, and they have failed to make the case for the environmental benefits of taxing fuel to reflect the damage which it gives rise to." The report points to figures showing that the real cost of fuel fell by some 11% from 2000 to 2002 as a reason why fuel should be taxed more (see graph). The select committee's conclusions should be viewed as worrying in the extreme,but perhaps there is a ray of light in the report. Depending on how you view these things the absence of any direct mention of freight transport is either reassuring or will serve to depress you further.

No consideration?

If it's the former then we can conclude that the select committee recognises that cars are the real issue here and sees LRUC as removing trucks from the scope of their deliberations.

However if it's the latter then once again trucks have been forgotten and stand to be tarred with the same brush as motorists The consequences of that are far reaching and potentially destructive. •