UPTURN, BUT WORSE TO COMI

Page 34

Page 36

If you've noticed an error in this article please click here to report it so we can fix it.

Last year was not as bad as had been feared by most commercial vehicle manufacturers, although Sweden's traditionally strong builders lost UK market share. Alan Millar reports

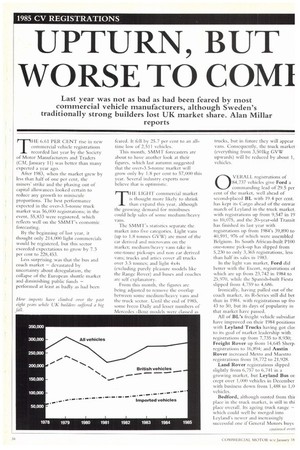

THE 6.61 PER CENT rise in new commercial vehicle registrations recorded last year by the Society of Motor Manufacturers and Traders (CM, January 11) was better than many expected a year ago.

After 1983, when the market grew by less than half of one per cent, the miners' strike and the phasing out of capital allowances looked certain to reduce any growth to miniscule proportions. The best performance expected in the over-3.5-tonne truck market was 56,000 registrations; in the event, 55,833 were registered, which reflects well on the SMMT's economic forecasting.

By the beginning of last year, it thought only 214,000 light commercials would be registered, but this sector exceeded expectations to grow by 7.3 per cent to 228,453.

Less surprising was that the bus and coach market — devastated by uncertainty about deregulation, the collapse of the European shuttle market and diminishing public funds — performed at least as badly as had been feared. It ta by 25.7 per cent to an alltime low of 2,511 vehicles.

This month, SMMT forecasters are about to have another look at their figures, which last autumn suggested that the over-3.5-tonne market will grow only by 1.8 per cent to 57,01)0 this year. Several industry experts now believe that is optimistic.

THE LIGHT commercial market is thought more likely to shrink than expand this year, although the growing demand for minibuses could help sales of some medium/heavy vans.

The SMMT's statistics separate the market into five categories. Light vans (up to 1.8 tonnes GVW) are most of the car derived and microvans on the market; medium/heavy vans take in one-tonne pick-ups and non car derived vans; trucks and artics cover all trucks over 3.5 tonnes; and light 4x4s (excluding purely pleasure models like the Range Rover) and buses and coaches are self explanatory.

From this month, the figures are being adjusted to remove the overlap between some medium/heavy vans and the truck sector. Until the end of 1985, some Iveco Daily and lesser numbers of Mercedes -Benz models were classed as trucks, but in future they will appear vans. Consequently, the truck market (everything from 3,501kg GVW upwards) will be reduced by about 1, vehicles.

0 VERALL registrations of 84,737 vehicles give Ford a commanding lead of 29.5 per cent of the market, well ahead of second-placed EL with 19.4 per cent. has kept its Cargo ahead of the onwar march of Leyland in the truck market. with registrations up from 9,547 in 19 to 10,075, and the 20-year-old Transit has finished its last year with registrations up from 1984's 39,890 to 40,591, 976 of which were assembled Belgium. Its South African-built P100 one-tonne pick-up has slipped from 5,230 to only 3,365 registrations, less than half its sales in 1983.

In the light van market, Ford did better with the Escort, registrations of which are up from 23,742 in 1984 to 25,970, while the Spanish-built Fiesta slipped from 4,759 to 4,686.

Ironically, having pulled out of the coach market, its R-Series still did bet than in 1984, with registrations up fro 43 to 50, but its days of popularity in that market have passed.

All of BL's freight vehicle subs idiar have improved on their 1984 positions with Leyland Trucks having got clos to its goal of market leadership with registrations up from 7,735 to 8,930; Freight Rover up from 14,645 Sheri): registrations to 16,894; and Austin Rover increased Metro and Maestro registrations from 18,772 to 21,928.

Land Rover registrations slipped slightly from 6,757 to 6,741 in a growing market, but Leyland Bus or crept over 1,0(() vehicles in December with business down from 1,488 to 1,0 vehicles.

Bedford, although ousted from thin place in the truck market, is still in thi place overall. Its ageing truck range — which could well be merged into Leyland's newer and increasingly successful one if General Motors buys Leyland lost volume business as well as market share, with registrations down from 6,9W) to 5,969, and the launch of its Venturer coach chassis could not halt a fall in registrations from 356 to 253.

But its investment in vans is paying dividends. In the light-van sector, the Astra and Astramax increased Bedford's registrations from 18,395 CO 19,662, although it lost market share. Next month's launch of the Rascal microvan, and the easing of supply problems at the Astra plant at Ellesmere Port, give Bedford confidence of gaining leadership of this market sector.

The Midi van, which is also helping Bedford gain export business in Europe, increased registrations in the medium/heavy van sector from 11,687 to 13,511, with the Midi having replaced the larger hut older CF as many customers' first choice of Bedford van.

Sales of the Japanese-built KB pick-up fell from 1,438 to 1,130, but the 4x4 equivalent did slightly better, with registrations up from 246 to 279.

IN TI IE TRUCK market, Mercedes-Benz's leap into third place (it is fourth in the overall CV market) is the greatest sign of importers' relentless incursion into the UK market. Truck sales are up from 5,089 to 6,395, with the greatest increase having been achieved with the 809/814 models from its LN2 range. The company insists that they have been sold on their merits and have not been discounted.

From registering 932 of the older LP range in 1984 (when supplies were also depressed by a West German metalworkers' strike). the I.N2 has rocketed by 93 per cent to 1,799. Mercedes has also done well in the tractive unit market, up from 1,068 to 1,334.

Its medium/heavy van registrations are up front 5,304 to 6,059, but coach registrations crept up from only one in 1984 to six.

FEWER trucks were sold last year by Renault Truck Industries (down from 4,833 to 4,787 registrations), but the fall in Dodge registrations from 4,461 to 4,343 and French-built Renaults from 351 to 229 was compensated by a rise in Britishbuilt Renaults from 21 to 215.

Renault's assault of the van market has gone on with Tratic and Master registrations up from 7,253 to 10,321, but it expects this year's performance to be affected by the launch of the new Transit. Its light van performance was poorer, down from 1,320 to 1,255.

Last year was notable for the loss of market share by both of the Swedish truck builders. Volvo attributes its slip to supply problems as the FL ranges have replaced the E6 and F7, while Scania has suffered from the collapse of sonic of its dealers.

Both did sell more trucks than in 1984. but Volvo's registrations were up by less than one per cent front 4,493 to 4,532. Scania's registrations went up by 5.2 per cent from 2,461 to 2,588. Volvo's bus and coach business fell from 368 coaches to 297 and 87 double-deck buses to 31, but Scania increased its registrations from 48 to 60 and is likely to climb further.

Although Metro-Cammell Weymann outsold Volvo last year, with registrations down only from 489 to 435 (11 per cent), MCW's loss of London Buses business this year will probably drive it further down.

Iveco, Daf and MAN-VW have all increased their shares again. Iveco's truck sales are up from 3,061 to 3,363 (West German-built models are down from 190 to 145), hut Daily van registrations fell from 201 to 109, and only lour rear-engined midicoaches were registered.

Daf had what it calls a "tremendous" year, with truck registrations up from 2,594 to 2,968, giving it 10.5 per cent of the market over 16 tonnes and 14.1 per cent of the tractive unit market. Its coach sales recovered to end the year only three below 1984's figure at 157.

MAN -VW had its best year ever in the truck market, with registrations up from 1,243 to 1,574 and it is aiming for 2,000 this year, most of that growth coming from its MT range of 6.5 to 10tonners. Volkswagen LT and Transporter van registrations fell from 8,372 to 7,481 and were overtaken by Renault in the league table, but the launch of the Caddy pick-up has boosted VW's light van registrations from 639 to 2,466, taking it from obscurity to sixth place in that market. MAN coach registrations are up from six to 22. 0 E THE smaller British build ERF and Seddon Atkinsor have both grown faster than market. ERF's registrations are up fr 1,526 to 1,657 and Seddon's from I,! to 1,641. But Foden and, to a lesser extent, Hestair Dennis have slumpe Foden, hit by competitors' pricing, ti from 745 to 450 (worse than the 522 registered in 1982), but it is more optimistic about this year's business.

Dennis truck sales (mostly tire eng and municipal vehicles) slipped from to 587, but it managed to out-sell Foden. Its bus and coach sales fell frc 124 to only 88 and are likely to be overtaken by Scania this year.

The days of the miscellaneous fore: coach imports, most of them integral by Neoplan, Van Hool and Bova, may also be passed, with registration down from 184 to only 94 as the mat shrinks.

Although they sold more vehicles, Japanese van manufacturers are also losing market share as their competio leap ahead of the Japanese import lim and some makers (notably Bedford Nissan) Europeanise Japanese designs In the light van sector the Japanese sl. is up from 6.4 per cent (5,376 vans) t 7.8 per cent (7,293); in the light 4x4 sector it is up from 45.1 per cent (5,7 vehicles) to 47.3 per cent (6,419); but the medium/heavy van sector it fell Irons 13.2 per cent (15,262 vans) to 1: per cent (14,598).

This year, two major factors will b at work. One, the new Ford Transit, may continue to stem the rise of imported medium/heavy vans. The other, the possible merger of Ford an lveco's and Leyland and Bedford's trt ranges, could dramatically alter the leading shares of the market to give u groupings more than half of the truck market.